简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Analysis: Crucial Resistance in Focus as Investors Eye FOMC Minutes

摘要:Gold Price Analysis: Crucial Resistance in Focus as Investors Eye FOMC Minutes

Gold Price Analysis and Talking Points:

Gold Buying Persists, Eyes on FOMC Minute

Crucial Technical Resistance May Spark Inflection Point

See our quarterly gold forecast to learn what will drive prices throughout Q1!

Gold Buying Persists, Eyes on FOMC Minute

Since the beginning of the year, Gold prices are up over 5%, trading at its highest level since April 2018 as global central banks take a more accommodative stance. Most notably the Federal Reserve who emphasized that not only would they be patient in rate hikes, they had also opened up to the idea that the balance sheet unwind may end sooner than what the markets expects. Consequently, investors have flocked to the non-yielding precious metal. Eyes will be on tonights FOMC minutes, whereby a dovish release could see gold push towards key resistance at $1350.

However, judging by the price action observed in the USD and gold yesterday, markets may have already positioned themselves for a dovish outcome, implying a slight near-term pullback if markets perceive the minutes as less dovish than expected. Outlook continues to remain bullish as global bond yields continue to dip.

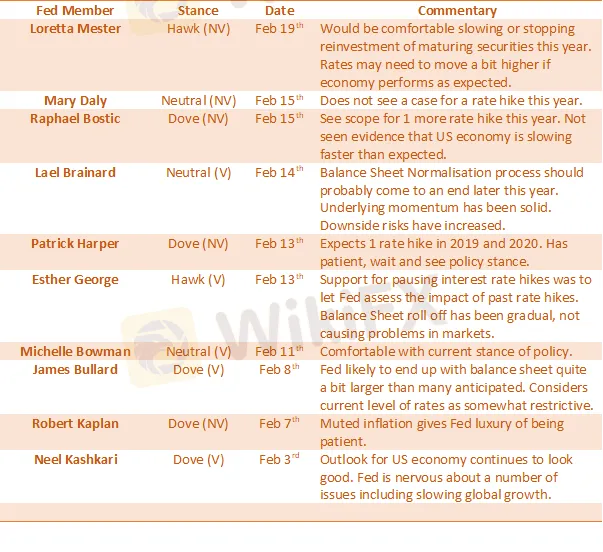

FOMC Tracker

Crucial Technical Resistance May Spark Inflection Point

With the gold uptrend firmly intact, the precious metal is now eying key resistance at $1350, which marks the descending trendline from the August 2013 peak, potentially sparking a near-term pullback. However, a closing break above increases scope for a move towards the 2018 peak at $1365-66. Elsewhere, a slight negative divergence on the RSI also raises the potential for a pullback.

GOLD PRICE CHART: Daily Time-Frame (Jun 2018-Feb 2019)

Chart by IG

GOLD PRICE CHART: Weekly Time-Frame (Aug 2010-Feb 2019)

RECOMMENDED READING

Gold Price Analysis: Fed Capitulation & Central Bank Buying Spree Maintains Bullish Outlook

What You Need to Know About the Gold Market

免責聲明:

本文觀點僅代表作者個人觀點,不構成本平台的投資建議,本平台不對文章信息準確性、完整性和及時性作出任何保證,亦不對因使用或信賴文章信息引發的任何損失承擔責任

天眼交易商

熱點資訊

小心踩雷!MERJ監管資訊存疑、涉虛假宣傳,遭投資人點名為詐騙平台

交易沒有耐心,其他都是浮雲!

Pro Club Team遭英國FCA列為詐騙風險平台,網站失效疑似已爆雷跑路

PipsMasterPro再爆假投資詐騙!高報酬話術誘騙入金,限制大額提領逼繳稅

匯率計算