简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

What Could Collapsing Currency Volatility Spell for the Forex Market?

摘要:Why has currency market volatility plunged to multi-year lows and what could it mean for forex traders going forward?

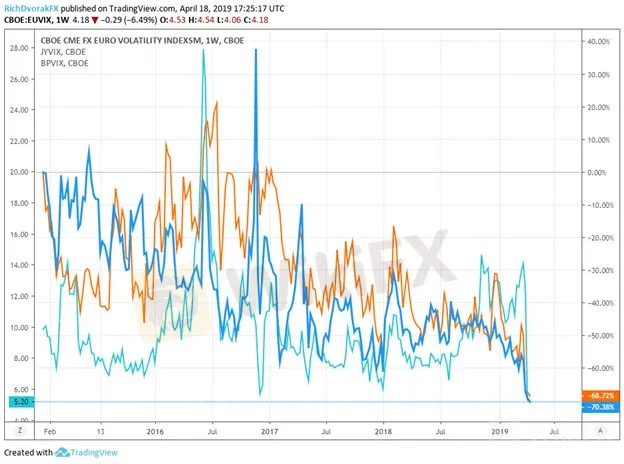

Forex market volatility has cratered to lows not seen in years. In fact, the Cboe Currency Volatility Index for the Euro, Yen, and British Pound have all plunged to their lowest levels on record since the financial instruments began trading in 2015.

EURO, YEN, AND STERLING VOLATILITY INDEX PRICE CHART: WEEKLY TIME FRAME (JANUARY 12, 2015 TO APRIL 18, 2019)

Although British Pound price action was on the rise as Brexit uncertainty sent the Sterling swinging in response to the latest headline, delaying the UKs departure date to October 31 has sent GBPUSD implied volatility nose-diving.

Rebounding market optimism with the help of central bank dovishness subsequent to last years widespread selloff has similarly contributed to the collapse in volatility for the Euro and Yen.

EURUSD PRICE CHART: WEEKLY TIME FRAME (JUNE 23, 2013 TO APRIL 18, 2019)

EURUSD‘s average-true-range has dropped to a mere 14 pips which is the metric’s lowest reading since September 8, 2014. Although, the last time spot EURUSD price action was this muted, currency traders subsequently experienced a sharp return in volatility between August 2014 and June 2015.

USDJPY PRICE CHART: WEEKLY TIME FRAME (JUNE 23, 2013 TO APRIL 18, 2019)

Likewise, the average-true-range for USDJPY has also collapsed to its lowest level since September 8, 2014. However, similar to the proverbial law of physics ‘what goes up must come down,’ volatility can only stay so low for so long before a catalyst emerges that sparks a significant market move.

The most recent occurrence of this was at the beginning of the year when Apple lowered its earnings guidance which sent a shockwave across APAC markets and ignited a currency flash-crash in the Japanese Yen.

Now with Brexit delayed for another 6 months, the US-China trade war supposedly coming to an end and rebounding global economic growth expectations, several of the markets largest risks have dwindled. These developments have contributed to the overarching risk rally and has increased the relative attractiveness for currency carry trades due to dissipating uncertainty and related volatility.

That being said, these risks albeit less prevalent are still unresolved. If uncertainty regarding these issues flares up or factor jolts market sentiment and risk appetite, this could just be the ‘calm before the storm.’

免责声明:

本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性作出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任

天眼交易商

热点资讯

币圈情侣在泰国芭提雅落网:诈骗+绑架,剧情堪比电影!

两万美刀利润不给,八百本金也被黑:民间高手遇到汇圈“茅坑里的石头”

刷抖音遇到外汇投资诈骗,公司CEO亲自下场 就为骗10美元

筑信为桥,再攀新高——WikiEXPO 2025 香港站 精彩收官!

财务经理也栽了!Facebook股票投资骗局曝光,损失高达RM36.4万!

美国追回700万美元!加密货币投资骗局受害者有望获赔,但谨防新骗局!

【WikiFX公告】模拟交易周赛暂停

汇率计算