简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

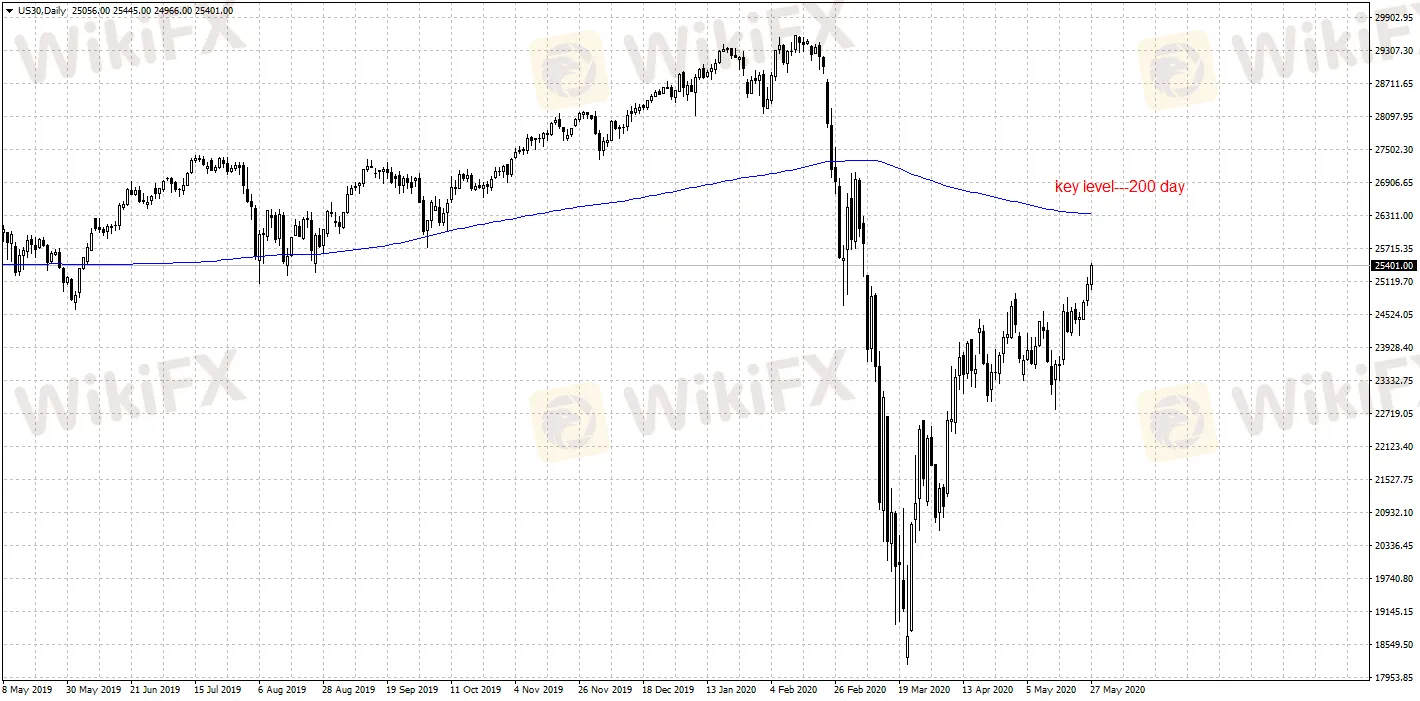

Investors Should Pay Attention to Short Positions in US Stock

Extracto:After the heavy slump in February, the US stock market has regained nearly 38% to date since March 22nd . WikiFX reminds investors that more attention should be given to the short interest in US stock market.

May 31st from WikiFX News.After the heavy slump in February, the US stock market has regained nearly 38% to date since March 22nd. WikiFX reminds investors that more attention should be given to the short interest in US stock market.

James McCormick, the Wall Street veteran who has been a market analyst since the 1990s, said that tracker funds had previously accumulated plenty of US stock market short positions, which can significantly affect the stock markets future trend.

S&P 500 Index is currently very close to 200 SMA (26339) and whether the level will be breached is significant to changes in positioning by investors. McCormick observed that this key indicator is near the most bearish level, with net shorts at the highest level since 2016, so this level is definitely worth-noting.

Currently, the Federal Reserve‘s liquidity is supporting the price of stocks and other assets, but this is not a good phenomenon from a long term perspective, for expanding monetary policies won’t cushion the hard blow on supply chains, and the long-term impact of unconventional monetary policies such as QE can be worrying.

To learn more, please download WikiFX. bit.ly/wikifx

Descargo de responsabilidad:

Las opiniones de este artículo solo representan las opiniones personales del autor y no constituyen un consejo de inversión para esta plataforma. Esta plataforma no garantiza la precisión, integridad y actualidad de la información del artículo, ni es responsable de ninguna pérdida causada por el uso o la confianza en la información del artículo.

Brokers de WikiFX

últimas noticias

Análisis del Dólar y perspectivas para la economía Latinoamericana.

La CNMV alerta de 41 entidades no registradas.

¿MercadosInvest es una estafa? Cliente afirma ser estafado por el bróker.

¿Cuáles son los 3 mejores brokers ECN para Latinoamérica en 2025?

¿Exness es un broker seguro? Análisis 2025.

PU Prime se asocia con AFA para expandir el alcance global.

Cálculo de tasa de cambio