简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

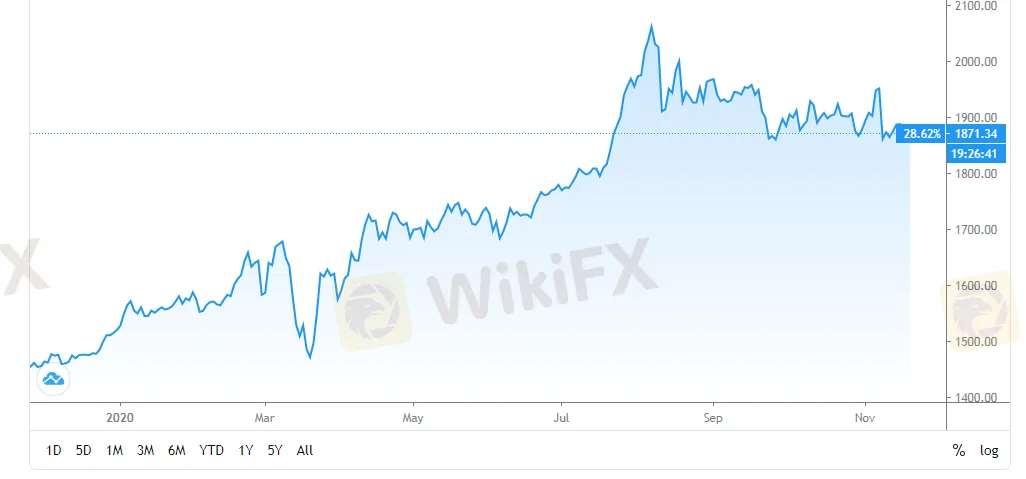

Too Early to Short Gold Despite Demand Plunge

Zusammenfassung:The recent positive news on the Covid-19 vaccine has weighed on the gold price, dragging it down to as low as $1,870 on Wednesday.

WikiFX News (19 Nov.) - The recent positive news on the Covid-19 vaccine has weighed on the gold price, dragging it down to as low as $1,870 on Wednesday. But the precious metal still holds upside momentum amid the global low-interest rates and the rising balance sheets.

Moderna announced this week that its vaccine was 94.5% effective against Covid-19. The key progress in the vaccine will lift the economy but punish gold because the yellow metal has been regarded as a hedge asset against the inflation.

According to Singapores non-oil domestic export (NODX) released recently, the country registered a 61% plunge in non-monetary gold shipments in October, reflecting a reduction in demand for investment gold.

Nonetheless, it‘s too early to short gold. Data from the Fed shows that the country’s balance sheet has a size of $7 trillion. Besides the Fed, global central banks have been growing their books rapidly with a potential increase of 30% this year, according to CrossBorder Capital.

The institution also stated that the rise in the gold price was just a matter of time as global governments and central banks continued to launch aggressive fiscal-stimulus packages, increase the money supply, and expand their balance-sheets and deficits.

All the above is provided by WikiFX, a platform world-renowned for forex information. For details, please download the WikiFX App: bit.ly/wikifxIN

Chart: Gold Trend

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

Neue Kaufanreize und Steuerfreiheit für E-Autos: Union und SPD beschließen diesen 8-Punkte-Plan für Elektro-Mobilität

Dieser Mann ist Deutschlands reichster Sport-Unternehmer – kennt ihr den Milliardär?

Jeder Zehnte ist Millionär: Diese deutsche Stadt ist die heimliche Hauptstadt der Superreichen

Gehälter im Handel: So viel verdienen Vorstände und Manager in der Lebensmittelbranche

Treffen zwischen Netanjahu und Trump: Israel will Handelsdefizit beseitigen und Zusammenarbeit stärken

Vermeintlich nischig und öde: So hat ein Bau-Lieferketten-Startup Project A und b2venture überzeugt

Börse stürzt wegen Trump-Zöllen ab: Diese 38 US-Aktien solltet ihr jetzt kaufen, raten Analysten

FT-Bericht: In Kanada werden Forderungen laut, Elon Musks Starlink von Subventionen auszuschließen

Neue Koalition will deutschen Astronauten zum Mond schicken

Gewinn bei Volkswagen zu Jahresbeginn eingebrochen – Ergebnis deutlich niedriger als erwartet

Wechselkursberechnung