简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USD/SEK May Dip on Swedens Trade Data, US-China Talks, EU Peril

요약:The Swedish Krona may fall on January 28 as Sweden prepares to release its Trade Balance. Slower growth in the European region may continue to

SEK TALKING POINTS - SWEDEN, TRADE BALANCE, TRADE WARS

The Swedish Krona may fall on Swedens Trade Balance report

Slower domestic growth suggests it will continue broad decline

Political, economic turmoil in EU may weigh on economic data

See our free guide to learn how to use economic news in your trading strategy!

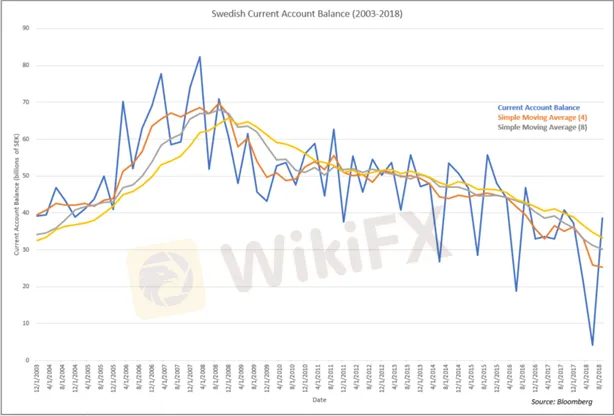

The Swedish Krona may have a small dip on January 28 as Sweden‘s Trade Balance is scheduled to be released at 08:30 GMT. For over a decade now, the Nordic country’s current account balance has been falling since approximately 2007. Despite the brief uptick October, it is not likely the data will significantly improve in 2019.

Growth in Sweden is expected to slow this year as outlined in the Riksbanks December meeting minutes. Policymakers are keeping their eye out for key domestic concerns such as high household indebtedness. The political uncertainty in Sweden is also still worrisome. They will also be closely monitoring political international economic and political forces that may influence the Swedish economy.

Some of these external risks include political turmoil in the EU with Brexit and the Italian budget crisis along with concerns of an economic slowdown. The influence of European events on the Swedish Krona is primarily attributed to the relationship the EU has with its Nordic counterparts.

As an export-driven economy, SEK is also vulnerable to trade wars and protectionism like what was seen in 2018 and may see in 2019. On that front, Chinese Vice Premier Liu He will be visiting the White House this week to further facilitate trade negotiations and attempt to reach a deal before the deadline on March 1.

The Swedish Krona in the meantime may continue its downward movement against the US Dollar. USD/SEK had a major jump last week and burst through 9.0032. Given the potential 2019 headwinds, the pair might continue to trade above this point and the key resistance at 9.0086.

USD/SEK Daily Chart

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

환율 계산기