简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USDCAD at 2019 Lows, EURUSD Dips on ECB Dove, GBPUSD Stabilises

요약:USDCAD at 2019 Lows, EURUSD Dips on ECB Dove, GBPUSD Stabilises

MARKET DEVELOPMENT – USDCAD at 2019 Lows, EURUSD Dips on ECB Dove

市场发展 - 美元兑加元在2019年低点,欧元兑美元贬值欧洲央行鸽派

DailyFX 2019 FX Trading Forecasts

DailyFX 2019外汇交易预测

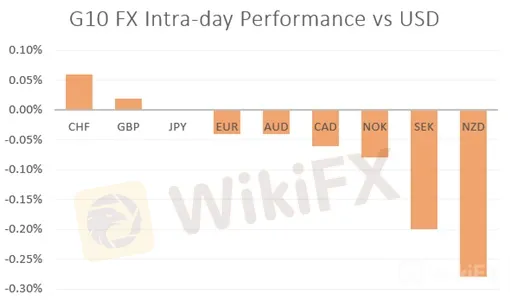

USD: FX pairs have held relatively tight ranges in this holiday thinned trading session. Alongside this, sizeable option expiries in major USD pairs have also kept price action relatively subdued. In particular, this has been observed in EURUSD with $6.2bln worth of vanilla options from 1.1265-1.1315. That said, the Euro did pullback from better levels, which in turn supported the greenback following very dovish commentary from ECBs Rehn who stated that further monetary stimulus is now needed until there is an improvement in inflation and economic prospects, adding that the slowdown is no longer temporary.

美元:外汇对在此持有相对较窄的区间假期变薄交易时段。除此之外,主要美元对中相当大的期权到期也使价格走势相对缓和。特别值得一提的是欧元兑美元从1.1265-1.1315价值62亿美元的香草期权。也就是说,欧元确实从更好的水平回落,而欧洲央行雷恩的非常温和的评论反过来支持美元,他表示现在需要进一步的货币刺激措施,直到通胀和经济前景有所改善,并补充说减速是否定的更长时间临时。

GBP: The Pound continues to hover around its recent lows, following BoE Governor Carneys recent cautious comments. However, GBPUSD has managed to stabilise with support stemming from the GBP October 2016 flash crash trendline.

英镑:继英国央行行长卡内斯近期谨慎评论后,英镑继续徘徊于近期低点附近。然而,英镑兑美元在2016年10月英镑闪电崩盘趋势线的支撑下成功稳定。

CAD: Following yesterdays close below the prior YTD low at 1.3068, USDCAD has grinded lower. Eyes are now firmly placed on a test of the 1.3000 level. However, little scheduled for the rest of the session, focus turns towards the Canadian jobs report.

加元:继昨日收盘跌破先前的年初至今低点1.3068后,美元兑加元已经走低。眼睛现在已经坚定地进行了1.3000水平的测试。然而,在本交易日剩余时间里,焦点转向加拿大就业报告。

EM FX: Global bond yields continue to collapse with German Bunds now yielding less that the ECBs deposit rate (-0.4%), as such, with expectations of fresh monetary stimulus from the ECB and the Fed, carry trade has begun to look attractive, which in turn has seen high yielders (ZAR, TRY, BRL) benefit, particularly given the low FX volatility.

新兴市场外汇:全球债券收益率继续下跌,德国国债现在收益率低于欧洲央行存款利率(-0.4%)因此预期欧洲央行和美联储采取新的货币刺激措施,套利交易开始看起来具有吸引力,这反过来又看到了高yielders(ZAR,TRY,BRL)的好处,特别是给予了低汇率波动。

Source: DailyFX, Thomson Reuters

来源:DailyFX,汤森路透

{9}

IG Client Sentiment

{9}

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

환율 계산기