简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Analysis: XAU/USD refreshes intraday high around $1,730 on Biden’s optimism

Zusammenfassung:Gold Price Analysis: XAU/USD refreshes intraday high around $1,730 on Biden’s optimism

Gold takes the bids after stepping back from 10-day top the previous day.

Biden lauds his administrations work on taming covid, stays cautious on job outlook.

Risks remain elevated amid vaccine optimism, hopes of further stimulus and economic recovery.

Light calendar in Asia probes bulls, US data eyed.

Gold refreshes intraday top to pierce $1,726, currently up 0.10% around $1,725, during early Friday. The yellow metal recently rose as US President Joe Biden gives his first prime-time appearance to commemorate the coronavirus (COVID-19)-led lockdowns anniversary and how the US managed to overcome.

During the initial words of the speech, US President Biden praised his administration during the initial two months of fighting the pandemic and promised vaccines for all American adults by May 01. The Democratic leader also praised the $1.9 trillion American Rescue Plan but hints at worries over the US jobs.

Even so, the markets arent too active. The recent lack of reaction to the key speech could be traced to the latest passage of the US $1.9 trillion stimulus and a lack of any hints for the recently chatters $2.5 infrastructure plan. Also, the pre-event update from the White House already conveying most highlights dimmed the importance of the event.

Even so, market sentiment remains positive as the US on the road to recovery from the pandemic times. Also favoring the mood could be the Novavax update suggesting strong results while trying to tame the UK covid variants.

Alternatively, AstraZeneca‘s fears to fall short of vaccine deliveries to the European Union (EU) and the US actions to disappoint Huawei suppliers join Australia’s dislike for Hong Kong conditions to challenge the risk-on mood.

Against this backdrop, US 10-year Treasury yields and S&P 500 Futures print mild gains whereas stocks in Asia-Pacific track Wall Streets uptrend by the press time.

Having witnessed the initial market reaction to US President Bidens prime-time speech, gold traders should keep eyes on the vaccine and unlock newsahead of the US Michigan Consumer Sentiment figures for March, expected 78.5 versus 76.8 prior.

Technical analysis

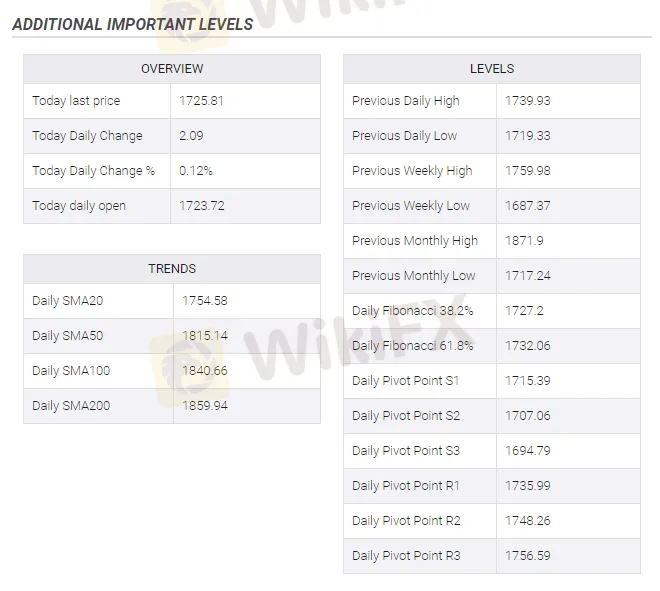

A clear break of 10-day SMA, currently around $1,713, not to forget sustained trading beyond the $1,700 threshold, keeps gold buyers directed towards the key $1,765 resistance confluence comprising a two-month-old falling trend line and November 2020 low.

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

Die EU prüft laut Bericht, wie Unternehmen aus langfristigen Gas-Verträgen mit Russland aussteigen können

Probleme bei Volkswagens Lkw-Tochter Traton: Aufsichtsrat holt McKinsey ins Haus

MHP, Audi und Lamborghini: Das sagt VW-Chef Blume zu möglichen Ausverkäufen

Geld sicher anlegen: Die besten Tagesgeld- und Festgeld-Angebote für Krisenzeiten

OpenAI entwickelt laut Bericht Konkurrenz für Musks X

Russlands Rubel ist der größte Gewinner zum Dollar – doch ausgerechnet die starke Währung bereitet Putin neue Geldprobleme

Meta startet KI-Offensive in Europa – so nutzt der Facebook-Konzern auch eure Beiträge dafür

Trotz Zöllen in die zig Millionen: Aluminium-Riese Alcoa will seine ruhenden Kapazitäten in den USA nicht aktivieren

Preise für klassische Osterprodukte ziehen stark an – Schokolade ist um 40 Prozent teurer geworden

Teuerstes Ostern aller Zeiten: Schokolade und Eier kosten 40 Prozent mehr als 2020

Wechselkursberechnung