简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Price Breakout Eyes Critical Trendline Resistance Ahead of NFP

摘要:Gold Price Breakout Eyes Critical Trendline Resistance Ahead of NFP

Gold Price Analysis and Talking Points:

黄金价格分析和谈话要点:

Gold on Course for Best Week Since March 2018

2018年3月以来最佳周课程的金奖

NFP Report in Focus

非全球新闻专业报告焦点

Technical Outlook | Key Trendline Resistance Remains Formidable

技术展望|主要趋势线阻力仍然强大

Gold on Course for Best Week Since March 2018

自2018年3月以来的最佳周课程金奖

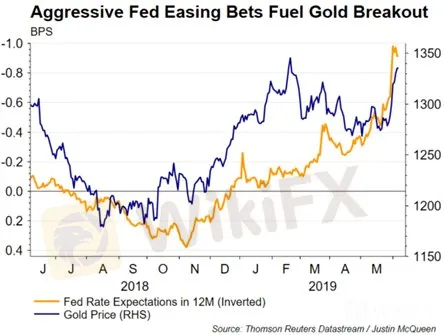

Amid the backdrop of raised expectations that the Federal Reserve will provide “insurance” rate cuts to insulate the US economy from adverse external events, gold prices have soared through $1300 to move within touching distance of the 2019 peak. Last week we highlighted that risks were tilted to gold upside on fueling rate cut bets (full story) after Fed Vice Chair Claridas statement in which he had seemingly opened the door to a rate cut. Since then, a raft of Fed rate setters had signaled their openness to a easing with Chairman Powell noting that policy could be adjusted in order to sustain the expansion, while Bullard was perhaps the most explicit having stated that a rate cut could be warranted soon.

在美联储将提出的预期提高的背景下保险降息以使美国经济免受不利的外部事件影响,金价飙升至1300美元以在2019年的峰值触及距离内移动。上周我们强调,在美联储副主席克拉丽达斯表示他似乎打开减息之门后,加息降息的风险倾向于黄金价格上涨(全文)。从那以后,一大批美联储利率制定者表示他们愿意放松对鲍威尔主席的宽松政策,并指出可以调整政策以维持扩张,而布拉德可能是最明确表示可能很快就会降息的说法。

Alongside this, the trade war backdrop has also provided underlying support for the precious metal. However, in the near term, focus will be on the outcome of the US and Mexican trade discussions this weekend as recent headlines suggest that tariffs on Mexican goods could be delayed thus potentially taking the shine of some of golds recent rally if indeed this was to be the case.

除此之外,贸易战背景也为贵金属提供了潜在支撑。然而,在短期内,焦点将放在本周末美国和墨西哥贸易讨论的结果上,因为最近的头条新闻表明墨西哥商品的关税可能被推迟,因此如果确实这样做,可能会使一些黄金最近的反弹大放异彩。情况如此。

NFP Report in Focus

非全球新一代报道聚焦报告

Todays focus will lie on the US jobs report, particularly after the weakest ADP reading in 9yrs. Although, to put some context on the ADP report, typically the correlation between that and NFP is relatively weak, while the 3-month average is a rather robust 153k with the 2019 average at 188k. Alongside this, the ISM employment index had been notably firmer, which tends to be more important for NFP. Elsewhere, the wage component remains the most important metric within the report as Fed officials look for inflationary signs.

今天的重点将放在美国的就业岗位上报告,特别是在9年来最弱的ADP读数之后。虽然,为了在ADP报告中加上一些背景,通常它与NFP之间的相关性相对较弱,而3个月的平均值是相当强劲的153k,2019年的平均值为188k。除此之外,ISM就业指数也明显走强,这对国家森林计划来说更为重要。其他方面,由于美联储官员寻找通胀迹象,工资部分仍然是报告中最重要的指标。

Technical Outlook | Key Trendline Resistance Remains Formidable

技术展望|关键趋势线阻力依然强大

While gold prices have soared, questions can be raised on whether the precious metal has moved too much in such a short space of time. As such, with gold now eying critical resistance in the form of the descending trendline that has held over the past 5yrs, there is a risk of a slight pullback.

虽然黄金价格飙升,但对于贵金属是否在如此短的时间内移动太多也存在疑问。因此,随着黄金现在以过去五十年来持续下行趋势线的形式出现关键阻力,可能会出现轻微回调。

GOLD PRICE CHART: Daily Time-Frame (Feb 2013-June 2019)

黄金价格表:每日时间范围(2013年2月至2019年6月)

免責聲明:

本文觀點僅代表作者個人觀點,不構成本平台的投資建議,本平台不對文章信息準確性、完整性和及時性作出任何保證,亦不對因使用或信賴文章信息引發的任何損失承擔責任

天眼交易商

熱點資訊

小心踩雷!MERJ監管資訊存疑、涉虛假宣傳,遭投資人點名為詐騙平台

交易沒有耐心,其他都是浮雲!

Pro Club Team遭英國FCA列為詐騙風險平台,網站失效疑似已爆雷跑路

PipsMasterPro再爆假投資詐騙!高報酬話術誘騙入金,限制大額提領逼繳稅

匯率計算