简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Reviews: PrimeXBT

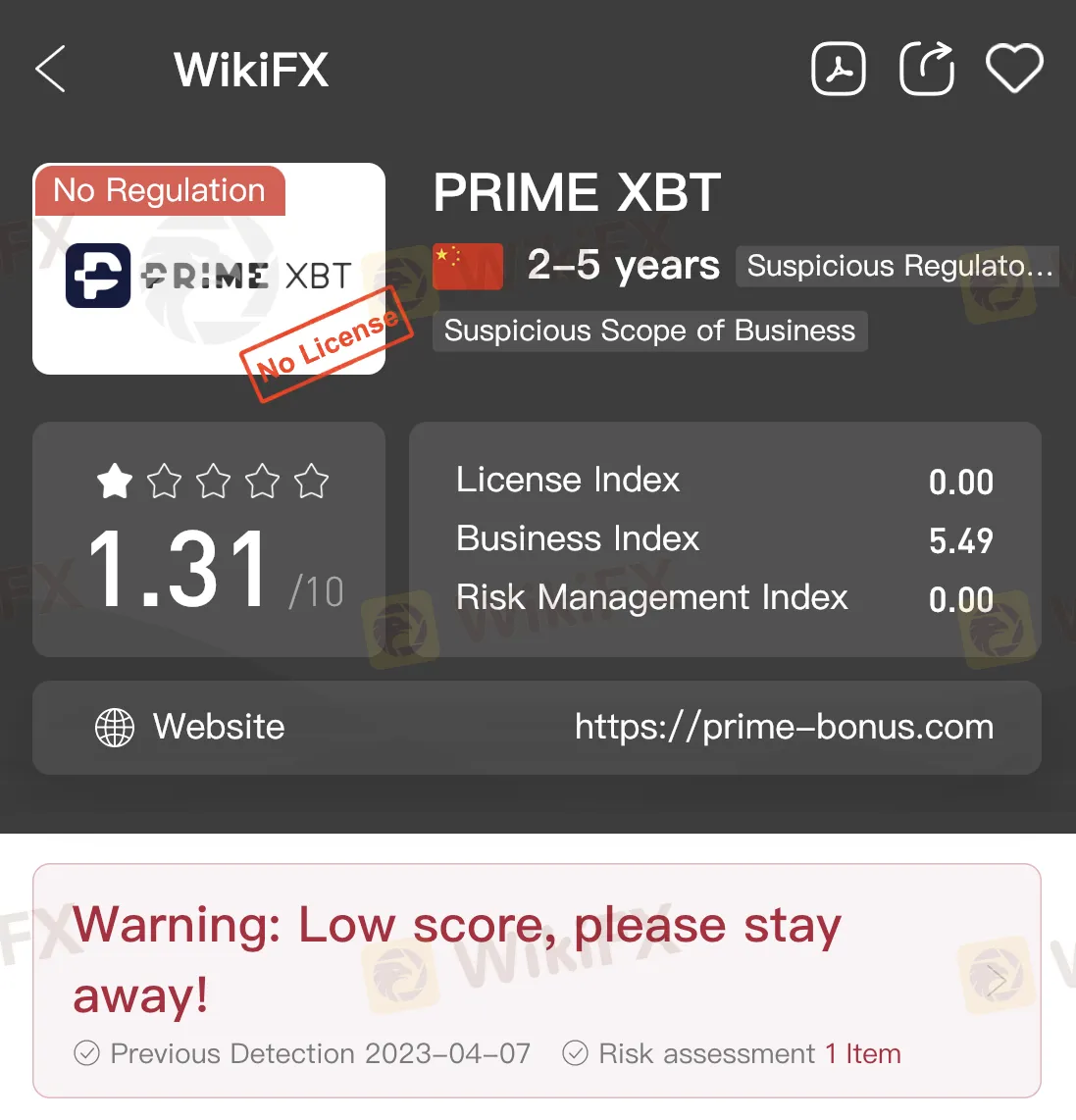

Abstract:In today’s article, WikiFX will explore PrimeXBT in depth, examining its features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service, to help you make an informed decision on whether or not to use this platform.

PrimeXBT is a brokerage that was established in 2018 in St. Vincent and the Grenadines. This bitcoin-based platform offers cryptocurrencies such as Bitcoin, Ether, Litecoin and Ripple, as well as a range of leveraged trades in stock indices, commodities and foreign currencies. The minimum threshold to open an account is just $1.

Currently, the company has over 1.5 million customers in more than 150 countries, and its average daily trading volume exceeds $1 billion. To provide full liquidity and a wealth of trading instruments and cryptocurrency security and liquidity, PrimeXBT maintains close partnerships with over 12 liquidity providers.

PrimeXBT's trading system is powerful and capable of processing a large number of orders per second while meeting extreme loads. This ensures extremely fast order execution and low latency. The company also ensures that every trader can easily customize the layout, tools and products that best suit their trading style.

In addition, PrimeXBT offers an automated copy-trading service called the Covesting Copy-trading Module. This allows users to browse through hundreds of trading strategies offered by other traders and automatically copy their trades. Experienced traders can also earn a second commission by offering a copy service on the Covesting Copy-trading Module.

Currently, PrimeXBT does not accept users or residents from certain countries, such as the United States, Japan, Canada, Cuba, Algeria, Ecuador, Iran, Syria, Korea or Sudan.

Safety:

PrimeXBT claims to offer several security measures for client protection. Its platform uses multiple signature access to defend against attacks and against loss of access to keys or facilities. Additionally, two-factor authentication (2FA) improves security by requiring users to authenticate themselves through two different authentication factors. An additional layer of protection is added with the ability to whitelist specific withdrawal addresses using cryptocurrency address whitelisting.

Fees:

There are two different types of fees that may be incurred when trading with PrimeXBT: transaction fees and overnight financing. Detailed information about the fees can be found on the company's website. Transaction fees are incurred when opening or closing a position, and the new trading day starts at 00:00 UTC. Overnight financing is generated at any time, and positions closed before the start of the new trading day will not be charged any fees.

Deposit/Withdrawal:

PrimeXBT offers two ways to deposit funds: depositing cryptocurrency directly from the user's personal cryptocurrency wallet to the PrimeXBT wallet or purchasing cryptocurrency with a bank card through third-party services such as Paxful, Coinify, Xanpool, or CEX.io. PrimeXBT does not have a minimum withdrawal amount, but every withdrawal involves a flat withdrawal fee, which varies depending on the network used.

Trading Platform:

PrimeXBT offers its own trading platforms for both mobile and computer versions. Traders can trade and manage up to 100+ popular commodities on this intuitive platform, monitor market movements in real-time, and enjoy other advanced features. PrimeXBT's trading platform has won numerous awards, including Best Cryptocurrency and Forex Broker, Best Margin Trading Platform, and Best Cryptocurrency Trading Application.

Customer Service:

While PrimeXBT does not offer online chat customer service, it is committed to serving users via email 24/7. Users can contact PrimeXBT through info@primexbt.com (for general information) or support@help.primexbt.com (for technical support).

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Silver surges past $33—are you ready for what comes next?

Silver has once again become the center of attention in global financial markets.

171 years! One of this country’s largest crypto-related fraud

A federal court in Brazil has handed down one of the harshest sentences in the country’s history for a crypto-related fraud, jailing three executives of the now-defunct Braiscompany scheme to a combined 171 years behind bars. The case, which saw some 20,000 investors lose approximately R$1.11 billion (about USD 190 million), underscores Brazil’s intensifying crackdown on unregulated cryptocurrency operations

Tradu Joins TradingView for Seamless CFD and Forex Trading

Tradu, a global trading platform, integrates with TradingView for seamless CFD and forex trading, offering transparency, tight spreads, and fast execution.

Protect Your Portfolio in the Storm | What Are Safe Haven Assets?

Gold surged to an all-time high on Tuesday, driven by renewed weakness in the US dollar, ongoing trade war tensions, and critical remarks from President Donald Trump aimed at the Federal Reserve. These factors fuelled strong demand for safe-haven assets, pushing bullion above US$3,485 an ounce for the first time. But what exactly are safe haven assets? Why is everyone raving about them?

WikiFX Broker

Latest News

eXch Exchange to Shut Down on May 1 Following Laundering Allegations

How a Viral TikTok Scam Cost a Retiree Over RM300,000

JT Capital Markets Review

FCA Proposes Simplifying Investment Cost Disclosure for Retail Investors

Fresh Look, Same Trust – INGOT Brokers Rebrands its Website

FCA Issues Alerts Against Unauthorised and Clone Firms in the UK

Consob Orders Blackout of 9 Fraudulent Financial Websites

Tradu Joins TradingView for Seamless CFD and Forex Trading

Japan Issues Urgent Warning on $700M Unauthorized Trades

Silver surges past $33—are you ready for what comes next?

Currency Calculator