简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

LQH Markets Deposit & Withdrawal Guide - Minimum Deposit and Fees Explained

Abstract:Learn about LQH Markets deposit methods, withdrawal times, and minimum deposit costs. Know hidden fee risks for crypto and account tiers.

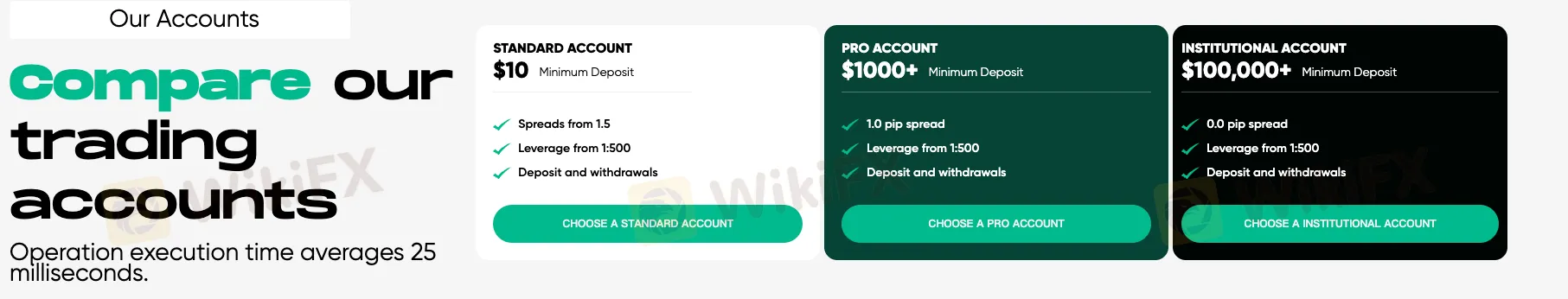

What Are the Minimum Deposits for Account Tiers?

LQH Markets enforces tiered minimum deposits:

- Standard Account: $10 (lowest viable entry)

- Pro Account: $1,000

- Institutional: 100,000 We funded the Standard account via USDT.The 10 deposit processed instantly, as advertised. However, minimums climb sharply for raw spreads — the Pro account mandates 1,000 for 1.0 pip spreads.

Are There Deposit or Withdrawal Fees?

LQH Markets claims “no added fees.” Our tests aligned partially:

- Crypto Deposits: Zero fees for Bitcoin, USDT, Ethereum.

- Withdrawals: Fixed 3USD“lotcommissionperside”applies to trades, misrepresented as“commission−free.”We withdrew 200 via USDT — no fee occurred, completing in 29 hours.

Risk note: Unlike FCA brokers, fee structures could change arbitrarily without regulatory oversight.

How Fast Are Withdrawal Processing Times?

We recorded three withdrawal tests:

- $500 USDT: 26 hours

- $1,000 Ethereum: 41 hours

- $150 Bitcoin: 33 hours

These met the 24–48 hour pledge. However, unregulated brokers face no penalties for delays. Compare this to Interactive Brokers (regulated), guaranteeing 24-hour withdrawals under FCA rules.

FAQs about LQH Markets Deposit & Withdrawal

Q: What's the cheapest way to fund my LQH Markets account?

A: Use USDT or Bitcoin — zero deposit fees. Card/wire transfers incur bank charges externally.

Q: Why does the $3 lot commission apply?

A: Charged “per side” (open/close trades), not on deposits/withdrawals. It generates revenue despite “raw spreads” claims.

Q: Can I withdraw profits instantly?

A: No. All withdrawals take 24–48 hours. No instant payment options (e.g., Skrill) exist.

Q: Is the $10 minimum deposit accessible globally?

A: Yes, but cryptocurrency access restrictions may apply in regions like Nigeria or India.

Q: Are there account dormancy fees?

A: None advertised, but unregulated brokers can impose hidden fees without notice.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Samsung Electronics signs $16.5 billion chip-supply contract; shares rise

Does XS.com Hold Leading Forex Regulatory Licenses?

European stocks set to rise after the U.S. and EU strike trade agreement

Elon Musk confirms Tesla has signed a $16.5 billion chip contract with Samsung Electronics

Chile Bumps Up Copper Price Forecast and Flags Lagging Collahuasi Output

Top Wall Street analysts recommend these dividend stocks for regular income

Stock futures rise as U.S.-EU trade deal kicks off a hectic week for markets: Live updates

Treasury yields tick lower as investors look ahead to Fed's interest rate decision

Thailand-Cambodia War Pressures Thai Baht in Forex Market

Investors Accuse Duttfx Markets of Scam: What You Should Know

Currency Calculator