简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EUR/CHF Outlook: SNB Steps up Currency Intervention

요약:EUR/CHF Outlook: SNB Steps up Currency Intervention

CHF Price Analysis and Talking Points:

SNB Steps up Currency Intervention

EUR/CHF May Continue to Head Lower Despite Intervention

See our quarterly FX forecast to learn what will drive prices throughout Q3!

SNB Steps up Currency Intervention

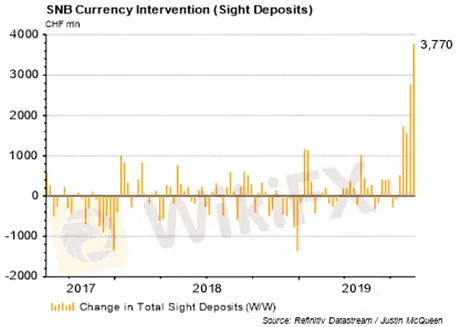

Since EUR/CHF has broken below the 1.1000 handle, the Swiss National Bank has stepped up its currency intervention in order to curb the appreciation in the Swiss Franc. Total sight deposits, which are used to gauge potential intervention from the SNB has shown a consistent trend higher, with the latest figures showing sight deposits increasing by CHF 3.770bln in the week to August 16th. However, this has been to little effect thus far with the Swiss Franc trading at its best levels in nearly 2yrs vs. Euro to hover around 1.0850 (2yr low 1.0834).

Source: Refinitiv Datastream

EUR/CHF May Continue to Head Lower Despite Intervention

Yesterday, the Bundesbank warned that Germany could potentially enter a technical recession, raising the need for the ECB to announce a fresh stimulus package (likely to come in the September meeting). That said, with risks evidently tilted to the downside for the Euro and with the global economic environment deteriorating, this raises the possibility for EUR/CHF to head lower. Consequently, this could further raise concerns for the SNB in regard to the strength in the Swiss Franc, raising questions as to whether the SNB can or will move in lockstep with the ECB. That said, since the 1.1000 handle has been breached, markets are now testing for the next line in the sand for the SNB to act more aggressively in preventing CHF gains.

EURCHF Price Chart: Weekly Time Frame (Jul 15 – Aug 19)

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

환율 계산기