简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The 3 Most Important Takeaways from FTX's First Day in Bankruptcy Court

Abstract:Tuesday, lawyers and officials for the now-defunct cryptocurrency platform FTX went to court and said that an investigation is still going on into the assets that the company's founder and former CEO, Sam Bankman-Fried, once owned.

They also asked that the identities of the company's consumers be kept private.

The two-hour hearing was a normal way to approve FTX's requests to pay its consultants, workers, and suppliers. It was also a chance to settle any early disagreements about how the lawsuit should go.

But the first hearing proved that FTX's Chapter 11 reorganization might be one of the most unusual cases ever heard in a US bankruptcy court. In fact, FTX's lawyer called it “an unprecedented event.”

Here are the three most important takeaways.

A 'lack' of asset information

As expected, U.S. Bankruptcy Judge John Dorsey, who is in charge of the case, gave FTX permission to pay its ongoing business costs. Bankman-Fried and his senior deputies before him, who have since left the platform, were not paid.

But FTX's lawyer, James Bromley of Sullivan & Cromwell, pointed out in a court presentation that the crypto exchange's new administrators and forensic investigators can't find its assets because of unusual circumstances.

“While significant progress has been made, your honor, we stand here today with a lack of information,” Bromley told Judge Dorsey. “We do not have the typical quantity of information that a debtor would have.” But we create more and more every day.

Bromley went on to criticize Bankman-Fried for running FTX with lax corporate and accounting procedures.

“Your Honor, what we have is a multinational organization, but it was essentially administered as Sam Bankman-personal Fried's domain,” he stated.

Still, the fact that more assets might be found is good news for people who want their money back, like consumers and other creditors. In court, Bromley said that “a large percentage of the debtor's assets are stolen or missing.”

FTX has hired Nikki Friedlaender, former chief of Complex Frauds and the Cybercrime unit in the Southern District of New York, and Steve Pekin, former director of enforcement for the Securities and Exchange Commission, as well as blockchain analytics firm Chainalysis and investigative firm Nardello, to determine whether the $400 million in stolen crypto assets can be recovered.

As of Tuesday, the exchange had shown that it owed about $9 billion and had about $1.24 billion in cash and cash equivalents. After payments for current costs, the indebted firms expect $459 million in cash on hand for the week ending December 23, according to FTX management.

For the time being, the identities of FTX customers will be kept under wraps.

During Tuesday's session, a disagreement arose over the identities of FTX's more than 1 million clients, whose monies are now entangled in the bankruptcy.

The U.S. Trustee, a government agent appointed in bankruptcy proceedings in the United States, objected to FTX's claim that the identities of its clients should be kept under seal.

“We suggest that overbroad redactions do not help transparency in these circumstances,” Ben Hackman said on behalf of the U.S. Trustee, saying that identities should be made public unless prohibited by foreign legislation, such as the European Union's GDPR.

Judge Dorsey eventually agreed to FTX's request to keep the names and addresses of the people involved secret for now, until the case is heard again at a later time.

Redacting the identities of crypto company creditors is an unsettled subject in US Federal Bankruptcy courts. In September, in the Southern District of New York, Celsius Network lost its bid to keep the names of its creditors secret.

“For the time being, the court went the safe road and prioritized consumer privacy and security concerns,” Jason DiBattista, Levin's director of legal analysis, told Yahoo Finance of today's judgment.

Jurisdiction

In anticipation of a dispute over which nation has the power to oversee FTX's assets—the United States or The Bahamas, where FTX is located — FTX identified two criteria that might benefit the United States Bankruptcy Court.

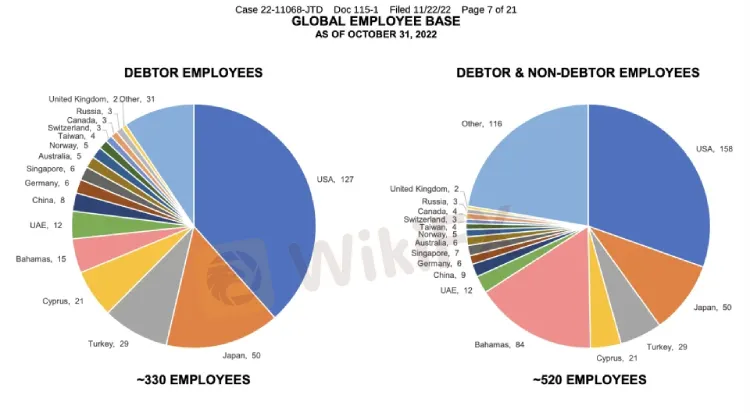

As of October 31, 2022, the debtor firms in the U.S. filing had 330 people working for them around the world, with 127 of those people working in the U.S.

He said that most of the company's customers come from the Cayman Islands and the Virgin Islands. Customers from China, the UK, and Singapore are next in line. Among FTX's overseas firms, 94% of its clients were FTX Trading Ltd., a US debtor.

FTX Digital Markets Ltd., a Bahamian company, has around 6% of the consumers.

The corporation has also spent $300 million on Bahamian real estate via FTX.com.

Stay tuned for more Forex hot news.

Download the WikiFX App from the App Store or Google Play Store to stay updated on the latest news.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Thinking of Investing? Read Must-Know Facts About Funding pips!

When you check the internet for Funding Pips, you'd be surprised to know it's filled with praise for Funding Pips but often lacks the real facts that traders need. Everything that seems too good to be true should always be verified first. It could be Fraud . So, we conducted research and collected several facts you must know about Funding Pips.

OctaFX Back in News: ED Attaches Assets Worth INR 134 Cr in Forex Scam Case

The Enforcement Directorate (ED) in Mumbai has attached assets worth around INR 131.45 crore. This included a luxury yacht and residential properties in Spain. Read this interesting story.

CryptoCurrency Regulations in India 2025 – Key Things You Should Know

Cryptocurrency has become a major trend in today’s world. Crypto Experts believe it’s the future, which is why many people are investing heavily in it. But before jumping in, it’s important for crypto enthusiasts to understand the key rules about cryptocurrency in India.

Truth About Angel One – Here’s What You Need to Know

Thinking about investing in Angel One? Wait! Know the essential things about the broker before Invest. It could be SCAM. Read, think, and invest .

WikiFX Broker

Latest News

CFD Brokers Face Dual Compliance Pressures Ahead of 2026: Australia and EU Tighten Rules

Services Surveys Signal 'Expansion' In June, Inflation Fears Remain High

Major Risks Associated with AuxiliumFX: You Need to Know

ASIC cancels AFS licences of Ipraxis and Downunder Insurance Services

CFI Financial Group Becomes Official Online Trading Partner of Etihad Arena

FxPro to Launch Crypto Trading Desk, Deepening Digital Asset Push

Global Brokers Vs. Indian Rules: Why They Struggle in India

Discover 5 Benefits of Trading with Trive FX Broker

Indian regulator bars U.S. firm Jane Street from accessing securities market, impounds $566 million in manipulation probe

Asia-Pacific markets trade mixed ahead of Trump's deadline for higher tariffs

Currency Calculator