简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

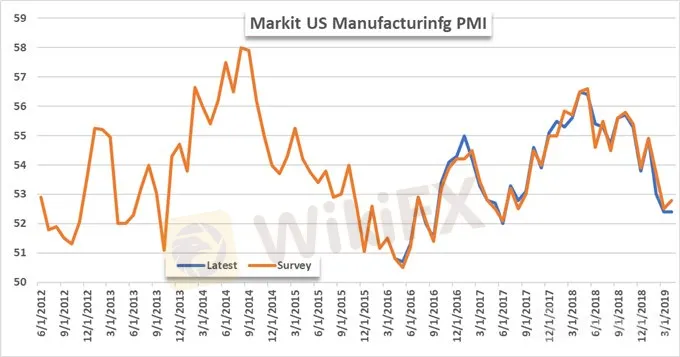

US Manufacturing and Services PMI Miss Estimates, Reveals Slow Growth

요약:Surveyed US services and manufacturing managers indicated a continued slowdown in growth for the start of the second quarter as the economy struggles to match its growth from the previous year.

Markit Economics released their monthly Purchasing Managers Index readings this morning for the service and manufacturing sectors. The Services PMI came in at 52.9 which missed analyst estimates of 55.0, which are largely attributed to purchasing managers revising their output expectations lower for the year and slower growth in employment. New business was also lower with it being the softest increase since March 2017.

The soft marks in the service sector follow weak numbers in consumer spending to start the year which coupled with continued weakness in the Service PMI could stoke fears that consumers are losing their appetite to spend, however some fears could be eased by this mornings stronger than expected retail sales - mainly attributed to strength in the auto sector.

The manufacturing PMI reading was 52.4 which missed estimates and went unchanged from last months reading. This was the weakest improvement in the manufacturing sector since June 2017. Improved indicators for output and new orders were offset from slowing increases in employment and pre-production inventories according to purchasing managers.

There was also an increase in new business, with the best reading in three months. However, compared to the same period last year, the increase is somewhat underwhelming. Inflation pressure eased across the sector with input prices declining for the sixth consecutive month, but survey participants noted that small increases in cost are generally being passed on to their clients.

The data from Markit puts the U.S. economy at its weakest growth since 2016 in relation to manufacturing and services, with hiring and output being the main sources for the slowdown. It appears weak manufacturing in the first quarter has started to bleed into April. The easing of inflation pressure on prices for manufactures has reduced pricing power which, coupled with weaker demand, could cause continued downward pressure into the rest of the second quarter.

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

최신 뉴스

제1회 모의 투자 대회 수상자 발표

벚꽃 앱테크 이벤트 당첨자 발표

[4월 2일 거래 팁] 美 관세 발표 임박,‘불확실성 장세’에서 살아남는 법은?

환율 계산기