简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Government Shutdown Weighs on GDP, Business-Leader Confidence

Ikhtisar:As the government shutdown drags on, investors are becoming increasingly concerned with the likelihood of a recession as business leader confidence dips.

Government Shutdown Talking Points:

As the government shutdown enters its 30th day, it continues to sap 0.13% from GDP per week according to the White House

United States GDP was already forecasted to slip moderately but that information has been masked by the lack of economic data released

On the other hand, soft data like business leader sentiment has dropped sharply amid the shutdown

See Q119 forecasts for the Dow, Dollar, Bitcoin and more with the DailyFX Trading Guides.

Economic data from the world‘s largest economy has been halted for the last month as the government shutdown continues to chip away at US GDP each week. Prior to the shutdown, US GDP was already slated to decline steadily as the impact of President Trump’s tax cuts fade. To compound this, a week of government closure equates to a -0.13% hit on total GDP according to the White House. Now that economic data is sparse, investors and economists are effectively flying blind.

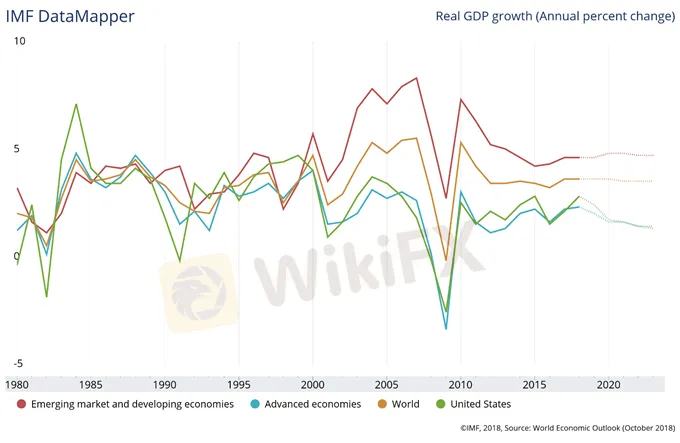

Global GDP Forecasts (Chart 1)

In lieu of hard data, investors look to sentiment and confidence readings to bridge the gaps. In a recent PwC survey, nearly 30% of 1,300 business leaders believe global growth will decline in the next twelve months. The level of pessimism is roughly six-times higher than it was one year ago.

Notably, the largest shift in sentiment came from North American executives. Optimism dropped from 63% to 37% in 2018 to 2019 and aligns with survey results from Boston Consulting Group conducted late last year which found 73% of respondents see a recession within the next two years.

S&P 500 Price Chart Daily Timeframe, October 2018 – January 2019 (Chart 2)

While the S&P 500 seems to be taking the lack of information in stride, negative impacts will only be exacerbated as the shutdown continues. With each day the government is shuttered, the pace of contraction will only grow steeper. Further, once the government is re-opened and data like the Federal Reserve Bank of Atlantas GDPNow model begin to cross the wires once again, the data gap could deliver a shock to newly reported figures.

Disclaimer:

Pandangan dalam artikel ini hanya mewakili pandangan pribadi penulis dan bukan merupakan saran investasi untuk platform ini. Platform ini tidak menjamin keakuratan, kelengkapan dan ketepatan waktu informasi artikel, juga tidak bertanggung jawab atas kerugian yang disebabkan oleh penggunaan atau kepercayaan informasi artikel.

WikiFX Broker

Berita Terhangat

Pengumuman WikiFX: Penghentian Kompetisi Simulasi Trading Mingguan

DENDA Lampaui €2,7 Juta ! Tekanan Peraturan Baru Uni Eropa pada Perusahaan Keuangan Siprus

Wawancara Pakar Global WikiEXPO: JinDao Tai — Masa Depan Perdagangan Valas

Potensi KEHILANGAN $274 Juta Apabila ASIC Melikuidasi Dana Investasi Bermasalah

Lisensi Broker Lepas Pantai Membuka Peluang Prop Firm Terhadap Metatrader 5

Transformasi Perombakan SEC, Pakar Peringatkan "Kematian Akibat 1.000 Pemotongan”

Broker Forex ICM Peroleh Lisensi di UEA Setelah Setahun Keluar dari Inggris

Menjembatani Kepercayaan, Menjelajahi yang Terbaik WikiEXPO Hong Kong 2025 Berakhir Spektakuler

Nilai Tukar