简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

AUDUSD Outlook: US-China Trade War Nearing the End

요약:AUDUSD Outlook: US-China Trade War Nearing the End

AUD Price Analysis and Talking Points:

US-China Trade Deal Possible in Near-Term

Chinese GDP to Add to AUD Downside Risks.

See our quarterly AUD forecast to learn what will drive prices through mid-year!

US-China Trade Deal Possible in Near-Term

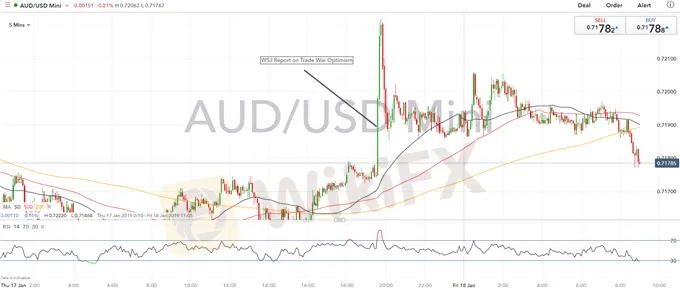

Overnight, equity markets and high beta currencies (AUD, NZD) initially rose on the back of reports from WSJ, which stated that US Treasury Secretary Mnuchin had suggested lifting import tariffs on China and potentially offering a tariff rollback in the upcoming trade discussions on January 30th. However, the treasury department had been quick to deny these rumors, while the WSJ report also highlighted that US Trade Representative Lighthizer (China hawk) had resisted this idea. Although, while these rumors may have been dismissed almost immediately, this does embolden the view that a US-China trade deal may be on the way in the near-term. As such, positive headlines in the run up to the January 30th meeting could increase the prospects of a deal.

AUDUSD PRICE CHART: 5-Minute Time-Frame (Jan 17-18th 2019)

Chart by IG

The initial spike higher in the Aussie had been quickly retraced. While trade war optimism can provide a undercurrent of support for the Australian Dollar, headwinds remain, most notably the slowdown in the Chinese economy. China will release their Q4 GDP figures next week, which is expected to dip to the lowest level since the financial crisis at 6.4%. Consequently, this will add to the woes that the Australian economy faces, thus keeping AUD upside limited and downside risks to 0.7000.

AUD TRADING RESOURCES:

See our quarterly AUD forecast to learn what will drive prices through mid-year!

Just getting started? See our beginners‘ guide for FX traders

Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

환율 계산기