简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Broker Assessment Series | BDSwiss: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of BDSwiss, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

In this article, we will conduct a comprehensive examination of BDSwiss, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Founded in 2012, BDSwiss operates as an online brokerage offering the trading of exchange-traded CFDs, with spreads as low as 0 pips.

The company provides a diverse range of over 250 tradable assets, including currency pairs, commodities, stocks, global indices, and cryptocurrencies.

Additionally, BDSwiss offers an Introducing Broker (IB) programme and an affiliate programme, which allow individuals and businesses to earn multi-tiered commissions by referring new clients to the company.

It is important to note that, at present, BDSwiss does not offer its services in Algeria, Bahrain, Cyprus, the Democratic Peoples Republic of Korea, the Democratic Republic of the Congo, Egypt, Eritrea, Iran, Iraq, Israel, Japan, Jordan, Kuwait, Lebanon, Libya, Mauritius, Morocco, Myanmar, Oman, Palestine, Qatar, Saudi Arabia, Seychelles, Somalia, Sudan, Syria, Tunisia, the United Arab Emirates, the United Kingdom, the United States (including U.S. reportable persons), Yemen, and the European Union.

Types of Accounts:

BDSwiss offers four account options: the Cent Account, the Classic Account, the VIP Account and the Zero-Spread Account.

Please refer to the attached image below for more detailed information on each corresponding account.

Deposits and Withdrawals:

BDSwiss offers a range of payment options, including bank transfers, Visa, Mastercard, Skrill, Neteller, and more.

While BDSwiss asserts a policy of not imposing any commission or fees for deposits and withdrawals, it is important to note that any fees levied by third-party providers shall be the responsibility of the trading client.

The company asserts a commitment to processing all withdrawal requests within 24 hours on business days.

The timeframe for funds to reflect in the account depends on the selected withdrawal method. Details for each deposit and withdrawal option can be found in the images below:

Trading Platforms:

BDSwiss offers the MetaTrader 5 (MT5) trading platform, available on PC, mobile, and web, renowned for its technological sophistication, which provides access to a depth of market and various advanced solutions. It offers features such as buy and sell flexibility with six types of pending orders, 38 technical indicators, 44 analytical objects, and 21 timeframes, providing a customizable platform with numerous online tools for integration. Quick order execution, an economic calendar for tracking global macroeconomic news, one-click trading, mobile trading capabilities, and an intuitive market search and grouping functionality contribute to the platform's comprehensive and user-friendly trading experience.

Research and Education:

BDSwiss offers a variety of educational resources to support traders at different levels, including beginners, intermediate, and advanced. These resources are available in the form of both texts and videos.

Customer Service:

BDSwiss offers customer support in several foreign languages, including English, Spanish, Thai, Turkish, Arabic, and others, via its live chat function and email (support@km.bdswiss.com).

Conclusion:

To summarize, here's WikiFX's final verdict:

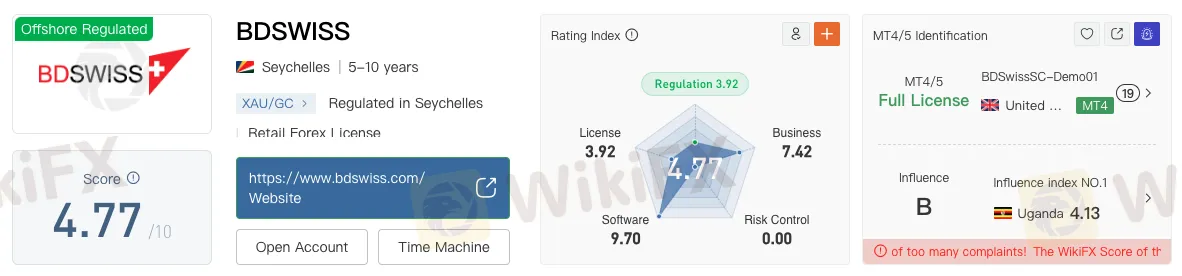

WikiFX, a global forex broker regulatory platform, has assigned BDSwiss a WikiScore of 4.77 out of 10.

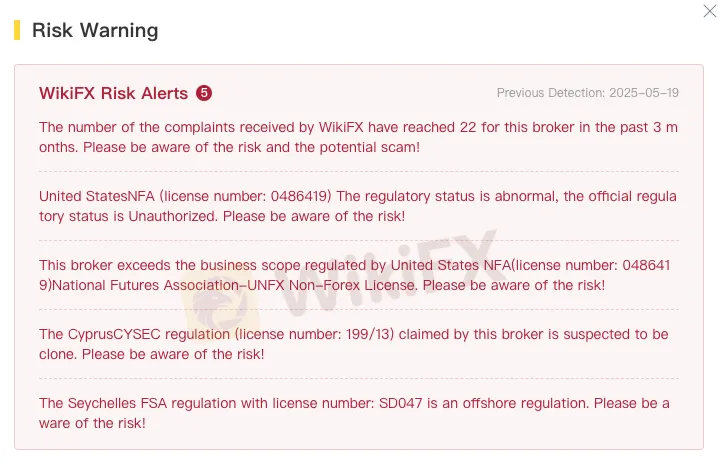

Upon reviewing BDSwisss licensing credentials, WikiFX found that only one of the three licences the broker claims to hold is valid and authentic.

BDSwiss has also received several complaints from users worldwide, casting doubt on its trustworthiness.

Therefore, WikiFX advises users to choose a broker with a higher WikiScore for greater credibility and security.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

ALERT! Morfin FX - The Scammer is Operating without a License

Morfin FX indeed has a nice trading software by which you can trade. But is it a safe bet? Does it carry any license? Can you withdraw money from it? Read our review of this forex broker.

ZFX: A Closer Look at Its Licences

In an industry where safety and transparency are essential, the regulatory status of online brokers has never been more important. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about ZFX and its licenses.

XChief Offers $100 No-Deposit Bonus for New Verified Clients

XChief has launched a no-deposit bonus promotion that provides new clients with a $100 trading bonus without requiring an initial deposit. The promotion is intended to allow users to test the platform’s services and trading conditions before committing their own funds.

Interactive Brokers Adds Global and US Funds to Mutual Fund Marketplace

Interactive Brokers expands its Mutual Fund Marketplace with new global and US fund families, now offering over 43,500 funds and zero custody fees worldwide.

WikiFX Broker

Latest News

Why Your Stop Loss Keeps Getting Hit & How to Fix It

Inside MBI: The Billion-Dollar Ponzi Scheme That Shook Malaysia

ZFX: A Closer Look at Its Licences

Should you buy or sell US dollars in the next three to six months?

Tradehall Broker Review 2025: Read Before Trade

XM Rolls Out New Forex Trading Competition Platform for 2025

IronFX Review 2025: Is This Broker Trustworthy or a Scam?

Exclusive Markets MT4 and MT5 Review 2025

WikiFX “Elite Night · Bogotá” Concludes Successfully

Is Copy Trading of AMarkets a Good One?

Currency Calculator