简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Forecast: Bearish Sequence Snaps Ahead of 2019-Low

Абстракт:Gold may stage a larger rebound over the coming days as the price of bullion snaps the series of lower highs & lows from the previous week.

Gold Price Talking Points

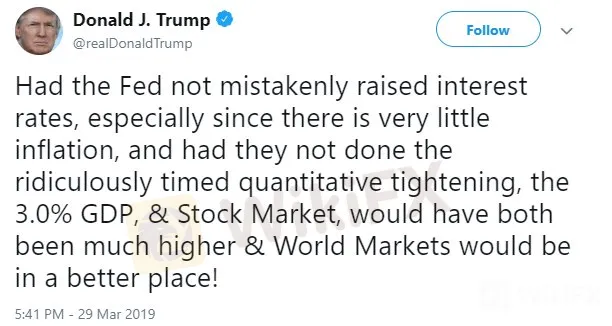

Gold attempts to retrace the sharp decline from the previous week as U.S. President Donald Trump tweets that the Federal Reserve has ‘mistakenly raised interest rates,’ and the price for bullion may stage a larger rebound over the coming days as it snaps the recent series of lower highs & lows.

Gold Price Forecast: Bearish Sequence Snaps Ahead of 2019-Low

The broader outlook for gold remains constructive as the pullback from the February-high ($1347) fails to produce a test of the 2019-low ($1277), and the lack of momentum to break the yearly opening range may keep the precious metal afloat as the Federal Open Market Committee (FOMC) faces accusations of a policy error.

It remains to be seen if the FOMC will continue to change its tune over the coming months as the inversion in the U.S. Treasury yield curve warns of a looming recession, but it seems as though the central bank largely endorse a wait-and-see approach at the next interest rate decision on May 1 as Fed Governor Randal Quarles remains ‘optimistic about the outlook for the U.S. economy.’ Recent comments from Governor Quarles suggest the FOMC has yet to abandon the hiking-cycle as ‘further increases in the policy rate may be necessary at some point,’ and Fed officials may continue to project a longer-run interest rate of 2.50% to 2.75% as the central bank pledges to be ‘data dependent.’

Nevertheless, Fed Fund Futures still reflect a greater than 50% probability for a rate-cut in December, and Chairman Jerome Powell and Co. may continue to adjust the forward-guidance over the coming months as the central bank plans to wind down the $50B/month in quantitative tightening (QT). In turn, upcoming changes in Fed policy may shore up gold prices throughout 2019, with the price for bullion at risk of exhibiting a more bullish behavior over the coming days amid the string of failed attempts to test the 2019-low ($1277). Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

Gold Price Daily Chart

The opening range for April is in focus as gold prices snap the series of lower highs & lows from the previous week, with the lack of momentum to close below the $1289 (23.6% expansion) area raising the risk for a larger rebound.

In turn, a move back above the Fibonacci overlap around $1298 (23.6% retracement) to $1302 (50% retracement) brings the $1315 (23.6% retracement) to $1316 (38.2% expansion) region back on the radar, with the next area of interest coming in around $1328 (50% expansion) to $1329 (50% expansion), which sits just above the March-high ($1324).

Отказ от ответственности:

Мнения в этой статье отражают только личное мнение автора и не являются советом по инвестированию для этой платформы. Эта платформа не гарантирует точность, полноту и актуальность информации о статье, а также не несет ответственности за любые убытки, вызванные использованием или надежностью информации о статье.

WikiFX брокеры

Подсчет курса