简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Weekly USD Outlook: Powell’s Message Is Worth Noting

摘要:S&P 500’s steep fall of 6% within one day last week gave the market risk warnings. Such a swift and sudden fluctuation usually benefits dollar as a global reserve currency, but on the other hand, demand for dollar may reduce if market volatility further declines.

WikiFX News (15 June) - S&P 500s steep fall of 6% within one day last week gave the market risk warnings. Such a swift and sudden fluctuation usually benefits dollar as a global reserve currency, but on the other hand, demand for dollar may reduce if market volatility further declines.

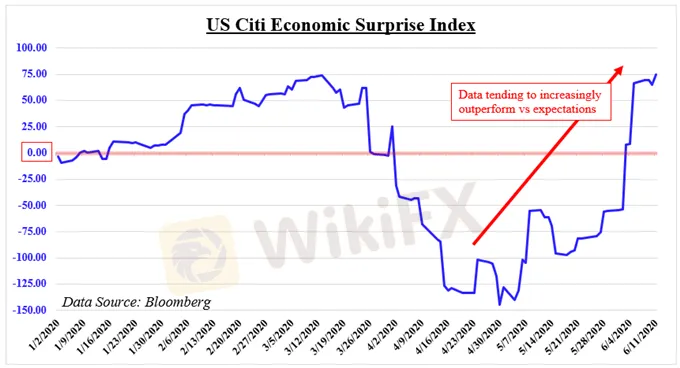

As for the fundamentals, US Retail Sales data will be released on Tuesday. Market expects a 7.4% Retail Sales Monthly Rate in May, and the improvement of consumption can boost Dow Jones and S&P 500. These factors will weigh on greenback, leading to inferior performance of USD against growth-related currencies such as AUD and NZD.

Meanwhile, investors also need to pay close attention to the speeches of Fed‘s policy makers, including Fed’s Chair Jerome Powell. He is expected to reiterate his concerns over economic prospect which he already mentioned last week.

The Fed‘s balance sheet saw little changes last week, which can increase the market’s demand for greater liquidity. If the present economic situation is not substantially improved, the US dollar will have less room to decline further.

From WikiFX, a renowned global forex broker inquiry platform where you can easily check brokers compliance and avoid being scammed. Download WikiFX App here bit.ly/WIKIFX.

免責聲明:

本文觀點僅代表作者個人觀點,不構成本平台的投資建議,本平台不對文章信息準確性、完整性和及時性作出任何保證,亦不對因使用或信賴文章信息引發的任何損失承擔責任

天眼交易商

熱點資訊

老牌券商Trade Nation值得信賴嗎?監管情形、交易環境、用戶評價、潛在風險一次看

SkyLine Guide 2025 Thailand正式啟動:評審團組建中

WB富格林疑似收割投資人?遭控點差暴利、強制平倉、出金卡關,話術不斷問題多

SEC Markets疑似無牌經營!高額贈金恐為非法吸金陷阱

外匯市場有哪些值得關注的指標?

加拿大CSA點名AlgoBitTrade無牌經營,投資人小心血本無歸

想要做好交易,必須懂得這些取捨

匯率計算