简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Most Asian Stocks Weaker On US Retail Shock, Trade Talks In Focus

Lời nói đầu:Asia Pacific stock markets struggled with worries about both the US and Chinese economies as trade negotiations between the two continued in Beijing.

Asian Stocks Talking Points:

Markets were broadly weaker thanks to Wall St.s data-inspired swoo

Chinese inflation missed expectations, hitting the Australian Dollar

Crude oil prices hit their 2019 peaks as investors mulled supply cut

Find out what retail foreign exchange investors make of your favorite currencys chances right now at the DailyFX Sentiment Page

Asian stocks were always likely to struggle Friday given that they had to follow Wall Streets gloomy Thursday which came in turn on the back off very weak US retail sales.

They fell by 1.2% on the month in December, the biggest monthly collapse since September 2009, sending Stateside equity lower. There was some patchy regional news too in the form of Chinese inflation which missed expectations at both the consumer and factory-gate levels. There may have been some holiday distortion in these figures but, taken with other recent softer numbers, they seem to have been taken by investors as more bad news out of China.

Markets are still of course watching for any trade headlines from the US/China meeting currently taking place in Beijing, but risk appetite took a knock even so.

The Nikkei 225 was down 1.3% as its Friday close loomed, with Shanghai off by 0.6% and the Hang Seng down 1.6%. Sydneys ASX 200 was an outlier, rising 0.3% as higher oil prices gave the energy sector a lift.

Crude oil prices hit their highs for the year thanks to supply cuts from OPEC.

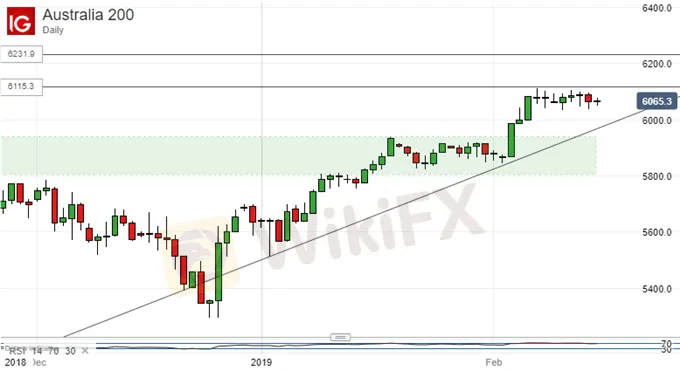

The ASX remains well-within its established uptrend, and above its former trading range.

However, it remains well short of its most pressing resistance level, which is proving a tough nut for bulls to crack. If they fail to do so soon then the index could be in danger of topping out.

The US Dollar edged lower against the Japanese Yen, but made gains against its Australian cousin which wilted initially after those Chinese inflation figures. Gold prices, meanwhile, got their customary risk-aversion lift.

The day‘s remaining economic data highlight will probably be the University of Michigan’s venerable US consumer sentiment snapshot, but its not alone on the docket. News of US industrial production is coming up too, along with import and export price figures for January. Before all that, investors will get a look at official UK retail sales number

Miễn trừ trách nhiệm:

Các ý kiến trong bài viết này chỉ thể hiện quan điểm cá nhân của tác giả và không phải lời khuyên đầu tư. Thông tin trong bài viết mang tính tham khảo và không đảm bảo tính chính xác tuyệt đối. Nền tảng không chịu trách nhiệm cho bất kỳ quyết định đầu tư nào được đưa ra dựa trên nội dung này.

Sàn môi giới

Exness

IC Markets Global

EC Markets

ATFX

STARTRADER

Saxo

Exness

IC Markets Global

EC Markets

ATFX

STARTRADER

Saxo

Sàn môi giới

Exness

IC Markets Global

EC Markets

ATFX

STARTRADER

Saxo

Exness

IC Markets Global

EC Markets

ATFX

STARTRADER

Saxo

Tin HOT

Thị trường Forex Việt Nam: Sàn môi giới nào tốt nhất tháng 03/2025?

MyForexFunds và 5 dấu hiệu nhận biết một quỹ đầu tư Forex nghi vấn

WikiEXPO Hong Kong 2025 – Xây dựng niềm tin, vươn tới tầm cao mới

Pi Network: Bí ẩn ví 10 tỷ Pi và tác động của đợt mở khóa token sắp tới

Gian lận trong ngành Prop Trading: Bài học từ cuộc chiến của Quỹ cấp vốn PipFarm

Pi Network hôm nay và nỗi đau của nhiều nhà đầu tư

Sự cố rút tiền tại sàn Exness: Hướng giải quyết và hỗ trợ từ WikiFX

Tính tỷ giá hối đoái