简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Signs Suggest that Global Stock Market would Stop Rising

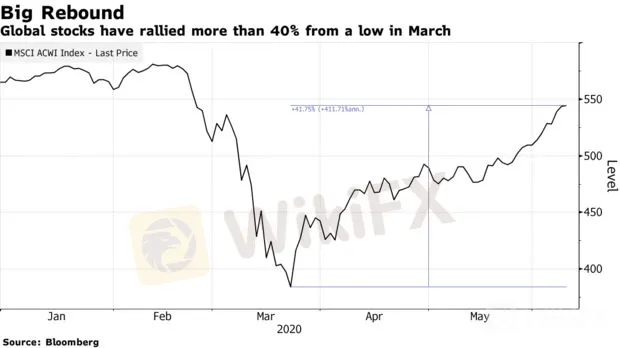

Extracto:Global stock market has recovered a value of US$21 trillion from the low in March, but the bubble in this asset class seems to keep increasing and the upward trend might stop.

WikiFX News (14 June)- Global stock market has recovered a value of US$21 trillion from the low in March, but the bubble in this asset class seems to keep increasing and the upward trend might stop.

At present, the global stock market has recovered to the level before the coronavirus epidemic began to spread rapidly around the world. Paul Sandhu, head of multi-asset quantitative solutions and customer consulting for BNP Paribas in the Asia-Pacific region, said: “This round of rebound is caused by the government's support for the economy.” A large amount of funds from global governments, easing of restrictions and shockingly positive employment data from the United States are attracting more buyers to participate, bringing more momentum for the stock market to rise.

However, the market still keeps a cautious attitude, for the rise in global stock prices last month is purely due to multiplier expansion, while earning expectations have barely changed since May. In addition, the MSCI Global Index has been in the overbought range since the beginning of this month, and the index's relative strength indicator has hit its highest level since January, which is considered as a bearish signal.

The above information is provided by WikiFX, a world-renowned foreign exchange information query provider. For more information, please download the WikiFX App: bit.ly/WIKIFX

Descargo de responsabilidad:

Las opiniones de este artículo solo representan las opiniones personales del autor y no constituyen un consejo de inversión para esta plataforma. Esta plataforma no garantiza la precisión, integridad y actualidad de la información del artículo, ni es responsable de ninguna pérdida causada por el uso o la confianza en la información del artículo.

Brokers de WikiFX

últimas noticias

Análisis del Dólar y perspectivas para la economía Latinoamericana.

La CNMV alerta de 41 entidades no registradas.

¿MercadosInvest es una estafa? Cliente afirma ser estafado por el bróker.

¿Cuáles son los 3 mejores brokers ECN para Latinoamérica en 2025?

¿Exness es un broker seguro? Análisis 2025.

PU Prime se asocia con AFA para expandir el alcance global.

Cálculo de tasa de cambio