简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar Steadies as May FOMC Minutes Detail “Patient” Approach

摘要:The May FOMC minutes detailed a reserved conversation among policymakers who believed that patience on rates would be appropriate for the foreseeable future.

FOMC Minutes Talking Points

The May FOMC minutes detailed a reserved conversation among policymakers who believed that patience on rates would be appropriate for the foreseeable future.

Many FOMC members saw the early-2019 dip in inflation readings as “transitory.”

Rates markets show a small dip in 2019 rate cut odds relative to where they stood prior to the May FOMC minutes release.

Looking for longer-term forecasts on the US Dollar? Check out the DailyFX Trading Guides.

The May Fed meeting minutes suggest that policymakers will be keeping interest rates at their current level for the foreseeable future. The May FOMC minutes echoed Fed Chair Jerome Powell‘s remark at the May Fed meeting press conference that the slowdown in inflation was “transitory” and not “persistent.” It’s worth noting that US inflation expectations have subsided in the weeks since the May Fed meeting.

In accordance with the FOMC‘s neutral view, the minutes noted that “members observed that a patient approach to determining future adjustments to the target range for the federal funds rate would likely remain appropriate for some time.” Earlier this year, the March Summary of Economic Projections’ dot plot suggested that FOMC members did not believe rates would move for the rest of 2019, before one 25-bps rate hike in 2020.

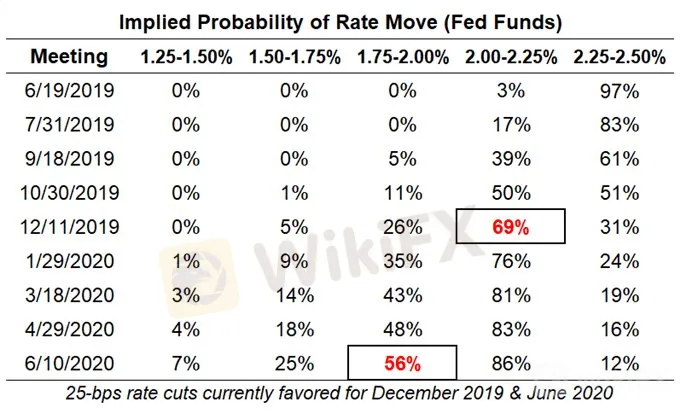

Fed Funds Futures Rate Expectations (May 22, 2019) (Table 1)

Following the May FOMC minutes, Fed funds futures were pricing in 69% chance of a 25-bps rate cut by the end of 2019 – barely lower than the 70% odds seen prior to the release.

DXY Index Technical Analysis: 1-minute Price Chart (May 22, 2019 Intraday) (Chart 1)

Following the release of the May FOMC minutes, the US Dollar (via the DXY Index) gyrated higher and lower, but ultimately steadied around levels seen prior to 14 EDT/18 GMT. Ahead of the release, the DXY Index was trading at 98.02, which is where it was last seen at the time this note was written.

免责声明:

本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性作出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任

天眼交易商

热点资讯

SILEGX投资骗局震惊全国!涉案金额高达4150万令吉,46人受害,含15名退休长者!

双面刽子手!FCA+ASIC全牌照高分IP Trade Nation正在地球村收割韭菜

币圈情侣在泰国芭提雅落网:诈骗+绑架,剧情堪比电影!

两万美刀利润不给,八百本金也被黑:民间高手遇到汇圈“茅坑里的石头”

筑信为桥,再攀新高——WikiEXPO 2025 香港站 精彩收官!

财务经理也栽了!Facebook股票投资骗局曝光,损失高达RM36.4万!

WikiEXPO全球专家访谈:戴金道——外汇交易的未来

美国追回700万美元!加密货币投资骗局受害者有望获赔,但谨防新骗局!

【WikiFX公告】模拟交易周赛暂停

汇率计算