简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USD/PHP Eyes Reversal as Crude Oil Revives 2018 Peso Selloff Fears

요약:The Philippine Peso fell as crude oil prices rose on Iran supply disruption fears. USD/PHP broke key resistance. Higher petroleum prices may reignite 2018 Peso selloff if CPI climbs.

USD/PHP, Crude Oil, Iran Sanction Waivers Talking Points

Philippine Peso weakens as crude oil prices rise on Iran supply disruption concerns

Higher oil may fuel excess Philippine inflationary fears, reigniting 2018 PHP selloff

USD/PHP climbed above critical resistance, opening the door to further gains ahead

Trade all the major global economic data live as it populates in the economic calendar and follow the live coverage for key events listed in the DailyFX Webinars. Wed love to have you along.

The largest rise in crude oil prices since the beginning of April triggered a bout of risk aversion during the early phase of the week, and the Philippine Peso is under pressure. On Monday, US Secretary of State Mike Pompeo confirmed that the nation is planning on ending Iran sanction waivers on imports of the commodity, increasing supply disruption concerns.

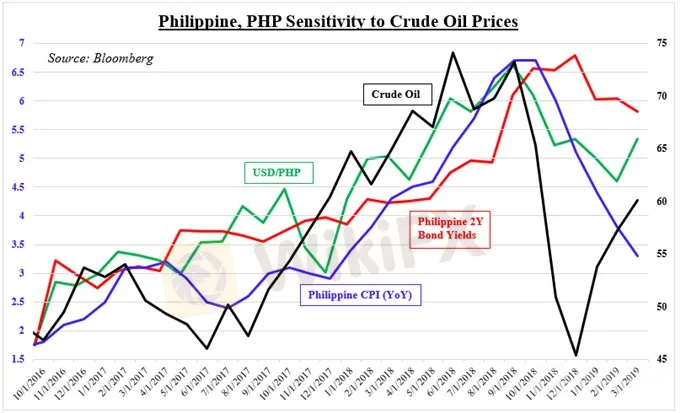

This poses a risk for USD/PHP for a couple of reasons. On the chart below, Philippine CPI tends to have a close relationship to crude oil. The commodity is a key import for the Philippines and fears of higher prices could reinstate strong inflationary pressures which triggered a PHP selloff last year. CPI recently came off from its highest point since 2009 to a more manageable 3.3% y/y in March, within the central banks target.

Philippine Economy, Peso Sensitivity to Crude Oil

In fact, the cooldown in oil towards the end of 2018 helped stem depreciation in the Peso as inflation slowed and local front-end government bond yields aimed lower. The latter is a sign of decreasing risk of holding Philippine government debt. Since then, the commodity has rebounded and if it continues doing so, we might see Philippine CPI follow suit. This comes as the Philippine central bank ponders potential rate cuts.

Keep a close eye on US energy earnings this week as well as the nations trade negotiations with Japan. Weakening global growth forecasts might be reflected from companies such as Chevron in their outlook. Meanwhile, sentiment may be at risk due to diverging EU-US foreign policy given the aforementioned developments on Iranian sanction waivers which may increase the odds of a transatlantic trade war.

USD/PHP Technical Analysis

On the daily chart, USD/PHP rose 0.62% in its best single-day performance in over a month. This highlights the pairs sensitivity to unexpected surges in crude oil. Support held above 51.59 (May 2018 lows) as PHP broke above a descending trend line from the middle of March.

This opened the door to further Peso weakness given confirmation. Keep a close eye on what may be support-turned-resistance at 52.12. For more updates on the Philippine Peso and ASEAN currencies, you may follow me on Twitter here at @ddubrovskyFX.

USD/PHP Daily Chart

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

환율 계산기