GBPUSD Near-Term Outlook Bearish as US Dollar Gains, AUD May Rise

The Pound Sterling outlook turned more bearish after GBPUSD cleared support as the Dollar gained and the Euro weakened. AUDUSD may rise if the RBA downplays near-term rate cut bets.

Sterling (GBP) Manages to Continue its Recovery Despite Dismal UK Manufacturing PMI

The Pound was marginally stronger against all currency pairs despite UK Manufacturing PMI data coming in much worse than expected. Brexit stockpiling wind down was expected.

GBP Price Outlook: Downtrend Still in Place After European Elections

GBPUSD is stable early Tuesday in London, largely ignoring the results of the European Parliament elections, but the slide lower in place since the start of the month may well continue.

GBPUSD Price May Yet Drop More as UK Inflation Data, Brexit Sour Mood

The GBPUSD price continues to trend lower, and further losses cannot be ruled out on a toxic mix of Brexit worries, uncertainty over UK PM Mays leadership and weak UK inflation figures.

GBPUSD Drop in Focus, Brexit Optimism Keeps Fading. CAD Up on USMCA

The GBP/USD downtrend may accelerate on bearish-contrarian signals with confidence of a Brexit deal persistently fading. The Canadian Dollar is benefiting from USMCA talk progress.

GBP Downtrend Losing Control on Cloudy Brexit Outlook, Yen May Gain

The GBP/USD downtrend eyes November lows on a more uncertain Brexit outlook. Reports that US-China trade talks stalled may boost the anti-risk Japanese Yen as the Nikkei 225 falters.

DailyFX Poll: Corbyn Could be Best Successor to PM May for GBP

Of the four leading candidates to replace Theresa May as UK Prime Minister, Opposition leader Jeremy Corbyn would be the most positive for the British Pound, according to a DailyFX poll.

GBP/JPY Support Taken Out on Brexit Talks, Japanese Yen May Rise

The GBP/JPY downtrend may accelerate with key support taken out under 143.79 on Brexit talks, US-China trade deal in focus. Sentiment warns bearish USD/JPY contrarian trading bias.

GBPUSD Uptrend Extends on Pressure for a Brexit Deal, Yen May Fall

GBP/USD surged, heading for resistance amidst pressures in the UK to get a Brexit deal, BoE rate hike bets brewing. S&P 500 gains may translate into follow-through for Asia as Yen falls.

Central Bank Weekly: Fed and BOE Shape Currency and Growth Forecasts

This week weve seen the Federal Reserve surprise markets while the Bank of England remains sidelined thanks to Brexit.

British Pound Currency Volatility Could Collapse from Brexit Can-Kicking

Implied volatility measures for the British Pound plunged following the European Council's offer to delay Brexit again, but less uncertainty could provide GBP traders with a unique opportunity.

Sterling Price Outlook: Pound at Key Support as Brexit Saga Continues

Sterling is trading within the confines of a near-term consolidation pattern just above key support. Here are the levels that matter on the GBP/USD charts this week.

USD/CAD Fell to Support on GDP. Asia Stocks May Rise as Yen Drops

USD/CAD dropped to support on rosy GDP data, the British Pound fell after Mays Brexit deal failed to pass through Parliament, delaying the divorce. Asia stocks may rise as Yen sinks.

GBP/USD Rate Threatens Bull Trend Ahead of Brexit Deadline

The British Pound may face a more bearish fate ahead of the Brexit deadline in April as the GBP/USD exchange rate threatens the upward trend from late last year.

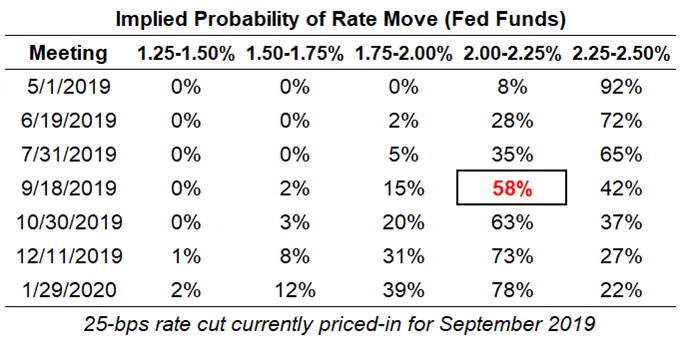

Central Bank Weekly: Has the Fed‘s Dovish Shift Altered the Market’s Course?

The March Fed meetings effects are still being felt more than a week later.

Yen Weakens as Crude Oil Prices Rise. NZD May Fall on Dovish RBNZ

The anti-risk Japanese Yen fell as sentiment mostly improved and crude oil price gains fueled energy sector stocks. Ahead, NZD/USD may fall if the RBNZ talks up rate cut prospects.

GBP/USD Gains, UK Parliament Forces Votes on Brexit Alternatives

GBP/USD gained as the UK Parliament seized control from Mays government, forcing votes on alternatives to her Brexit deal. The anti-risk Japanese Yen may rise as recession fears linger.

GBPUSD: Brexit Latest Pushes Overnight Implied Volatility to Extremes

Spot GBPUSD could skyrocket or plummet over the next 24-hours according to implied volatility priced in to overnight option contracts as the Brexit saga continues.

ASEAN FX at Risk to US Recession Fears & Sentiment on Brexit, ECB

The US Dollar may regain ground versus ASEAN currencies if rising concerns about a recession fuel demand for safe havens. Markets eyeing US economic data, Brexit and ECB commentary.

GBP/USD Uptrend Holds, EU Gave May Third Shot to Pass Brexit Deal

GBP/USD fell on the ongoing Brexit saga as the EU gave UK Prime Minister Theresa May a third shot to pass her divorce deal in Parliament next week. Ahead, the Japanese Yen may fall.