简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

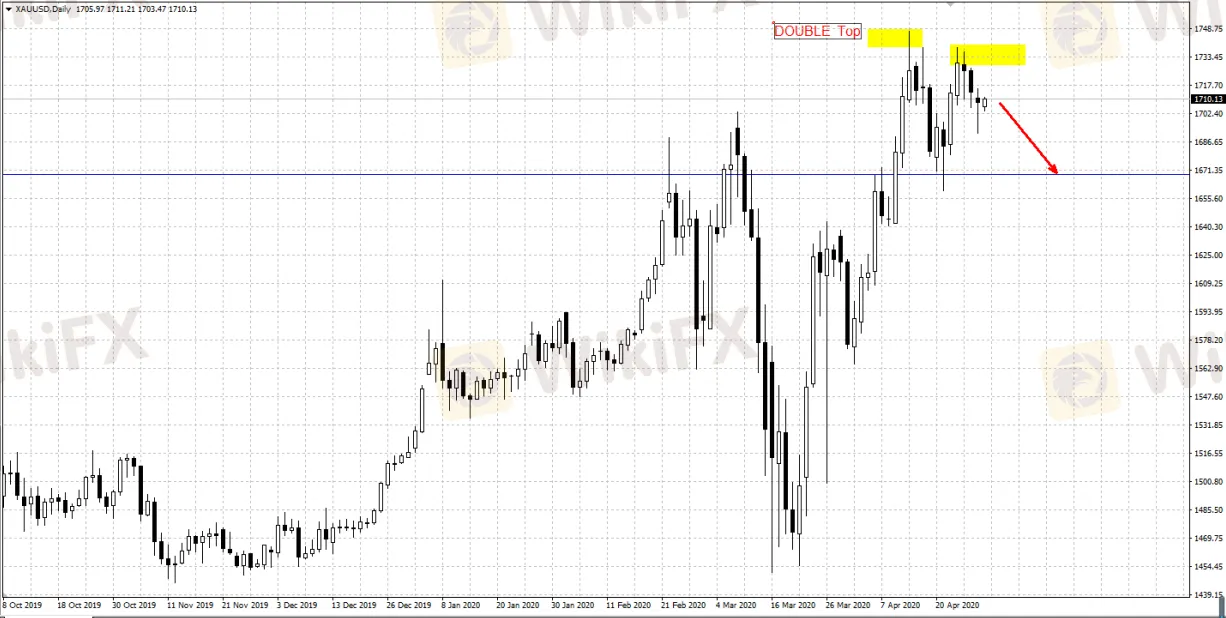

Gold Continues to Fall as Risk-aversion Sentiments Decline

摘要:Gold price has been falling for the third straight day, as global governments’ measures of reopening economy and the stock market’s rally reduced part of the market’s risk-aversion demands.

Gold price has been falling for the third straight day, as global governments’ measures of reopening economy and the stock market’s rally reduced part of the market’s risk-aversion demands.

Investors are closely following the stimulus measures governments and central banks will implement to revive economy.

In addition, statistics also show that China and India’s gold imports have declined starkly, as lockdown measures and spiking gold prices dampen consumers’ demand of the precious metal. According to data from General Administration of Customs People’s Republic of China (GACC), China’s Gold imports dropped over 80% in March and over 60% in the first quarter this year.

China imported only 17.5 tonnes of gold in March, the lowest level recorded by GACC since January, 2018. Similarly, India’s gold imports are also near historical low.

Gold’s daily pivot point 1704-1706

S1: 1694 R1: 1719

S2: 1680 R2: 1730

免責聲明:

本文觀點僅代表作者個人觀點,不構成本平台的投資建議,本平台不對文章信息準確性、完整性和及時性作出任何保證,亦不對因使用或信賴文章信息引發的任何損失承擔責任

天眼交易商

熱點資訊

WikiFX“全球模擬交易精英賽”圓滿落幕,外匯精英共襄盛舉!

手機MT4外匯怎麼復盤?

因應川普關稅震撼市場,IG取消「保證停損單」手續費

老牌券商Trade Nation值得信賴嗎?監管情形、交易環境、用戶評價、潛在風險一次看

SkyLine Guide 2025 Thailand正式啟動:評審團組建中

EE TRADE易投詐騙黑幕曝光!投資人控出金遭拒、帳戶被凍,宣稱多國監管全是造假

4/7-4/13最新外匯詐騙券商黑名單公布

外匯市場有哪些值得關注的指標?

匯率計算