简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Yen Weakens as Crude Oil Prices Rise. NZD May Fall on Dovish RBNZ

एब्स्ट्रैक्ट:The anti-risk Japanese Yen fell as sentiment mostly improved and crude oil price gains fueled energy sector stocks. Ahead, NZD/USD may fall if the RBNZ talks up rate cut prospects.

Asia Pacific Market Open Talking Points

Japanese Yen weakens as sentiment improves, oil gains

British Pound welcomes rising support for Mays Brexit

New Zealand Dollar may fall if RBNZ talks up rate cuts

Find out what the #1 mistake that traders make is and how you can fix it!

Key FX Developments Tuesday

The anti-risk Japanese Yen underperformed against its major counterparts, pulling back alongside an improvement in market optimism, particularly during the European trading session. As recession fears seemed to abate, cycle-sensitive crude oil prices received a lift. Then later in the day, Russian Energy Minister Alexander Novak said that the nation is on track to reach output cuts within the OPEC+ deal.

This helped energy sector stocks climb, with Norways OBX Index climbing as much as 0.7% before trimming most of its upside progress. Towards the end of the day, sentiment somewhat fell apart. The S&P 500 spent most of its day trading lower after gapping to the upside. This occurred alongside rising bond prices, signaling risk aversion.

Still, the pro-risk Australian Dollar aimed cautiously higher by the end of the day. Sterling saw slight gains after Jacob Rees-Mogg, head of the European Research Group of Tory MPs, backed Theresa May‘s Brexit deal. This stoked bets that other opposers to May’s divorce deal could follow suit. If the UK Prime Minister can gain more support, she may be able to put her deal for a third round of voting before Parliament.

Wednesdays Asia Pacific Trading Session

The US Dollar aimed narrowly lower in early Wednesday trade after Stephen Moore, President Donald Trumps nominee to the Federal Reserve Board, said that the central bank should immediately cut rates by 50 basis point. He still faces a confirmation process in the Senate.

Next, the New Zealand Dollar looks to the RBNZ rate decision. Ever since the central bank proposed to increase bank capital requirements, there has been speculation that the RBNZ may cut rates down the road. This is in addition to concerns about the global growth outlook. NZD/USD may fall if this is emphasized.

Join DailyFX Analyst David Cottle for LIVE coverage of the RBNZ rate decision, where he will be taking a look at the New Zealand Dollar and what to expect ahead!

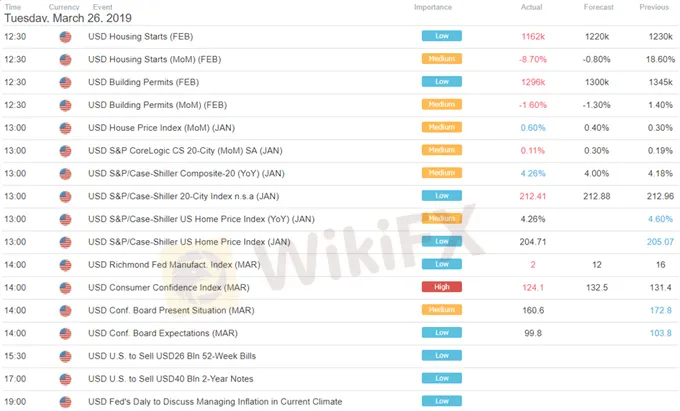

US Trading Session Economic Events

Asia Pacific Trading Session Economic Events

अस्वीकरण:

इस लेख में विचार केवल लेखक के व्यक्तिगत विचारों का प्रतिनिधित्व करते हैं और इस मंच के लिए निवेश सलाह का गठन नहीं करते हैं। यह प्लेटफ़ॉर्म लेख जानकारी की सटीकता, पूर्णता और समयबद्धता की गारंटी नहीं देता है, न ही यह लेख जानकारी के उपयोग या निर्भरता के कारण होने वाले किसी भी नुकसान के लिए उत्तरदायी है।

WikiFX ब्रोकर

रेट की गणना करना