简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Attention: USD May Fluctuate Due to FED Resolution

요약:The Federal Reserve’s interest rate decision to be announced at 18:00 GMT on Wednesday may expose dollar-linked currency pairs such as EUR/USD, GBP/USD, USD/JPY, USD/CAD and AUD/USD to an above-average level risk of price fluctuations.

WikiFX News (10 June)-The Federal Reserves interest rate decision to be announced at 18:00 GMT on Wednesday may expose dollar-linked currency pairs such as EUR/USD, GBP/USD, USD/JPY, USD/CAD and AUD/USD to an above-average level risk of price fluctuations. WikiFX reminds investors to pay attention to risks when trading USD.

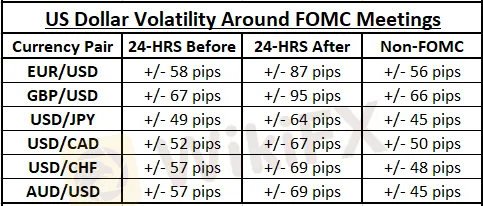

The Fed‘s interest rate resolution has triggered sharp fluctuation of the US dollar in the past. The transaction data of the EUR/USD, GBP/USD, USD/JPY, USD/CAD and AUD/USD since 2008 shows that the USD volatility before and after the Fed’s interest rate is sharper than usual. Therefore, forex investors should remain highly vigilant when the Feds resolution is made.

The Fed resolution is an important catalyst for fluctuations in the price of the US dollar. Forex investors should fully consider implementing strict risk management techniques when trading US dollars before and after the Fed interest rate resolution, such as tightening stop-loss level (up/down adjustments to stop loss) or reducing the size of positions.

The above information is provided by WikiFX, a world-renowned forex information query provider. For more information, please download: bit.ly/WIKIFX

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

환율 계산기