简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

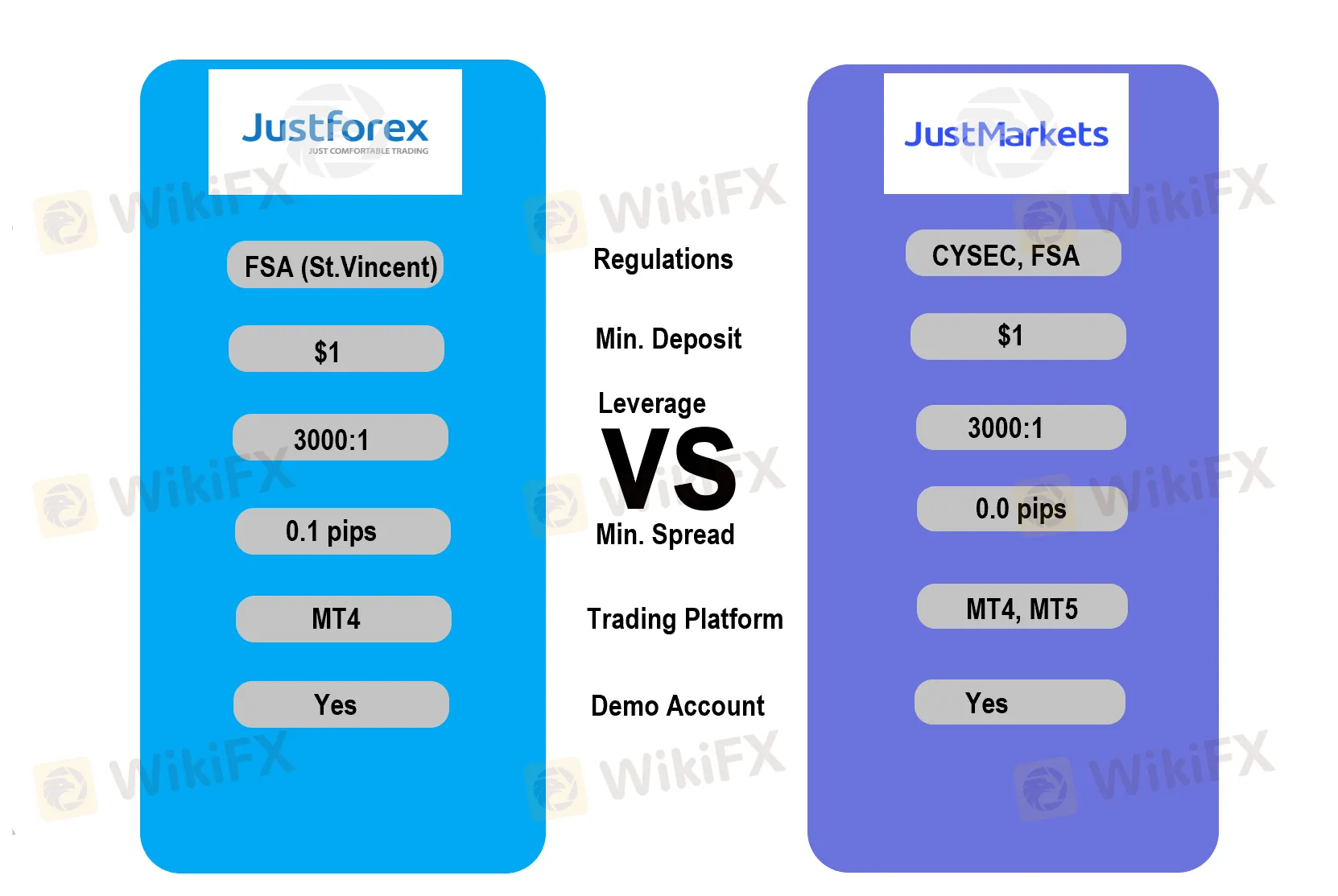

JustForex vs JustMarkets: A Comprehensive Comparison in 2025

Abstract:Selecting the right forex broker can make the difference between trading success and frustration for most investors, especially retail investors. As retail traders gain unprecedented access to global markets, the choice between platforms like JustForex and JustMarkets becomes increasingly significant. Both brokers offer some shining features within the forex and CFD trading space, but their approaches differ in some areas.

Selecting the right forex broker can make the difference between trading success and frustration for most investors, especially retail investors. As retail traders gain unprecedented access to global markets, the choice between platforms like JustForex and JustMarkets becomes increasingly significant. Both brokers offer some shining features within the forex and CFD trading space, but their approaches differ in some areas.

Modern traders demand not only competitive spreads and a great variety of tradable assets but also robust platforms, professional customer support, and trustworthy regulatory oversight. This article compares how JustForex and JustMarkets differ, helping you make better choices.

Basic Information and Regulation

JustForex: An offshore Player

Founded in 2012, Just Forex is a trading brand operating under GM Group Limited., and this broker claims its registration in Saint Vincent and the Grenadines through the Financial Services Authority (FSA). This offshore FSA, which offers basic registration services rather than comprehensive regulatory oversight, features operational flexibility, yet comes with more regulatory considerations for traders.

Regarding its trading conditions, some shining features like low deposit from $1, plus flexibility leverage up to 3000:1, are quite scalpers and high-frequency traders' type. However, we don't consider JustForex's Trading fees low, as they can be much higher in most cases.

JustMarkets: An European Player

JustMarkets entered the forex market more recently in 2019 but quickly established a good reputation in Europe under its Cyprus-regulated entity, JustMarkets Ltd. This places it under the umbrella of European financial regulations, specifically the Markets in Financial Instruments Directive (MiFID II). This European regulatory framework translates to tangible benefits for traders, including mandatory segregation of client funds, participation in the Investor Compensation Fund (up to €20,000 per client), and negative balance protection.

Featuring a low entry barrier, a 50% deposit bonus, and robust tradig platforms-MetaTrader 4 and MetaTrader 5, JustMarkets has gained great popularity among retail investors in recent years. JustMarkets allows its traders to trade over 260 CFD-based instruments, yet not an extensive range. Though it allows more focused trading for retail investors, professional traders may find brokers with a greater variety of tradable instruments more suitable.

| Logo |  |  |

| Broker Name | JustForex | JustMarkets |

| Regulation | FSA | CYSEC, FSA |

| Authorized Region | Saint Vincent and the Grenadines | Europe |

| Client Fund Protection | Basic segregation requirements | Strict segregation of client funds |

| Compensation Scheme | Not available | Investor Compensation Fund (up to €20,000) |

| Negative Balance Protection | Not guaranteed for all accounts | Mandatory for all retail clients |

| Leverage Restrictions | No regulatory restrictions (up to 1:3000) | Subject to ESMA rules (1:30 for retail EU clients) |

| Regulatory Transparency | Limited reporting requirements | Comprehensive financial reporting |

JustForex VS JustMarkets: Pros and Cons to Explore

JustForex's Pros and Cons

✅Where JustForex Shines

- Low entry barrier, friendly to beginners

- Flexible leverage up to 3000:1 to increase trading flexibility

- Introduces copy trading solution

- Offers access to MetaTrader 4 trading platform

- Offer 7/24 multichannel customer support

❌Where JustForex Falls Short:

- Offshore registration and weak regulation

- Expensive trading fees

- Educational contents lacking structure progression

- Withdrawals experience frequent delays

JustMarkets Pros and Cons

✅Where JustMarkets Shines:

- CYSEC-regulated, has gained a good reputation in Europe

- Relatively low trading costs

- Generous 50% deposit bonuses provided

- Low minimum required to start real trading, quite encouraging for beginners

- Free demo accounts provided

❌Where JustMarkets Falls Short:

- An inactivity fee of $4 for accounts being active for 150 days

- EU-based clients with leverage limited to 30:1

- No VPS services supported

JustForex Vs JustMarkets: Comparison on Trading Platforms

JustForex - Offer access to MT4 only

JustForex offers traders access to the popular MetaTrader 4 available on both web and mobile devices (Android and IOS), beloved by traders for its intuitive interface and extensive technical analysis capabilities. JustForex MT4 trading platform is free to use, and it includes many built-in features including charting tools, over 80 indicators, automated trading tools, and more. However, JustForex does not provide a more advanced MetaTrader platform - MT5.

JustMarkets' Focused MT4 and MT5 Platform Approach

JustMarkets focuses on the MetaTrader experience, offering both MT4 and MT5 platforms with additional plugins and enhancements designed to improve trading efficiency and analysis capabilities.

JustMarkets has paid attention to platform stability and execution speed, using dedicated servers and low-latency connections to minimize slippage during volatile market conditions. Their mobile applications mirror this focused approach. Aside from third-party MetaTrader, JustMarkets also offers its proprietary mobile app.

| Logo |  |  |

| Platform Feature | JustForex | JustMarkets |

| Available Platforms | MetaTrader 4 | MT4, MT5, Mobile Apps |

| Proprietary Platforms | No | Yes |

| Custom Indicators | Standard MT4/MT5 plus custom suite | Standard MT4/MT5 plus enhanced plugins |

| Automated Trading | Full EA support with VPS options | Full EA support with optimized VPS service |

| One-Click Trading | Available | Available with enhanced execution |

| Mobile Trading | iOS, Android | iOS, Android |

JustForex VS JustMarkets: Comparison on Accounts and Trading Conditions

JustForex Accounts - Cheap and Flexible Options

JustForex offers multiple account options targeting various traders. The entry-level Cent Account requires $0 to begin trading with positions denominated in cents rather than standard lots.

The Mini Account does not require a minimum deposit, either. The Mini account spreads start from 0.3 pips, with the available maximum leverage has been raised to 3000:1.

The Standard Account delivers more conventional trading conditions with variable spreads starting from 0.1 pips and leverages up to 1:1000. This account also requires no minimum deposit.

For more experienced traders, JustForex offers a professional-grade option: theECN Zero Account,which provides direct market access with raw spreads from 0.0 pips, offset by a commission of $3.50 per lot and a minimum deposit requirement of $500.

The Crypto account does not have a minimum deposit, offering spreads from 0 pips, with its account currency being USD. And this account does charge commissions.

JustMarkets - Account Tailored for MT4 & MT5

JustMarkets has a similar account structure, yet it takes a more focused approach to accounts and platform compatibility.

MT4 Accounts offers four options: Standard Cent, Standard, Pro, and Raw Spread, all coming with operation on MetaTrader 4.

Notably, the Standard Cent account is specially designed for beginners, allowing them to trade with micro lots. However, it is notable that this account can make deposits through USDC only, and the available instruments are limited to forex and commodities. The Standard Account remains the most popular account that suits all types of trading strategies, requiring the same minimum deposit as the Standard Cent account. More experienced traders might prefer the Pro or Raw Spread accounts, both of which require a $200 initial deposit.

JustMarkets MT5 Accounts give three tailored options: Standard, Pro, and Raw Spread, all come with operation on MetaTrader 5. The account-based currencies available include USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, ZAR, AED, and NGN. Traders can access forex, indices, commodities, stocks, and cryptocurrencies with leverage up to 3000:1. The Standard and Pro accounts are commission-free, with spreads starting from 0.3 and 0.1 pips, respectively. The Raw Spread account offers tighter spreads but charges a $3 commission per lot, per side. JustMarkets uses market execution, and swap-free options are available for all three accounts.

JustForex VS JustMarkets: Comparison on Investment Options

Regarding investment products, obviously, JustForex is the winner. JustForex offers a greater variety of offerings for forex pairs, stocks, and cryptocurrency, Which tends to increase more platform engagement among retail and professional traders. However, both forex brokers fail to offer a more diversified range, like futures, options, ETFs.

| Logo |  |  |

| Tradable Assets | JustForex | JustMarkets |

| Forex Pairs | 84 pairs | 60 pairs |

| Stocks | 180 | 100 |

| Cryptocurrency | 20 | 5 |

| Metals | ✅ | ✅ |

| Energies | ✅ | ✅ |

| Indices | ✅ | ✅ |

| Commodities | ✅ | ✅ |

JustForex VS JustMarkets: Comparison on Fees

JustForex - Average Spreads and Higher Trading Costs

JustForex does not offer competitive trading costs for its regular accounts, and actually, spreads can be expensive during volatile periods. Standard accounts operate on a spread-only model with no direct commissions, variable spreads starting from 1.3 pips on major pairs. ECN accounts tend to offer lower spreads, however, they require large trading volume and mature trading experience. JustForex charges an inactivity fee, which applies after 180 days without trading activity. Deposit processing remains free from broker charges, withdrawal fees vary considerably by method. Electronic withdrawals typically incur fees between $1-15, while bank transfers may cost $20-30 depending on the amount and destination, which sit slightly above industry averages.

JustMarkets' Competitive Fee Structure

Compared with JustForex, JustMarkets has a slightly lower fee structure. The Standard account features variable spreads from 1.0 pips on major pairs. ECN accounts provide raw spreads from 0.0 pips, yet with a commission of $3 per standard lot. JustMarkets 's swap rates align with market standards, but it uses a more stringent inactivity policy than JustForex, with a fee of $5 applying after 150 days without trading. Like JustForex, deposits are free across all methods at JustMarkets, and withdrawal fees are applied by third-party payment providers.

| Fee Comparsion | JustForex | JustMarkets |

| Standard Account Spreads | From 1.3 pips | From 1.0 pips |

| ECN Account Spreads | From 0.1 pips | From 0.0 pips |

| ECN Commission | $3.50 per standard lot | $3.00 per standard lot |

| Swap Rates | Standard market rates | Standard market rates |

| Inactivity Fee | 180 days | $5 (150 days) |

| Deposit Fees | Free | Free |

| Withdrawal Fees | $1-$30 (Vary by method) | Fees Applied |

| Account Maintenance | No | No |

JustForex vs JustMarkets: Comparison on Deposits & Withdrawals

Traditional payment options at JustForex include major credit and debit cards (Visa and Mastercard), alongside bank wire transfers with typical processing times of 3-5 business days. Where JustForex shines is in its e-wallet integration, supporting not only options like Skrill and Neteller but also regional favorites such as Perfect Money and WebMoney. Besides, JustForex also supports Bitcoin, Ethereum, and Litecoin for both deposits and withdrawals. While JustForex doesn't charge direct deposit fees, withdrawal costs vary by method, typically ranging from $1-$30 depending on the payment system used. Their withdrawal processing cannot be considered reliable because of frequent delays, typical for offshore-registered brokers.

JustMarkets supports major credit cards, bank transfers, and popular e-wallets like Skrill and Neteller, with cryptocurrency options available for Bitcoin and selected altcoins. The broker's EU regulatory status requires stringent verification procedures, but once completed, transfers typically proceed without complications. Generally, withdrawal requests receive processing within 24 hours for electronic methods, with actual receipt times determined by the payment processor.

JustMarkets maintains transparent fee structures with no deposit charges from their side (though third-party fees may apply). However, like Justforex, traders on this platform also frequently experience delays in withdrawals, which means the maximum withdrawal time cannot be guranteened.

| Payment Methods | JustForex | JustMarkets |

| Credit/Debit Cards | Visa, Mastercard | Visa, Mastercard |

| E-wallets | Skrill, Neteller, Perfect Money, WebMoney | Skrill, Neteller |

| Cryptocurrencies | Bitcoin, Ethereum, Litecoin | Bitcoin, Selected altcoins |

| Bank Transfers | Supported with 3-5 day processing | Supported with 1-3 day processing |

| Local Payment Methods | Extensive regional options | Selected regional options |

| Deposit Processing Time | Same day for most methods | Same day for electronic methods |

| Withdrawal Processing | 24-48 hours (electronic methods) | 24 hours (electronic methods) |

| Withdrawal Fees | Vary by method ($1-$30) | Minimal Fees |

JustForex VS JustMarkets: Tools and Additional Features

JustForex introduces the popular copy trading feature, an attractive option for those with limited time for direct market analysis. Besides, JustForex also provides VPS services, but it is not free to use, typically with a monthly fee ranging from $15 to $50.

In contrast, JustMarkets focuses more on value-added services, like advanced charting tools, custom indicator packages, and risk assessment calculators. What's more, JustMarkets offers professional trading signals with detailed entry, exit, and risk parameters. However, VPS services cannot be used on the JustMarkets platform.

JustForex VS JustMarkets: Customer Support and Education

Customer support at JustForex operates 24/7, accessible via live chat, email, international telephone lines, Telegram, and WhatsApp. Generally, response times remain acceptable during standard market hours, though they can extend during peak periods or for complex issues.

JustMarkets also offers 24/7 customer support through live chat, email, and phone. Compared with JustForex, JustMarkets'online support features more quick and responsive replies, with their customer support staff always being active.

JustForex offers learning resources including written guides, video content, and regular webinars—though the overall offerings lack the structured progression found in more education-focused brokers.

In contrast, JustMarkets has developed structured educational content, including the trading academy, regular webinars, and seminars conducted by market professionals, covering both theoretical concepts and practical trading applications. Their market research department produces daily insights combining fundamental analysis with technical perspectives, helping traders explain price movements.

| Support & Education | JustForex | JustMarkets |

| Customer Support Hours | 7/24 | 7/24 |

| Contact Channels | Live chat, email, telephone, WhatsApp, Telegram | Live chat, email, telephone |

| Language Support | Multiple languages | Comprehensive multilingual service |

| Webinars | Regular webinars | Frequent webinars & seminars |

| Market Analysis | Daily technical reviews | Comprehensive fundamental and technical analysis |

| Trading Tools | Basic calculators and indicators | Advanced risk assessment and strategy tools |

| Trading Signals | Limited | Comprehensive |

JustForex VS JustMarkets: Which Broker Is Better?

Currently, we consider JustMarkets the Winner. Firstly, JustMarkest comes from a strict regulatory framework, and this matters when comes to client funds protection. Secondly, overall trading fees on the JustMarkets platform are much lower and applicable to both short-term and long-term trading. Thirdly, JustMarkets features a stable platform performance and withdrawals are generally processed quicker than JustForex. However, no matter which broker you want to open an account with, we advise that test their demo account first - experiencing firsthand how their execution, platform interface, and customer support. Notably, pay particular attention to execution quality during volatile market conditions, as this often reveals performance differences invisible during normal trading.

Frequently Asked Questions (FAQs)

Can I trust both of these brokers with my money?

Generally, JustMarkets provides stronger regulatory protections through CySEC, including fund segregation and investor compensation. JustForex's offshore registration offers less regulatory oversight, which some traders consider a higher risk factor. Therefore, JustMarkets has maintained a generally positive reputation throughout its operation.

What regulatory protections does JustMarkets offer?

As a CySEC-regulated broker, JustMarkets must maintain segregated client funds, participate in the Investor Compensation Fund (protecting up to €20,000 per client), implement negative balance protection, and adhere to MiFID II requirements for transparency and business conduct.

Which broker offers better spreads?

Generally, JustMarkets offers tighter spreads. Their Standard account spreads start from 1.0 pips on major pairs compared to JustForex's 1.3 pips. On ECN accounts, JustMarkets offers spreads from 0.0 pips versus JustForex's 0.1 pips.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

CySEC reaches €20k settlement with ZFN EUROPE

According to report, the Cyprus Securities and Exchange Commission (CySEC) announced today that it has entered into a settlement agreement with ZFN EUROPE Ltd for the amount of €20,000. This settlement resolves a regulatory inquiry into ZFN Europe’s compliance with Cyprus’s Investment Services and Activities and Regulated Markets Law of 2017, as amended.

PrimeXBT Expands Trading Options with Stock CFDs on MT5

PrimeXBT launches stock CFDs on MetaTrader 5, offering shares of major U.S. companies with crypto or USD margin for enhanced multi-asset trading.

Webull Listed on Nasdaq Following SPAC Merger with SK Growth

Webull and SK Growth complete their business combination, with Webull now trading under the ticker “BULL.” App hits 50 million downloads worldwide.

PrimeXBT Expands with Stock CFDs for Major Global Companies

PrimeXBT introduces stock CFDs, allowing trading of major US stocks like Amazon, Tesla, and MicroStrategy with crypto or fiat margin options.

WikiFX Broker

Latest News

Love, Investment & Lies: Online Date Turned into a RM103,000 Scam

Broker’s Promise Turns to Loss – Funds Disappear, No Compensation!

Broker Took 10% of User's Profits – New Way to Swindle You? Beware!

Pi Network: Scam Allegations Spark Heated Debate

Broker Comparsion: FXTM vs AvaTrade

Account Deleted, Funds Gone: A New Broker Tactic to Beware Of?

El Salvador and U.S. Launch Cross-Border Crypto Regulatory Sandbox

The Instagram Promise That Stole RM33,000

Coinbase Launches Bitcoin Yield Fund for Institutional Investors

Before You Trade the Next Big Thing, Remember the Dot-Com Collapse

Currency Calculator