简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trump’s Post Fuels Gold Rally — But Are We in a Bubble?

Abstract:On April 21st, Donald Trump took to his social media platform with a striking message:“THE GOLDEN RULE OF NEGOTIATING AND SUCCESS: HE WHO HAS THE GOLD MAKES THE RULES. THANK YOU!”This statement, both

On April 21st, Donald Trump took to his social media platform with a striking message:

“THE GOLDEN RULE OF NEGOTIATING AND SUCCESS: HE WHO HAS THE GOLD MAKES THE RULES. THANK YOU!”

This statement, both literal and metaphorical, is a classic example of Trump‘s “realpolitik-meets-business” rhetoric. It's a twist on the traditional “Golden Rule,” instead suggesting that power and wealth dictate the rules. Whether a worldview or a subtle jab at his opponents, Trump’s message reinforces his belief in strength-driven leadership.

Markets, now in an increasingly irrational phase, are quick to react to any catalyst — even a tweet. Gold extended its rally, breaking above $3,450/oz, further reflecting the emotional exuberance. But from a historical perspective, these are signs of a classic asset bubble.

Remember the Tulip Mania?

Tulip Mania, which occurred in the Netherlands during the 1630s, is one of the earliest recorded asset bubbles in financial history. Tulips, once symbols of wealth and status, saw prices skyrocket — with rare bulbs selling for more than a luxurious house in Amsterdam. Even unbloomed bulbs were traded in speculative futures contracts, luring in citizens from all walks of life.

Then came the crash. A failed auction in 1637 triggered panic. Prices collapsed by over 90%, leaving speculators wiped out. Though the broader economy remained largely intact, Tulip Mania became a textbook example of how emotion-driven markets can implode when fundamentals are ignored.

Is Gold the New Tulip?

During a visit to a gold store yesterday, the shop owner shared an anecdote:

“One customer recently lost a lot in stocks. His wife said, ‘You lose money in stocks, but never in gold.’”

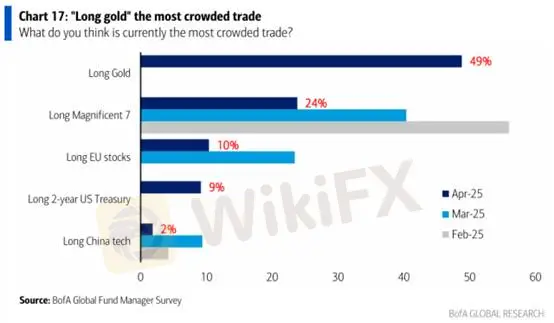

This sentiment is telling — not just among retail investors, but across institutions. Major global banks and funds are pouring into gold, turning it into one of the most crowded trades in the market today.

(Chart: Gold ranks as one of the most crowded trades among global fund managers — Source: BofA FMS)

Gold Technical Outlook

Gold continues to print new highs, and in this kind of rally, support levels are more meaningful than resistance. A break below $3,343 would signal a weakening bullish momentum, and falling under $3,411 would damage the broader uptrend. Investors are advised to remain cautious and avoid chasing the rally or prematurely shorting at the top.

Support levels: 3,343 / 3,411

Resistance levels: None clearly defined at this stage

Risk Disclaimer: The views, analysis, research, prices, or any information presented above are intended solely as general market commentary. They do not represent the official stance of this platform. All readers are advised to conduct their own due diligence and assume full responsibility for their decisions.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Inside MBI: The Billion-Dollar Ponzi Scheme That Shook Malaysia

ZFX: A Closer Look at Its Licences

Should you buy or sell US dollars in the next three to six months?

Tradehall Broker Review 2025: Read Before Trade

XM Rolls Out New Forex Trading Competition Platform for 2025

Tether Freezes $12.3 Million in USDT Over Money Laundering Concerns

MiCA Unlocks EU Crypto Market, but National Tensions Rise as Gemini and Coinbase Near Approval

Retirement Dreams Shattered: Don't Do This To Yourself!

Philippines Sets Southeast Asia’s First Crypto Regulatory Framework

EU Regulators Imposed Over €71M in Sanctions in 2024, ESMA Calls for Enforcement Convergence

Currency Calculator