简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

GBP/USD: Pound Sterling Eyes Q2 GDP Amid Rising Brexit Risks

Resumo:The British Pound faces major event risk with UK Q2 GDP data due for release Friday which looks to provide the latest health check on the British economy amid prolonged Brexit uncertainty.

GBP PRICE OUTLOOK TURNS TO UK Q2 GDP REPORT

Spot GBPUSD has traded in a narrow range so far this month, but Friday‘s UK Q2 GDP report has potential to reignite the currency pair’s slide lower

The British Pound Sterling and UK economy activity remains subdued by prolonged Brexit uncertainty

GBPUSD currency traders are gearing up for heightened price action in the Pound Sterling with the UK Q2 GDP report on deck for release Friday at 8:30 GMT. The British economy is expected to grow at a year-over-year annual rate of 1.4% - a modest decline from the 1.8% figure printed in the first quarter.

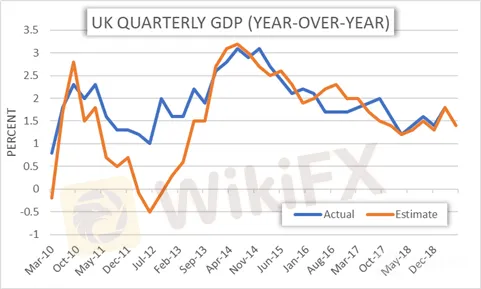

UK QUARTERLY GDP (YEAR-OVER-YEAR)

UK GDP growth has been on a steady decline and is not likely to return to post-recession highs any time soon with Brexit uncertainty weighing negatively on consumption, business confidence and investment. Also, with new PM Boris Johnson now at the helm of UK Parliament – a Brexit hardliner – the impact of heightened fears over no-deal Brexit could begin to show signs in the UK Q2 GDP report.

While there may be evidence of further inventory stockpiling which boosts economic output, which was the case found in the Q1 GDP report, this development is expected to serve as a headwind to GDP growth going forward. Yet, the British economy has remained quite resilient on balance all else considering.

GBPUSD PRICE CHART: DAILY TIME FRAME (APRIL 15, 2019 TO AUGUST 08, 2019)

GBPUSD price action is expected to maintain a downward bias, however, considering the dominant headwind of no-deal Brexit risk even if tomorrow‘s UK GDP report provides a positive sign for the economy. That said, spot GBPUSD might be expected to trade between 1.2083-1.2189 with a 68% statistical probability judging by the currency pair’s overnight implied volatility reading of 8.37%.

SPOT GBPUSD & IG CLIENT SENTIMENT INDEX PRICE CHART: DAILY TIME FRAME (FEBRUARY 11, 2019 TO AUGUST 08, 2019)

According to IG Client Sentiment data, 77.2% of GBPUSD retail forex traders are net-long resulting in a long-to-short ratio of 3.39 to 1. Traders have remained net long since 06 May when the cable traded near 1.2981; spot GBPUSD has moved 6.4% lower since then. Furthermore, the number of traders net long is 5.6% lower than last week while the number of traders net-short is 1.7% higher than last week. Seeing that we typically take a contrarian view to crowd sentiment, spot GBPUSD could continue to drift lower.

Isenção de responsabilidade:

Os pontos de vista expressos neste artigo representam a opinião pessoal do autor e não constituem conselhos de investimento da plataforma. A plataforma não garante a veracidade, completude ou actualidade da informação contida neste artigo e não é responsável por quaisquer perdas resultantes da utilização ou confiança na informação contida neste artigo.

Corretora WikiFX

Últimas notícias

TradeEU Global: Manipulação de Operações e Dificuldades de Saque

Dólar Hoje: Moeda Sobe a R$ 5,47 com Ameaças Tarifárias de Trump em Foco

Dólar Hoje: Moeda Abre em Alta com Foco nas Tarifas

Monovex: Trader Espanhol Com Mais de US$ 5.000.000 Não Consegue Sacar Fundos

Ouro Hoje (07/07/2025): Prazo Final das Tarifas se Aproxima e o Ouro Segue Forte

Neex: Essa Corretora Australiana é uma Escolha Segura para Forex Trading?

Como a Inflação de 5,18% e as Tarifas de Trump Impactam o Forex Brasileiro

Bybit: Trader Perde Mais de Um Milhão de Pesos Colombianos em Fraude

TMGM: Uma Análise Completa da Corretora de Forex e CFDs

Cálculo da taxa de câmbio