简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Top 5 Events: May RBNZ Meeting & NZDUSD Price Forecast

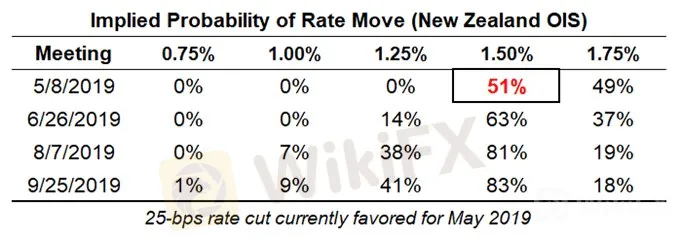

摘要:The Reserve Bank of New Zealand meets on Wednesday, May 8 at 02:00 GMT; rates markets are pricing in a 51% chance of a 25-bps rate cut.

Talking Points:

- The Reserve Bank of New Zealand meets on Wednesday, May 8 at 02:00 GMT; rates markets are pricing in a 51% chance of a 25-bps rate cut.

- NZDUSD prices reached fresh 2019 lows at the end of April, breaking the January 3 flash crash low in the process.

- Retail traders are currently net-long NZDUSD and have remained net-long since April 2; during that timeframe, NZDUSD prices fell by -2.6%.

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

05/08 WEDNESDAY | 02:00 GMT | NZD RESERVE BANK OF NEW ZEALAND RATE DECISION

The Reserve Bank of New Zealands overnight cash rate peaked at 3.50% in May 2015 and has been on a slow erosion over since; the most recent 25-bps rate cut was at the November 2016 meeting. Mounting concerns about a soft economy may have reached the tipping point in recent weeks, finally provoking the Reserve Bank of New Zealand into its first rate move in two and a half years.

The Q1‘19 New Zealand GDP report showed that growth was weaker than anticipated, coming in at 2.3% annualized versus 2.5% expected, from 2.6% in Q4’18. Meanwhile, the Q119 New Zealand inflation report produced a similar disappointment, registering 1.5% versus 1.7% expected, from 1.9% (y/y). Overall, the Citi Economic Surprise Index for New Zealand, a gauge of economic data momentum, has fallen from -1.8 to -11.2 since the March RBNZ meeting.

Since the last RBNZ meeting in March, traders have steadily pulled forward expectations of a 25-bps rate cut into the first half of 2019. Prior to the last RBNZ meeting there was a 7% chance of a cut at the May meeting; currently, there is a 51% chance of a 25-bps cut this week.

Pairs to Watch: AUDNZD, NZDJPY, NZDUSD

NZDUSD Technical Analysis: Daily Timeframe (April 2018 to May 2019) (Chart 1)

The near-term price forecast for NZDUSD remains bearish as technical studies point to a weak momentum environment. Price remains below its daily 8-, 13-, and 21-EMA envelope, while both daily MACD and Slow Stochastics point lower in bearish territory. After breaking the early-2019 flash crash low set on January 3 at 0.6587, NZDUSD prices established a fresh 2019 low at 0.6580 in the final week of trading in April. As such, a move below the April low of 0.6580 would likely trigger an effort to return back to the November 1, 2018 low at 0.6514.

IG Client Sentiment Index: NZDUSD Price Forecast (May 6, 2019) (Chart 2)

NZDUSD: Retail trader data shows 69.8% of traders are net-long with the ratio of traders long to short at 2.32 to 1. In fact, traders have remained net-long since April 2 when NZDUSD traded near 0.67808; price has moved 2.6% lower since then. The number of traders net-long is 8.4% higher than yesterday and 22.6% higher from last week, while the number of traders net-short is 1.6% lower than yesterday and 9.1% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests NZDUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger NZDUSD-bearish contrarian trading bias.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX

免責聲明:

本文觀點僅代表作者個人觀點,不構成本平台的投資建議,本平台不對文章信息準確性、完整性和及時性作出任何保證,亦不對因使用或信賴文章信息引發的任何損失承擔責任

天眼交易商

熱點資訊

小心踩雷!MERJ監管資訊存疑、涉虛假宣傳,遭投資人點名為詐騙平台

美國FED到底是什麼?該機構具體有什麼作用?

PipsMasterPro再爆假投資詐騙!高報酬話術誘騙入金,限制大額提領逼繳稅

交易環境獲AAA評級的澳洲券商Neex好用嗎?點擊查看平台監管情形、用戶評價、運作狀況

外匯天眼警報:3/24-3/30最新外匯詐騙券商黑名單

受塞浦路斯、塞席爾監管的WisunoFX斯瑞好用嗎?監管情況、用戶評價、網站概況一次看

匯率計算