简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

USDCAD Rate May Rise Further After Monthly Opening Range Break

Абстракт:Current market conditions may fuel a larger rebound in USDCAD as the exchange rate clears the opening range for July.

Canadian Dollar Talking Points

USDCAD takes out the opening range for July, with the exchange rate climbing to a fresh monthly high (1.3164), and current market conditions may keep Dollar Loonie afloat as US lawmakers take steps to avoid the debt ceiling.

USDCAD Rate Risks Larger Rebound After Clearing Monthly Opening Range

USDCAD breaks out of a narrow range as Congress reaches a two-year budget deal, and the narrowing threat of a government shutdown may fuel a larger rebound ahead of the Federal Reserve interest rate decision on July 31 as it boosts bets for an “insurance cut.”

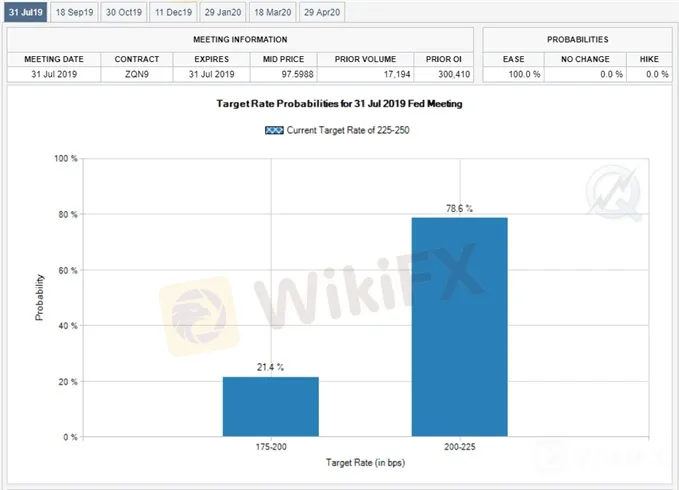

Recent remarks from the Federal Open Market Committee (FOMC) suggest the central bank will insulate the US economy from the shift in trade policy, with Fed Fund futures still highlighting a 100% probability for at least a 25bp rate cut as “participants generally agreed that downside risks to the outlook for economic activity had risen materially since their May meeting, particularly those associated with ongoing trade negotiations and slowing economic growth abroad.”

However, it remains to be seen if Chairman Jerome Powell and Co. will establish a rate easing cycle as there appears to be dissenting views within the FOMC, and the central bank may ultimately revert back to a wait-and-see approach as Fed officials “expect growth in the United States to remain solid, labor markets to stay strong, and inflation to move back up and run near 2 percent.”

As a result, the Feds forward guidance may largely influence the broader outlook for USDCAD especially as the Bank of Canada (BoC) sticks to the sidelines, with USDCAD at risk of exhibiting a more bearish behavior if the FOMC shows a greater willingness to implement lower interest rates throughout the second half of 2019.

Nevertheless, recent price action warns of a larger rebound as USDCAD breaks out of the monthly opening range, with the recent series of higher highs and lows in the exchange rate bringing the topside targets on the radar.

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

USD/CAD Rate Daily Chart

Keep in mind, the broader outlook for USDCAD is no longer constructive as the advance from the April-low (1.3274) stalls ahead of the 2019-high (1.3665), with the break of trendline support raising the risk for a further decline in the exchange rate.

Moreover, the break of the February-low (1.3068) suggests theres a broader shift in USDCAD behavior, but the failed attempt to break/close below the 1.3030 (50% expansion) region may generate a larger rebound as the exchange rate pushes back above the Fibonacci overlap around 1.3120 (61.8% retracement) to 1.3130 (61.0% retracement).

In turn, the 1.3220 (50% retracement) zone sits on the radar, with the next area of interest coming in around 1.3280 (23.6% expansion) to 1.3330 (38.2% expansion).

Additional Trading Resources

Are you looking to improve your trading approach? Review the Traits of a Successful Trader series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

Отказ от ответственности:

Мнения в этой статье отражают только личное мнение автора и не являются советом по инвестированию для этой платформы. Эта платформа не гарантирует точность, полноту и актуальность информации о статье, а также не несет ответственности за любые убытки, вызванные использованием или надежностью информации о статье.

WikiFX брокеры

WikiFX брокеры

Подсчет курса