EUR/USD to Fall on Eurozone, German GDP? Downside Risks Growing

摘要:The Euro may experience some pain tomorrow as Eurozone and German GDP is scheduled to be released. The risk of a EUR/USD selloff is potentially

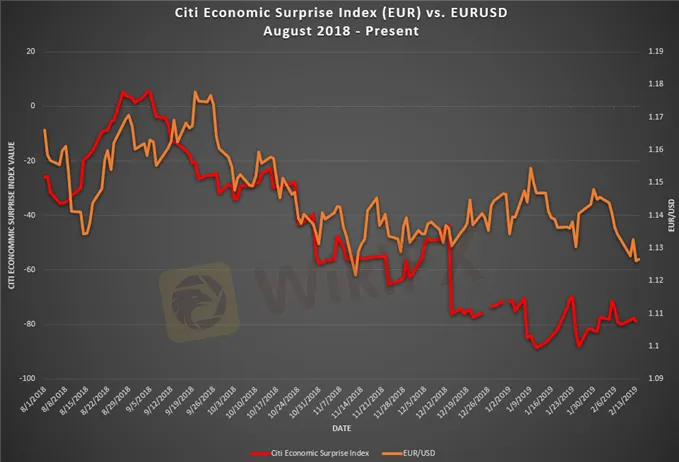

The Euro may have a painful fall tomorrow if quarter-on-quarter German and Eurozone GDP falls short of expectations. Current forecasts stand at 0.1 percent and 0.2 percent, respectively. Euro Area growth has been dramatically slowing and major economic indicators continue to underperform relative to economists expectations as shown by the Citi Economic Surprise Index.

If data continues to disappoint and the outlook for EUR/USD continues to look gloomier in the face of growing political obstacles, it is likely the Euro will continue to feel pain. As it stands, the three largest Eurozone economies – Germany, France and Italy – are all struggling to keep up steam, with the last one only recently having entered a technical recession.

As risk aversion turns investors optimism sour, the spread between Italian and German 10-year bond yields has widened over 100 percent since May, signaling greater trepidation in lending to Rome vs Berlin. The shifting political landscape is also weighing down on the Euro. The decline of Europhile liberals combined with rising Eurosceptics ahead of the European Parliamentary elections is also concerning.

Spread on Italian-German 10-Year Bond Yield

Looking ahead, the Euro will struggle to maintain any significant upward momentum following yesterdays disappointing industrial production data. Following the release, EUR/USD dropped and closed below 1.1269 with the next possible support at 1.1216. Given the fundamental outlook, it is difficult to say with confidence that the Euro has much room for upward momentum considering the many hurdles it must overcome in 2019.

EUR/USD – Daily Chart

免責聲明:

本文觀點僅代表作者個人觀點,不構成本平台的投資建議,本平台不對文章信息準確性、完整性和及時性作出任何保證,亦不對因使用或信賴文章信息引發的任何損失承擔責任

天眼交易商

熱點資訊

Stone Bridge Funds缺乏有效監管、疑似使用免洗網站,更遭加拿大CSA示警

外匯天眼Gala Night · 馬來西亞站圓滿落幕

外匯券商ActivTrades遭控取消利潤、拒絕出金,平台實際營運情況究竟如何?

FXGT.com持多國牌照卻評價兩極,這家外匯券商究竟安不安全?

eToro E投睿與富蘭克林坦伯頓推出目標日期投資組合

ZFX山海證券在七月重要經濟事件前調降槓桿比率

持有塞浦路斯CYSEC全牌照的券商Markets.com評價如何?點擊了解更多平台營運概況、潛在風險

IG Group在資本減資中釋出超過4.25億英鎊資金

MT5交易軟體有哪些作用?

匯率計算