简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

GBP/USD Breaks Down to Flash Crash Lows on Brexit Showdown

Resumo:GBP/USD Breaks Down to Flash Crash Lows on Brexit Showdown

GBP/USD Analysis and Talking Points

GBP/USD Breaks 1.20 Handle

Snap Election Provides Additional Uncertainty

GBP Implied Volatility Surging

GBP/USD Breaks 1.20 Handle

GBP/USD is once again under pressure as the Brexit showdown between Tory rebels and the government highlights the current constitutional crisis that is weighing on the currency. The pair made a break below the psychological 1.20 handle, hitting a low of 1.1959, which marks the lowest level since the October 2016 Sterling flash crash. Focus today will be on the debate surrounding the Brexit delay bill (looks to delay Brexit till January 31st, 2020), whereby Prime Minister Johnson has threatened to call a general election by October 10th if passed. As a reminder, under the Fixed Term Parliaments Act, for an election to take place, 2/3 of MPs must support this.

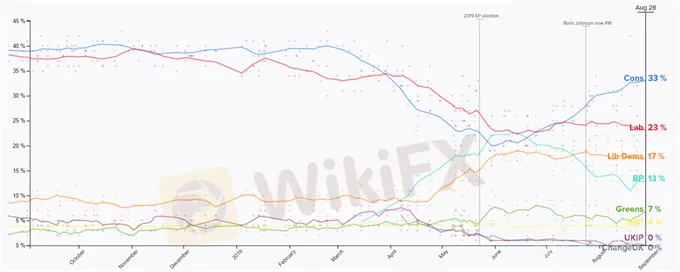

UK Election Opinion Polling

Source: Politico

Snap Election Provides Additional Uncertainty

As it stands, according to opinion polling, the Conservative Party are comfortably ahead of its opposition parties at 33% with Labour at 23%. As such, a snap election in the Autumn is not only going to increase the political uncertainty but also raise the risk of a more pro-Brexit government, which in turn keeps risks firmly titled to the downside for GBP.

GBP Implied Volatility Surging

As the risk of a snap election looms, implied volatility has been on the rise with the 1-week tenor at the highest level since April, while 2-month expiries are nearing the levels seen at the 2016 Brexit referendum as investors continue to price in the risk premium attached to a no-deal Brexit. With that said, Sterling is expected to remain the largest source of volatility across the G10 FX space. Elsewhere, with speculative shorts hovering near extreme levels, there is of course a possibility for a sharp snapback higher, provided the risk of a no-deal Brexit eases slightly. However, as has typically been the case, a sharp move higher tends to provide opportunities to fade.

Isenção de responsabilidade:

Os pontos de vista expressos neste artigo representam a opinião pessoal do autor e não constituem conselhos de investimento da plataforma. A plataforma não garante a veracidade, completude ou actualidade da informação contida neste artigo e não é responsável por quaisquer perdas resultantes da utilização ou confiança na informação contida neste artigo.

Corretora WikiFX

Últimas notícias

TradeEU Global: Manipulação de Operações e Dificuldades de Saque

Dólar Hoje: Moeda Sobe a R$ 5,47 com Ameaças Tarifárias de Trump em Foco

Dólar Hoje: Moeda Abre em Alta com Foco nas Tarifas

Monovex: Trader Espanhol Com Mais de US$ 5.000.000 Não Consegue Sacar Fundos

Ouro Hoje (07/07/2025): Prazo Final das Tarifas se Aproxima e o Ouro Segue Forte

Neex: Essa Corretora Australiana é uma Escolha Segura para Forex Trading?

Como a Inflação de 5,18% e as Tarifas de Trump Impactam o Forex Brasileiro

Bybit: Trader Perde Mais de Um Milhão de Pesos Colombianos em Fraude

TMGM: Uma Análise Completa da Corretora de Forex e CFDs

Cálculo da taxa de câmbio