简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USD/NOK Eyeing Norway CPI - Slower EU Growth May Hurt Nordics

요약:The Norwegian Krone will be closely eyeing tomorrow‘s CPI data as the European economy slows down and may begin to weigh on Norway’s performance.

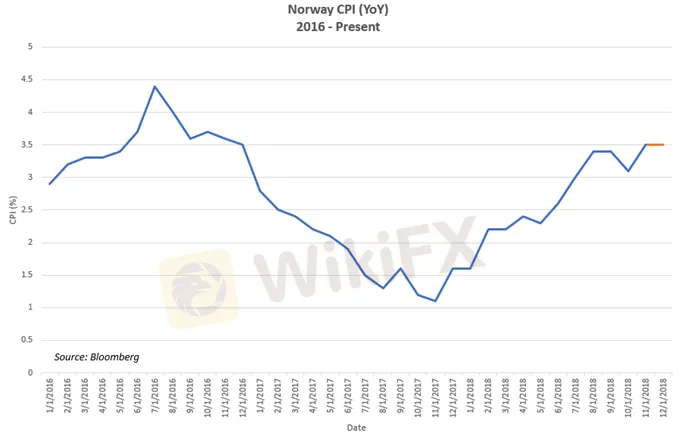

Norwegian Krone traders may be closely watching tomorrows scheduled release of year-on-year CPI data. The current forecast stands at 3.3 percent with the previous at 3.5 percent. Despite reaching its highest point since December 2016, the most recent price data has stalled as most GDP reports on Friday fell short of expectations.

On the same day, the OBX – Norways benchmark equity index – shaved off almost two percent, the biggest drop since December 27. The slower economic activity suggests CPI data may fall short of expectations and hurt the Norwegian Krone.

OBX Equity Index – Daily Chart

This comes during a time when the European economy is beginning to slow down as risks associated with political turmoil are rising. The third largest eurozone economy is in a technical recession with Germany not far behind as France deals with domestic protests that are weighing on the economys performance.

With most economic activity in Norway being dependent on Europe‘s growth, it is possible that the de-acceleration in the EU could begin to weigh on the performance in the Nordic countries. Norway especially could be susceptible to a European fall in demand due to the Scandinavian country’s huge petroleum sector that is sensitive to changes in the business cycle. It also accounts for 31 percent of all the EUs natural gas imports.

Since its last policy meeting, the Norges Bank – Norways central bank – has stated it will “most likely” raise rates in March. However, policymakers must be careful not to tighten credit conditions at a time when economic activity is slowing and uncertainty looms over matters such as Brexit and the US-China trade war.

Conversely, the central bank may want to squeeze in a rate hike so there is more room to cut if economic conditions warrant such an action. Given the outlook provided by the World Bank and IMF, such a policy measure is not entirely outlandish.

USD/NOK has closed higher for a week straight, bulldozing through several support levels and has gained over 2.5 percent since January 31. The pair is now trading above a key support at 8.6323, with the fundamental outlook suggesting the pair possibly has significant upward potential. In the short term, the pair may experience some resistance at 8.6244.

USD/NOK – Daily Chart

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

환율 계산기