Billionaire T. Boone Pickens's final message before he died

In his final written message before dying, T. Boone Pickens shared the most important lessons he learned on how to succeed in business and in life.

China could be the biggest loser from the Saudi Arabia oil attack

An expert told Business Insider that China has been the largest buyer of Saudi oil since 2009 and could be most impacted by a halt to oil exports.

The US is building a case against Iran in the attacks on Saudi Arabia, but Trump is in no rush to act

The US is publicly and in leaks to the press making the case that Iran struck Saudi oil sites, but it remains unclear what the next step will be.

Investors want hedge funds to stick to their guns in market upheaval

The slide in momentum stocks last week and oil's spike this weekend has thrashed hedge funds. Investors want them to stand by their strategies.

Saudi Aramco oil attack also hit world's biggest oil reserve capacity

Drones hit two key Saudi Aramco oil refineries, shutting down production on around 5% of the world's daily oil production and causing prices to surge.

Drones wiped out half of Saudi Arabia's oil production — and it could lead to higher gas prices

A drone strike that knocked out half of Saudi Arabia's oil production could lead to higher oil prices globally, according to analysts.

Attacks wiped out half of Saudi Arabia's oil production — and it could lead to higher gas prices

A drone strike that knocked out half of Saudi Arabia's oil production could lead to higher oil prices globally, according to analysts.

Crude Oil Price Flops; Trump May Ease on Iran After Bolton Fallout

US Crude Oil Futures are dropping today as reports cross the wire revealing that Boltons prompt exit from his advisory role stemmed from a fundamental disagreement with President Trump on Iran.

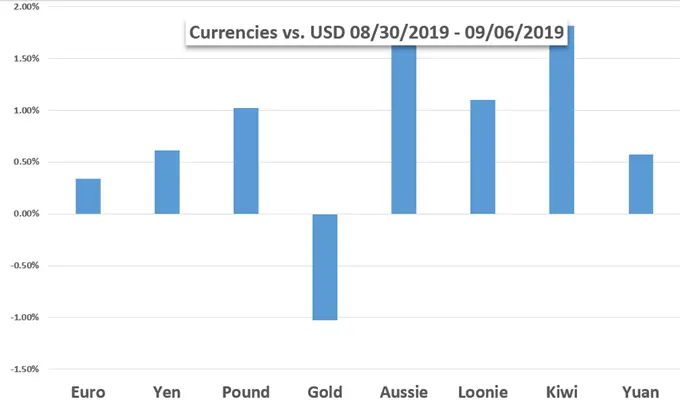

Dow Rises and Gold Falls on Trade War Enthusiasm, ECB Decision Top Event Ahead

Though tentative, market participants latched on to nascent signs that trade war conditions may improve and the threat of recession is not as imminent as many fear. This would be the perfect opportunity for monetary policy to further leverage the uneven swell in sentiment. The ECB will start a run

Sliding Crude Oil Cant Look to Jackson Hole For Price Support

Crude oil prices continue to drop as the economic data keep huge question marks glowering over likely demand levels.

Oil Price Outlook: Crude Reversal Targets – WTI Trade Levels

Oil prices have rallied more than 5% since the start of the week – is a near-term low in place? Here are the levels that matter on the WTI weekly chart.

What is the Strait of Hormuz, how does it tie into Iran tensions?

The US blames Iran for two tanker explosions and a drone shooting near the Strait of Hormuz. Some 21 million barrels of oil pass through it every day.

Oil Price Outlook: Crude Spills into Support – WTI Trade Levels

Oil prices plummeted more than 15% from the July highs with crude now threatening a break of the June lows. Here are the levels that matter on the WTI technical charts.

Weekly Trading Forecasts: EURUSD Top Fundamental Candidate on Fed Speculation, ECB Decision Approaches

We may find the top scheduled event risk next week displaced for market moving potential by an increasingly volatile theme. Key event risk ahead includes Fridays US 2Q GDP update and the global PMIs for July which would seem to put the focus on growth and recession concerns. Yet, the

Oil Price Chart: Crude Crushed Down to Support – WTI Trade Levels

Oil prices have sold off for the past five days with crude now approaching the first major support zone. Here are the levels that matter on the WTI technical charts.

Oil Price Outlook: Crude Rally Halted at Resistance– WTI Weekly Chart

Oil prices may be at risk after failing to close above a critical resistance zone last week. Here are the levels that matter on the WTI weekly chart.

What is the Strait of Hormuz, how does it tie into Iran tensions?

The US blames Iran for two tanker explosions and a drone shooting near the Strait of Hormuz. Some 21 million barrels of oil pass through it every day.

Oil Price Outlook: Crude Crushed – Trade Levels to Know for WTI

Crude oil prices have plummeted more than 11% form the yearly high with the sell-off now eyeing initial support targets. Here are levels that matter on the WTI charts.

Data isn't the new oil, says former Goldman executive

While data has potential to drive revenue growth and cut costs, most companies don't have the expertise to get real value from it, the author argues.

Oil Weekly Price Outlook: Crude Rally Stalls- Correction Underway

Oil prices risk a larger pullback after posting fresh yearly highs this week. These are targets & invalidation levels that matter on the crude oil weekly chart.