简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crude Oil Price May Falter as IEA Forecasts Supply Swamp

요약:The International Energy Agency found it may be difficult for the energy market to absorb newfound crude supply from non-OPEC members.

Crude Oil Talking Points:

The IEA found demand to be constant from the month prior, despite many agencys warning of slower growth

Other energy agencies like OPEC and the EIA have recently lowered their demand expectatio

With the two pricing factors at odds, the price of crude oil could come under pressure

Interested in trading Crude oil, Bitcoin or the Dow Jones? Learn specific trading strategies with ourDailyFX Trading Guides.

Crude oil may slide in the coming months as energy agencies continue to forecast a crude market swamped with supply at a time when demand has wavered. The International Energy Agency (IEA) reported their monthly prognosis of the oil market on Wednesday and the findings echoed concerns of recent reports from OPEC and the Energy Information Administration (EIA). While OPEC and the EIA lowered their most recent demand expectations, the IEA maintained the same figures from January at 1.4 million barrels per day.

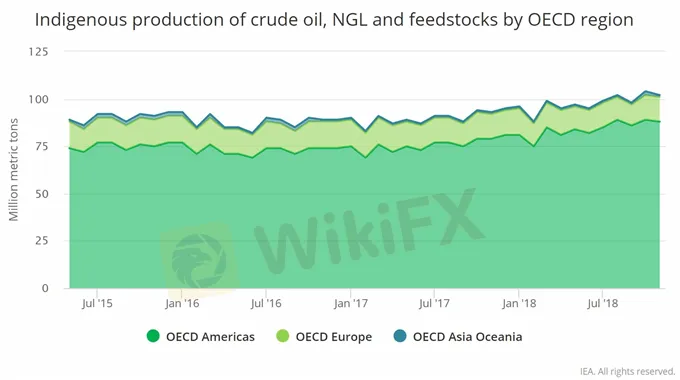

Crude Oil Supply Chart: IEA (Chart 1)

On the supply side, the agency highlighted the headline factors that may drive crude lower in the coming quarters. “The global oil market will struggle this year to absorb fast-growing crude supply from outside OPEC, even with the groups production cuts and U.S. sanctions on Venezuela and Iran,” the agency said. Despite the already considerable increase in crude production outside of OPEC, the IEA again raised its forecasts for supply from non-OPEC members in the month ahead. The estimate increased to 1.8 million barrels per day in 2019, from 1.6 million barrels per day previously.

One key uncertainty in the crude oil market is Venezuela. The OPEC member faces a multitude of sanctions from the United States and political uncertainty as the current President faces mounting pressure from the public and other countries to step down. Should the issue be resolved quickly, crude production could return to levels seen in prior years and flood the market further. On the other hand, a prolonged struggle may sap even more production from the country and drain some of the excess supply in the market. Either way, the situation will be important to watch as the struggle unfolds.

Crude Oil Price Chart: Daily Timeframe (January 2018 – February 2019) (Chart 2)

Despite the ominous report crude closed slightly higher than it opened Wednesday, marginally below $54.00. That said, Crudes price remains considerably lower than its altitude in October when it traded north of $75.00. Recent concerns of waning global growth helped to drive the price lower on the demand side, and the supply glut offered by non-OPEC members may look to keep it pressured for the foreseeable future.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

환율 계산기