简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ECB Sinks EUR/USD Towards July 2017 Lows, Chinese Trade Data Next

요약:EUR/USD faces June 2017 lows after sinking through key support levels after dismal ECB economic projections. Up next, markets eye the impact of slowing growth

Asia Pacific Market Open Talking Point

Risk appetite deteriorated after dismal ECB economic projectio

EUR/USD sunk through support levels, eyeing June 2017 lows next

Markets eye China trade data to monitor impact of slowing growth

Build confidence in your own EUR/USD strategy with the help of our free guide!

Key FX Developments Thursday

The Euro depreciated following a significantly more dovish-than-expected ECB rate decision. The European Central Bank, after leaving interest rates unchanged, envisioned keeping it that way through this year. Previously, policymakers were envisioning an increase at some point beyond this summer. The central bank also announced that TLTROs, another stimulus tool, will begin from September 2019.

Despite the news of lower rates for longer, which can bode well for equities, and indeed the Euro Stoxx 50 initially rallied on the news, stocks turned lower in the aftermath. This may have been due to Eurozone 2019 growth estimates being significantly weakened from 1.7% to 1.1% in 2019. Meanwhile, global growth is slowing. Chinas GDP is at a decade low and Italy recently entered a technical recession.

EUR/USD Technical Analysis - Eyeing June 2017 Low

EUR/USD declined about 1%, suffering its worst day since the beginning of January. The Euro dropped through multiple support areas, exposing June 2017 lows at 1.1119. Near-term resistance appears to be 1.1217 which was as low as prices got in 2018. With that in mind, EUR/USD seems to be resuming its dominant downtrend from April.

EUR/USD Daily Chart

Chart Created in TradingView

With that in mind, another central bank that turned increasingly pessimistic about the outlook had knock-on effects for trading during the Wall Street session. The S&P 500 declined 0.81%, extending its losing streak to 4 days, which was the longest since the middle of December. The haven-linked US Dollar understandably appreciated as well as the anti-risk Japanese Yen.

Fridays Asia Pacific Trading Sessio

S&P 500 futures are pointing cautiously higher, perhaps indicating that there is room for a breather when Asia Pacific stock markets trade. At an unspecified time during the APAC session, Chinas February trade report is expected to cross the wires. Markets will continue gauging the global impact of slower growth on the worlds second-largest economy.

US Trading Session Economic Event

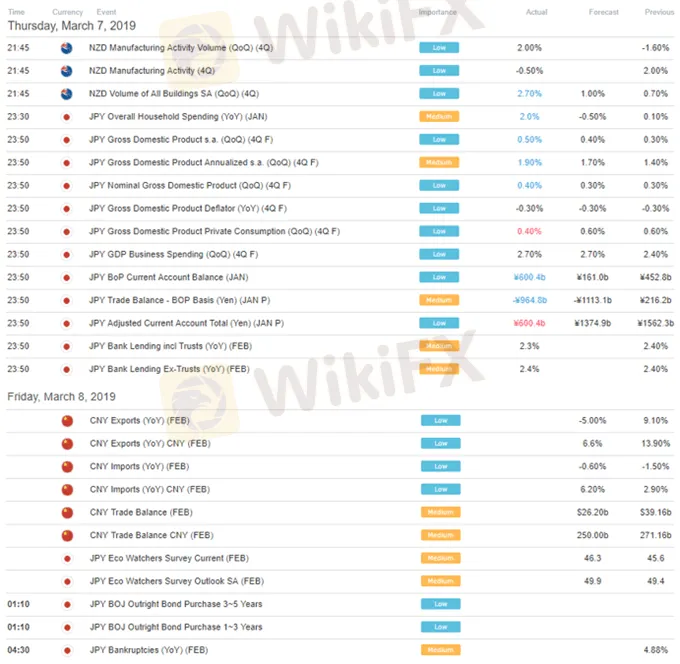

Asia Pacific Trading Session Economic Event

** All times listed in GMT. See the full economic calendar here

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

환율 계산기