简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Weekly USD Outlook: Powell’s Message Is Worth Noting

요약:S&P 500’s steep fall of 6% within one day last week gave the market risk warnings. Such a swift and sudden fluctuation usually benefits dollar as a global reserve currency, but on the other hand, demand for dollar may reduce if market volatility further declines.

WikiFX News (15 June) - S&P 500s steep fall of 6% within one day last week gave the market risk warnings. Such a swift and sudden fluctuation usually benefits dollar as a global reserve currency, but on the other hand, demand for dollar may reduce if market volatility further declines.

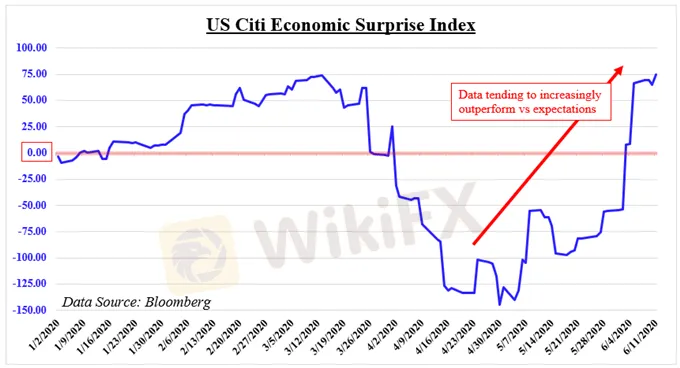

As for the fundamentals, US Retail Sales data will be released on Tuesday. Market expects a 7.4% Retail Sales Monthly Rate in May, and the improvement of consumption can boost Dow Jones and S&P 500. These factors will weigh on greenback, leading to inferior performance of USD against growth-related currencies such as AUD and NZD.

Meanwhile, investors also need to pay close attention to the speeches of Fed‘s policy makers, including Fed’s Chair Jerome Powell. He is expected to reiterate his concerns over economic prospect which he already mentioned last week.

The Fed‘s balance sheet saw little changes last week, which can increase the market’s demand for greater liquidity. If the present economic situation is not substantially improved, the US dollar will have less room to decline further.

From WikiFX, a renowned global forex broker inquiry platform where you can easily check brokers compliance and avoid being scammed. Download WikiFX App here bit.ly/WIKIFX.

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

환율 계산기