简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

EUR/USD Rate Risks Larger Rebound as U.S. GDP Forecast Deteriorates

摘要:EUR/USD continues to retrace the sharp selloff following the European Central Bank (ECB) meeting as U.S. data prints point to a slowing a economy.

Euro Talking Point

EUR/USD continues to retrace the sharp selloff following the European Central Bank (ECB) meeting as U.S. data prints point to a slowing a economy, and the exchange rate may stage a larger rebound over the coming days as it initiates a string of higher highs & lows.

EUR/USD extends the advance from earlier this week as the U.S. Consumer Price Index (CPI) unexpectedly narrows to 1.5% from 1.6% per annum in January, with the core rate of inflation highlighting a similar dynamic as the gauge slips to 2.1% from 2.2% during the same period.

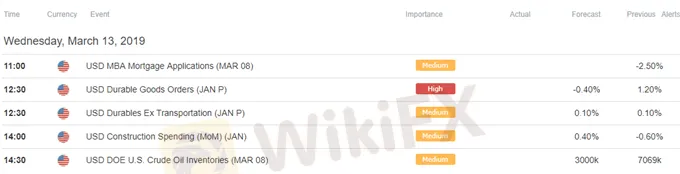

Looking ahead, updates to the U.S. Durable Goods Orders report may also produce a bearish reaction in the U.S. dollar as demand for large-ticket items are expected to contract 0.4% in February, while Non-Defense Capital Goods Orders excluding Aircrafts, a proxy for business investment, are projected to fall 0.2% after holding flat the month prior.

As a result, the Atlanta Fed‘s ’GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2019 is 0.2 percent on March 11, down from 0.5 percent on March 8,‘ and the Federal Open Market Committee (FOMC) may continue to alter the forward-guidance at the next interest rate decision on March 20 as ’some risks to the downside had increased, including the possibilities of a sharper-than-expected slowdown in global economic growth, particularly in China and Europe, a rapid waning of fiscal policy stimulus, or a further tightening of financial market condition.

It seems as though the FOMC has long but abandoned the hiking-cycle as the central bank prepares to taper the $50B/month in quantitative tightening (QT), with Chairman Jerome Powell asserting that ‘the Committee can now evaluate the appropriate timing and approach for the end of balance sheet runoff’ as Fed officials lower their forecast for growth and inflation. It remains to be seen if there will be a further adjustment to the Summary of Economic Projections (SEP) as the previous update still indicate a longer-run interest rate of 2.75% to 3.00%, and a material change it the Fed forecasts are likely to impact the near-term outlook for the U.S. dollar as the central bank drops the hawkish forward-guidance for monetary policy.

With that said, developments coming out of the U.S. economy may continue to drag on the greenback, with EUR/USD at risk for a larger rebound as the exchange rate retraces the selloff following the ECB meeting. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups ahead of the ECB meeting.

EUR/USD Daily Chart

Keep in mind, the broader outlook for EUR/USD remains tilted to the downside as it clears the 2018-low (1.1216), but the failed attempt to close below the Fibonacci overlap around 1.1190 (38.2% retracement) to 1.1220 (7.86% retracement) may generate a larger rebound especially as the exchange rate initiates a fresh series of higher highs & lows.

A close back above the 1.1270 (59% expansion) to 1.1290 (61.8% expansion) region) raises the risk for a move towards 1.1340 (38.2% expansion), with the next region of interest coming in around 1.1390 (61.8% retracement) to 1.1400 (50% expansion).

Will keep a close eye on the Relative Strength Index (RSI) as it reverses course ahead oversold territory and now approaches trendline resistance.

For more in-depth analysis, check out the 1Q 2019 Forecast for EUR/USD

免责声明:

本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性作出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任

天眼交易商

汇率计算