简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Exness Secures FSCA ODP License in South Africa

Abstract:Recently, Exness has announced a significant milestone in its operational journey, as the Financial Sector Conduct Authority (FSCA) of South Africa has granted the company an ‘Over-the-Counter Derivative Provider’ (ODP) license.

Recently, Exness has announced a significant milestone in its operational journey, as the Financial Sector Conduct Authority (FSCA) of South Africa has granted the company an ‘Over-the-Counter Derivative Provider’ (ODP) license. This prestigious license not only broadens Exness regulatory portfolio but also reinforces its dedication to maintaining the highest standards of client security, regulatory compliance, and market transparency within the South African financial landscape.

Strengthening Client Protection and Trust

The ODP license is a testament to Exness unwavering commitment to client protection. It mandates rigorous risk management protocols and stringent reporting standards, offering clients an additional layer of security in their trading activities. By adhering to these elevated regulatory requirements, Exness continues to solidify its reputation as a trusted broker for local traders, ensuring a secure and reliable trading environment.

Paul Margarites, Exness Regional Commercial Director, highlighted the significance of this achievement:

“The ODP license acquisition signifies a significant stepping stone for Exness in South Africa. Our promise to provide a frictionless trading experience doesn‘t stop at trading conditions and a seamless client journey. Still, it extends to robust safety and security measures that put our clients first. In today’s online trading landscape adherence to the FSCAs stringent standards ensures that our South African clients have an extra layer of peace of mind when trading with Exness.”

Elevating Industry Standards Through Technology and Ethics

Exness is known for leveraging advanced technology and ethical practices to set new benchmarks in the trading industry. The company‘s proprietary platform, renowned for its superior performance and unique market protections, offers clients a seamless and frictionless trading experience. This latest regulatory achievement is a reflection of Exness’ ongoing efforts to create favorable conditions for traders, ensuring that their market interactions are secure, efficient, and transparent.

With the FSCA ODP license, Exness not only enhances its regulatory stature but also reaffirms its dedication to providing top-tier trading services in South Africa. This development is poised to instill greater confidence among traders, further establishing Exness as a leading force in the global financial markets.

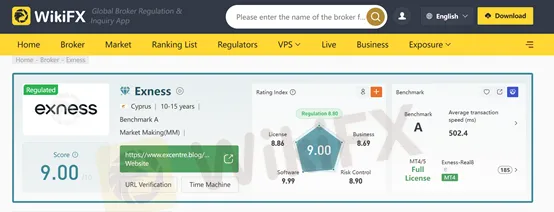

Exness on WikiFX

Exness is a globally recognized forex broker, operating in over 170 countries, offering a diverse range of tradable assets, including currencies, commodities, and cryptocurrencies. With a daily execution of over 300,000 trades and monthly trading volumes exceeding $1 trillion, Exness is a high-volume broker known for its transparency. Regulated by CySEC , FCA FSCA, and FSA in different jurisdictions, Exness adheres to strict financial standards. In this Exness review, we'll explore the broker's offerings in detail to reveal the real exness.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

U.S. Stocks Bounce Back for Two Consecutive Days, Is a Positive Outlook Ahead?

The U.S. stock market has rebounded for two consecutive days. Could this signal a potential turning point, or is it just a temporary uptick? Let's explore the market movements, their underlying causes, and how investors should respond.

U.S. Consumer Weakness: Is It Good or Bad?

U.S. retail data for February came in below expectations, raising concerns about slowing consumer spending. Does this signal the beginning of an economic slowdown, or is it just a temporary fluctuation? Let's dive into the analysis.

Acuity Trading and interop.io have joined forces

Acuity Trading and interop.io have joined forces to streamline financial data integration, enabling traders, brokers, and institutions to access real-time market intelligence without disrupting their existing systems. This partnership represents a significant step forward in addressing one of the financial industry’s most persistent challenges—integrating vast amounts of market data from diverse sources.

TopFX Launches New Website & Brand Identity for Enhanced Trading

TopFX unveils a redesigned website and brand identity, offering faster trading, advanced technology, and institutional-grade liquidity for serious traders.

WikiFX Broker

Latest News

Beware: Forex Investment Fraud Targeting Low Income Earners

Central Bank Policies,Forex Markets and Gold Prices

These 24 Crypto Scams Are Accelerating the Theft of Your Assets

49 Foreigners Arrested in Illegal POGO Raid in Pasay City

Beware of Fake 'Educational Foundations' Targeting Crypto Investors, Warns North Dakota Regulator

We Asked Grok About Illegal FX Brokers—Here’s What It Revealed

Exposing Trading Academy Scams: How Aspiring Traders are at Risk

Online Investment Scams on the Rise: How Two Victims Lost Over RM100K

Vanished Savings: How One Woman Lost RM412,443 to an Online Scam

Investor Alert: FCA Exposes 9 Unregistered Financial Companies

Currency Calculator