简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Attention: USD May Fluctuate Due to FED Resolution

Özet:The Federal Reserve’s interest rate decision to be announced at 18:00 GMT on Wednesday may expose dollar-linked currency pairs such as EUR/USD, GBP/USD, USD/JPY, USD/CAD and AUD/USD to an above-average level risk of price fluctuations.

WikiFX News (10 June)-The Federal Reserves interest rate decision to be announced at 18:00 GMT on Wednesday may expose dollar-linked currency pairs such as EUR/USD, GBP/USD, USD/JPY, USD/CAD and AUD/USD to an above-average level risk of price fluctuations. WikiFX reminds investors to pay attention to risks when trading USD.

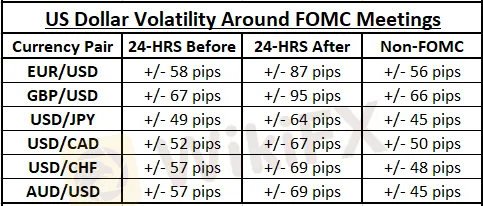

The Fed‘s interest rate resolution has triggered sharp fluctuation of the US dollar in the past. The transaction data of the EUR/USD, GBP/USD, USD/JPY, USD/CAD and AUD/USD since 2008 shows that the USD volatility before and after the Fed’s interest rate is sharper than usual. Therefore, forex investors should remain highly vigilant when the Feds resolution is made.

The Fed resolution is an important catalyst for fluctuations in the price of the US dollar. Forex investors should fully consider implementing strict risk management techniques when trading US dollars before and after the Fed interest rate resolution, such as tightening stop-loss level (up/down adjustments to stop loss) or reducing the size of positions.

The above information is provided by WikiFX, a world-renowned forex information query provider. For more information, please download: bit.ly/WIKIFX

Feragatname:

Bu makaledeki görüşler yalnızca yazarın kişisel görüşlerini temsil eder ve bu platform için yatırım tavsiyesi teşkil etmez. Bu platform, makale bilgilerinin doğruluğunu, eksiksizliğini ve güncelliğini garanti etmez ve makale bilgilerinin kullanılması veya bunlara güvenilmesinden kaynaklanan herhangi bir kayıptan sorumlu değildir.

WikiFX Broker

Son Haberler

Merkez Bankası faiz kararını açıkladı

Altında kâr satışı: Zirveden döndü

Borsada haftanın kazandıranları

Merkez Bankası ne zaman faiz indirecek? Tahminler güncellendi

Altının kilogram fiyatında yüzde 0,6 artış

Gözler Merkez Bankası faiz kararında

Stagflasyon nedir, neden olur? Stagflasyonun sonuçları nelerdir?

Trump‘tan Fed'e faiz tepkisi: Powell’ın görevinin sonlanmasını iple çekiyorum

Türkiye Sigorta kasko ürünleri ile araçlar güvence altında

Altında rekor üstüne rekor

Kur Hesaplayıcı