简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USD Gains Awakens Currency Volatility, EUR and GBP Pressured - US Market Open

요약:USD Gains Awakens Currency Volatility, EUR and GBP Pressured - US Market Open

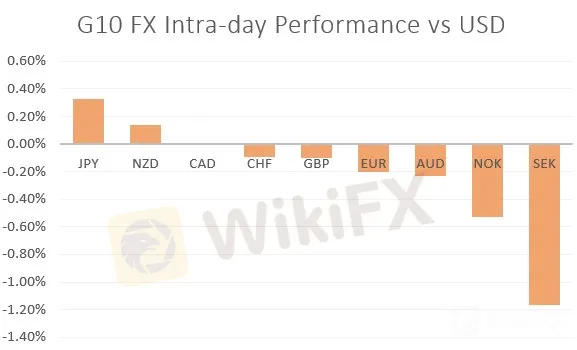

MARKET DEVELOPMENT – USD Gains Awaken Currency Volatility

DailyFX Q2 2019 FX Trading ForecastsUSD: The US Dollar has continued to go on from strength to strength at the detriment to its major counterparts, with the exception of the Japanese Yen. In turn, the Euro has edged towards 1.11 with a break below raising the risk of a 1.10 handle, while the Pound is now trading at its lowest level in 10-weeks. With the greenback breaking above the 61.8% Fibonacci situated at 98.03, eyes are now on for a test of 98.50. Alongside this, the breakout in the USD index has awakened FX volatility, which has lifted from the multi-year lows. (Full volatility article, here).

TRY: The Turkish Lira back on the defensive following the Turkish Central Bank monetary policy decision, in which they had omitted their pledge that further tightening is needed from the monetary policy statement. Consequently, this raises questions as to whether the central bank will keep high interest rates in order to combat inflation, as such, USDTRY rose to session highs with the 6.00 handle firmly in sight.

SEK: The Riksbank provided a much more dovish message than the markets had expected, which in turn saw EURSEK catapult higher and is track for its biggest intra-day gains since October 2016. The central bank had lowered its repo-rate path, having noted that the rate will remain at current levels for a longer period of time than assumed in February.The main focal point behind the decision had been due to the soft inflation prospects with the Riksbank highlighting that inflationary pressures have been weaker than expected and is now seen to be lower over the next few years. As such, the Riksbanks view that the repo rate is expected to be raised again towards the year-end or beginning of next year looks to be somewhat hopeful.

Source: Thomson Reuters, DailyFX

{6}

DailyFX Economic Calendar: – North American Releases

{6}

IG Client Sentiment

How to use IG Client Sentiment to Improve Your Trading

WHATS DRIVING MARKETS TODAY

“Will the US Dollar Breakout Last? A Glance at EURUSD, GBPUSD & USDJPY Charts” by Paul Robinson, Currency Strategist

“Brexit Latest: PM May Survives; GBPUSD Hits a 10-Week Low” by Nick Cawley, Market Analyst

“Currency Volatility: Euro Volatility Reignited, Deeper Losses on the Horizon” by Justin McQueen, Market Analyst

“Gold Price Outlook: Stabilizing After Hitting 2019 Low” by Martin Essex, MSTA , Analyst and Editor

“Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

환율 계산기