简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Future Gold Market May Be Supported Despite of Volatility

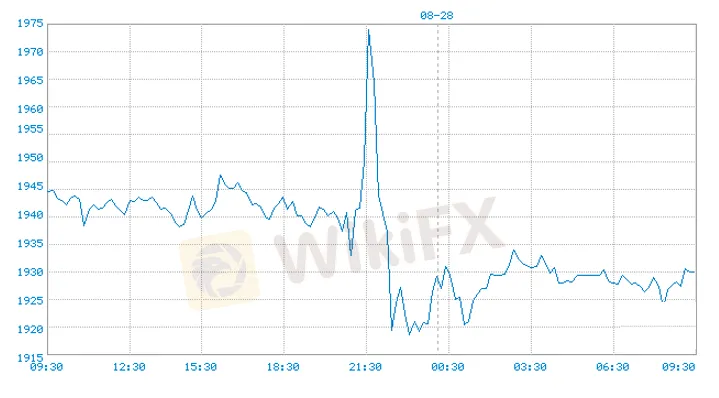

Resumo:Gold prices slumped to $1,910.19 in yesterday’s trading after an initial gain of $40, while U.S. Treasury yields jumped to 0.745% in the wake of the changes made by the FED to its framework for monetary policy.

WikiFX News (28 Aug) - Gold prices slumped to $1,910.19 in yesterdays trading after an initial gain of $40, while U.S. Treasury yields jumped to 0.745% in the wake of the changes made by the FED to its framework for monetary policy.

The FED Chair Jerome Powell proposed a new strategy to shoot the 2% inflation objective with the duration of low rate and the level of inflation both in uncertainty.

Investors believe that gold purchases for inflation hedge will not be strong enough if the FED is devoid of a strategy other than keeping interest rates low because such policy changes are too little to change anything now.

According to the report of Wells Fargo Bank, the rally in the greenback reflects the anticipation of forex pricing on the FED's changes, thus more factors are required for another decline in the dollar.

TD Securities stated that gold markets may take a consolidation for several months, in which sharp correction may occur along the descent while the upside may be constrained. More drops are foreseeable unless there is a strong rebound in gold prices this week.

The Economist Intelligence Unit reported that:“The support for gold prices is expected to maintain strong on the back of central banks who have to give such favor in order to avoid a setback amid the long and slow economic recovery from the COVID-19 crisis, which has been reflected in Powells speech.”

Credit Suisse pointed out that, gold prices would head to the resistance level of $2,075/oz, followed by $2,175/oz, $2,300/oz and $2,417/oz successively, while such level in the long term would stand at $2,700/oz.

All the above is provided by WikiFX, a platform world-renowned for foreign exchange information. For details, please download the WikiFX App:

bit.ly/WIKIFX

Chart: Trend of Gold Prices

Isenção de responsabilidade:

Os pontos de vista expressos neste artigo representam a opinião pessoal do autor e não constituem conselhos de investimento da plataforma. A plataforma não garante a veracidade, completude ou actualidade da informação contida neste artigo e não é responsável por quaisquer perdas resultantes da utilização ou confiança na informação contida neste artigo.

Corretora WikiFX

STARTRADER

IB

Pepperstone

IC Markets Global

FXTM

FOREX.com

STARTRADER

IB

Pepperstone

IC Markets Global

FXTM

FOREX.com

Corretora WikiFX

STARTRADER

IB

Pepperstone

IC Markets Global

FXTM

FOREX.com

STARTRADER

IB

Pepperstone

IC Markets Global

FXTM

FOREX.com

Últimas notícias

Dólar Hoje: Moeda Ultrapassa R$ 5,98 nesta Terça-feira

MultiBank Group Bate Record de US$ 55,85 Bilhões em um Único Dia

TNFX: Retenção de Lucros e Práticas Questionáveis

GO4REX: Investidor Chileno Perde Mais de 30 Mil Dólares

Mercados Asiáticos Reagem às Tarifas de Trump

Dólar Hoje: Moeda Americana Dispara e Ultrapassa R$ 6,05

Interactive Brokers: Uma Análise Completa da Corretora de Hong Kong

Tributação de Ganhos e Legalidade do Forex no Brasil

Cálculo da taxa de câmbio