简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Top 5 Events: March US Nonfarm Payrolls & EURUSD Price Outlook

Lời nói đầu:Markets are expecting the weak February print of 20K to be a one-off; consensus calls for 170K.

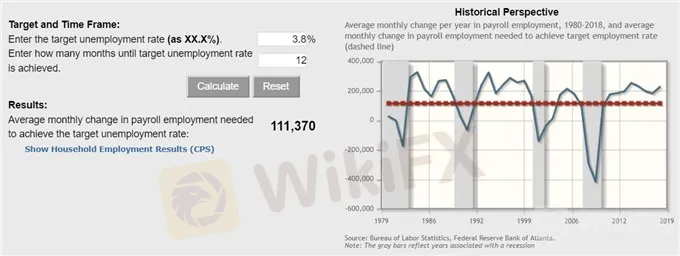

The main issue for the US Dollar when it comes to the March US Nonfarm Payrolls report is whether or not the US labor market rebounded after the US government shutdown. After all, the February reading was a meager 20K. But with the unemployment rate still near cycle lows at 3.8%, there is still evidence that the labor market remains tight by the FOMCs standards. Market participants are expecting that March reading will show a strong rebound, given that jobless claims remain low. Accordingly, current expectations for the data are calling for the unemployment rate to hold at 3.8%, and for the headline jobs figure to come in at +170K.

According to the Atlanta Fed Jobs Growth Calculator, the economy only needs +111K jobs growth per month over the next 12-months to sustain said unemployment rate at its current 3.8% level.

Pairs to Watch: DXY Index, EURUSD, USDJPY, Gold

EURUSD Price Chart: Daily Timeframe (June 2018 to April 2019)

EURUSD has been on a losing streak since the Feds March meeting, falling all but one day since March 20. Momentum is firmly to the downside right now, with price squarely below the daily 8-, 13-, and 21-EMA envelope in sequential order. Likewise, daily MACD and Slow Stochastics are trending lower, with the former having crossed below its signal line last week; the latter is nearing a sell signal. A test of the yearly low at 1.1176 is not out of the question this week (nor would be a break to fresh yearly lows).

Miễn trừ trách nhiệm:

Các ý kiến trong bài viết này chỉ thể hiện quan điểm cá nhân của tác giả và không phải lời khuyên đầu tư. Thông tin trong bài viết mang tính tham khảo và không đảm bảo tính chính xác tuyệt đối. Nền tảng không chịu trách nhiệm cho bất kỳ quyết định đầu tư nào được đưa ra dựa trên nội dung này.

Sàn môi giới

FBS

IC Markets Global

Neex

STARTRADER

TMGM

FOREX.com

FBS

IC Markets Global

Neex

STARTRADER

TMGM

FOREX.com

Sàn môi giới

FBS

IC Markets Global

Neex

STARTRADER

TMGM

FOREX.com

FBS

IC Markets Global

Neex

STARTRADER

TMGM

FOREX.com

Tin HOT

WikiFX Review sàn Forex Vantage 2025: Hành trình chinh phục trader Việt?

Pi Network và tin đồn cơ chế neo giá: Những điều bạn cần biết

Làm sao để tránh bẫy sàn lừa đảo khi đầu tư Forex? Đây là Tips từ WikiFX

Bí quyết giao dịch Forex giúp bạn thắng lớn mà không cần margin cao

Cơn sốt đầu tư Pi Network: Bao nhiêu người Việt Nam đang tham gia?

Pi Network hôm nay: Ai cứu 'Pi thủ' đây?

Pi Network hôm nay: Giá Pi lại giảm giữa những nghi vấn

Pi Network hôm nay: Chuyên gia dự báo giá Pi sắp tới sẽ đạt con số kỷ lục!

WikiFX Review sàn Forex IC Markets 2025: Nói không với spread?

Top 3 sàn Forex nạp rút nhanh chóng tháng 03/2025

Tính tỷ giá hối đoái