简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

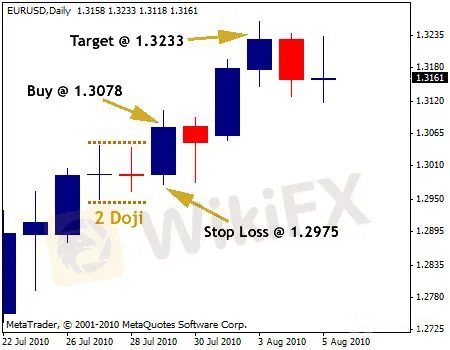

Double Doji Strategy: Allow Profits of Hundreds of Pips

요약:When two dojis form one after one on the charts, traders can consider the Double Doji Forex Breakout Trading Strategy.

WikiFX Analysis (22 Dec.) -When two dojis form one after one on the charts, traders can consider the Double Doji Forex Breakout Trading Strategy. Learn more about best trading strategies on WikiFX bit.ly/wikifxIN

The doji is one of the most popular candlestick patterns, which reveals indecision in the market. It suggests that neither buyers nor sellers are in control and that price is about to break in either direction. It doesnt matter whether the market is going to go up or down at this point because a clear trend will emerge afterwards. Whichever way it goes, the thing you need to do is place pending buy stop and sell stop orders on both sides to capture the breakout.

Timeframe: 4 hours; Currency pairs: any; Candlestick pattern: doji; Forex indicators: none

Trading Rules

1. Watch until you spot 2 consecutive doji candlesticks on the charts;

2. Mark the high and low of the doji borders;

3. Wait for the third candlestick to close;

4. If the third candlestick closes above the upper border, buy at market and place your stop loss 2-3 pips below the low that you marked, or you can place it 2-3 pips below the low of the third candlestick.

5. If the third candlestick closes below the lower border, sell at market and place your stop loss 2-3 pips above the high that your marked, or you can place it 2-3 pips above the high of the third candlestick;

6. In terms of profit target, you can use previous swing highs for buy orders and swing lows for sell orders, or you can target three times what your risked.

면책 성명:

본 기사의 견해는 저자의 개인적 견해일 뿐이며 본 플랫폼은 투자 권고를 하지 않습니다. 본 플랫폼은 기사 내 정보의 정확성, 완전성, 적시성을 보장하지 않으며, 개인의 기사 내 정보에 의한 손실에 대해 책임을 지지 않습니다.

WikiFX 브로커

환율 계산기