简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Alert】Behind the strengthening of gold: multiple drivers of fiscal risks, policy games and ma

Abstract:Against the backdrop of global economic and political uncertainty, gold, as a traditional safe-haven asset, is gaining new attention.1. Fiscal and political risks: the core logic of long-term support

Against the backdrop of global economic and political uncertainty, gold, as a traditional safe-haven asset, is gaining new attention.

1. Fiscal and political risks: the core logic of long-term support for gold

The increasingly severe fiscal situation in the United States is becoming an underlying factor supporting gold prices. The World Gold Council pointed out that with the passage of the "Big and Beautiful Act", if the Trump administration fails to achieve its growth expectations, the United States will add $3.4 trillion in debt in the next decade, and the debt ceiling will be increased by $5 trillion, which will make the US debt of $36.2 trillion even worse. Coupled with the political atmosphere caused by Musk's threat to establish the "American Party", the dual accumulation of fiscal and political risks has triggered a global capital reconfiguration.

2. Trade frictions and policy fluctuations: catalysts for short-term market sentiment

The Trump administration's trade policy is becoming an important variable that stirs market sentiment. Recently, the United States announced a new 50% tariff on copper imports and made it clear that "the exemption period will not be extended and retaliatory measures will be responded to by increasing taxes." This move directly triggered market concerns about the slowdown in global economic growth and accelerated the inflow of safe-haven funds into the gold market. Data shows that gold prices have rebounded from the recent low of one and a half weeks, and the short-term upward momentum is significant.

Uncertainty in trade policy also indirectly affects gold by affecting economic expectations. The World Gold Council pointed out that consumer confidence and business investment willingness are being impacted by the swings in trade policy, which is triggering the reallocation of global capital from US assets. Investors are beginning to look for alternative safe-haven tools to US Treasury bonds, and gold has become an important option. This capital flow not only pushed up gold prices, but also linked to the weakening of the US dollar: the US dollar index fell from a two-week high to around 97.40, further enhancing the attractiveness of gold denominated in US dollars.

3. Fed policy and interest rate game: a new market normal with traditional logic reconstructed

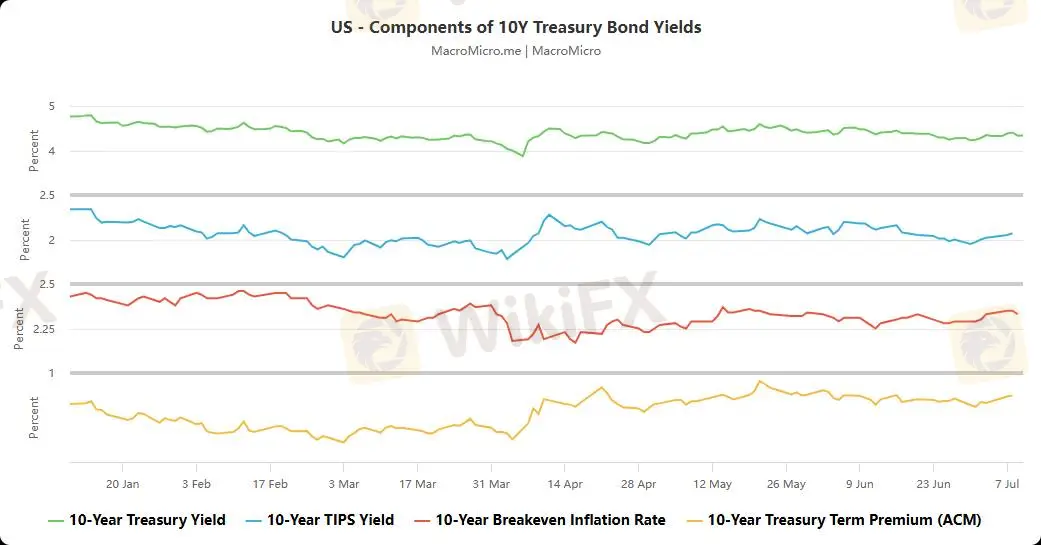

The Fed's interest rate policy path has always been a key variable affecting gold prices, but since 2022, the traditional logic of "interest rates and gold prices are inversely correlated" is being broken. Although the current real interest rate in the United States has risen to more than 2%, gold prices have risen against the trend. Behind this phenomenon is the balance of multiple factors: investors' urgent need for risk mitigation, the continued gold purchases of global central banks, and the market's expectations of a shift in the Fed's policy. The minutes of the Fed's June meeting showed that although most officials believed that there was no need to cut interest rates immediately, it was generally expected that if tariffs pushed up inflation, interest rate cuts might be initiated within the year .

四、Central bank gold purchases and market structure: a historic shift on the demand side

The continued gold purchases by central banks are becoming another important pillar supporting gold prices. Data show that the demand for gold reserves by central banks in emerging markets has increased significantly, with multiple factors including diversification of foreign exchange reserves and hedging of geopolitical risks. The World Gold Council pointed out that since 2022, the pace of gold purchases by central banks around the world has significantly accelerated. This trend contrasts with the relative weakening of US fiscal credit, reflecting a deep adjustment in the structure of global reserve assets.

5. Short-term fluctuations and long-term trends: Golds position in uncertainty

From the perspective of short-term market performance, gold price fluctuations are significantly affected by technical and emotional factors. Currently, the gold price is approaching the 100-period simple moving average (around $3,335/ounce). If it breaks through this key resistance level, it may trigger short-covering and push the gold price towards $3,400/ounce. If it falls below $3,300, it is necessary to pay attention to the support levels of $3,282 and $3,247. This fluctuation reflects the market's sensitive response to short-term policy signals.

Whether it is the accumulation of long-term fiscal risks or the disturbance of short-term policy games, the strengthening of gold is not only a temporary release of market sentiment, but also a re-pursuit of certainty by capital in the process of reconstructing the global economic order. This pursuit may be the key to understanding the current gold market.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

US Government Interest Grows in Victory Metals’ Rare Earths Supply

How Are Trade Policies Affecting the Aluminum Market?

RM71,000 Lost in a Share Scheme That Never Existed

Scammed by a Click: He Lost RM300,000 in a Month

Manual vs. Automated Forex Trading: Which One Should You Choose?

Revealing Factors That Help Determine the Gold Price in India

Why Regulatory Compliance Is the Secret Ingredient to Trustworthy Forex Brokers

Pentagon to become largest shareholder in rare earth miner MP Materials; shares surge 40%

Delta shares jump 12% after airline reinstates 2025 profit outlook as CEO says bookings stabilized

Delta shares jump 13% after airline reinstates 2025 profit outlook as CEO says bookings stabilized

Currency Calculator