Key Events This Week: Light On Data, Heavy On Earnings

Abstract:As discussed earlier, this week is pretty quiet in terms of planned economic and macro events... alt

As discussed earlier, this week is pretty quiet in terms of planned economic and macro events... although as Jim Reid notes, this year has been as busy as he can remember outside of a crisis in terms of unplanned events so the first part of this sentence will likely be proved to be meaningless.

In terms of the known highlights, we have the global flash PMIs on Thursday alongside what is universally accepted to be an ECB on hold meeting. With the Fed on their blackout ahead of next week's FOMC, the only noise will come from how hard Trump wants to continue to push on with criticizing Powell (on a daily basis). Powell does open a regulatory conference tomorrow but won't discuss monetary policy given the blackout.

The key US data are some regional manufacturing surveys tomorrow, existing home sales on Wednesday, new home sales, jobless claims and the Chicago Fed survey on Thursday, and then durable goods on Friday.

In Europe, the key to the ECB meeting this Thursday is how long they're expected to pause. The central bank will also release its bank lending survey tomorrow.

In terms of economic data, other sentiment indicators out in the region will include consumer confidence in Germany (Thursday), the UK, France and Italy (Friday). The German Ifo survey is out on Friday.

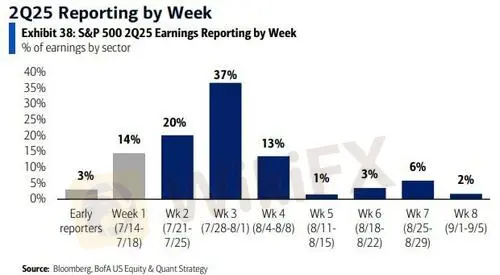

It's certainly busier on the earnings side as we start to see Q2 earnings get fleshed out a little more this week with 135 S&P 500 and 189 Stoxx 600 companies reporting. Two of the Magnificent 7, Alphabet and Tesla, will report on Wednesday. Other tech firms releasing results this week include IBM, ServiceNow and Intel. Defence firms including RTX, Lockheed Martin and Northrop Grumman also report.

In Europe, earnings will be due from the region's largest company, SAP tomorrow. Three others from the top 10 by market cap - LVMH, Roche and Nestle - also report, along with several European banks. See the full day-by-day calendar of events as usual at the end

Monday July 21

- Data: US June leading index, China 1-yr and 5-yr loan prime rates, Canada June industrial product price index, raw materials price index

- Central banks: BoC Q2 business outlook survey

- Earnings: Verizon, Roper, NXP Semiconductors, Ryanair, Domino's Pizza

Tuesday July 22

- Data: US July Philadelphia Fed non-manufacturing activity, Richmond Fed manufacturing index, Richmond Fed business conditions, UK June public finances, France June retail sales

- Central banks: Fed's Powell speaks, ECB's bank lending survey, BoE's Bailey speaks, RBA minutes of the July meeting

- Earnings: SAP, Coca-Cola, RTX, Texas Instruments, Intuitive Surgical, Danaher, Capital One Financial, Chubb,

- Lockheed Martin, Sherwin-Williams, Northrop Grumman, General Motors, MSCI, Givaudan, EQT, Equifax, Halliburton, Sartorius

Wednesday July 23

- Data: US June existing home sales, Eurozone July consumer confidence

- Central banks: BoJ's Uchida speaks

- Earnings: Alphabet, Tesla, IBM, T-Mobile US, ServiceNow, AT&T, Thermo Fisher Scientific, NextEra Energy, Boston Scientific, GE Vernova, Amphenol, Iberdrola, UniCredit, Fiserv, Chipotle Mexican Grill, Equinor, Hilton, Freeport-McMoRan, CSX, Thales, Moncler

- Auctions: US 20-yr Bond (reopening, $13bn)

Thursday July 24

- Data: US, UK, Japan, Germany, France and the Eurozone flash July PMIs, US June Chicago Fed national activity index, new home sales, July Kansas City Fed manufacturing activity, initial jobless claims, Germany August GfK consumer confidence, France July business confidence, EU27 June new car registrations, Canada May retail sales

- Central banks: ECB decision

- Earnings: LVMH, Roche, Nestle, Blackstone, SK Hynix, Honeywell, TotalEnergies, Union Pacific, Intel, BNP Paribas, Newmont, Lloyds, Digital Realty Trust, Deutsche Boerse, Dassault Systemes, L3Harris, Keurig Dr Pepper, Galderma, Nokia, BT, MTU Aero Engines, Southwest Airlines, Dow, Sabadell, Repsol, Deckers Outdoor, Carrefour, American Airlines, Wizz Air

- Auctions: US 10-yr TIPS ($21bn)

Friday July 25

- Data: US June durable goods orders, July Kansas City Fed services activity, UK July GfK consumer confidence, June retail sales, Japan July Tokyo CPI, June PPI services, Germany July Ifo survey, France July consumer confidence, Italy July consumer and manufacturing confidence, Eurozone June M3

- Central banks: ECB's survey of professional forecasters

- Earnings: HCA Healthcare, Charter Communications, Volkswagen, NatWest, Eni

Monday, July 21

- There are no major economic data releases scheduled.

Tuesday, July 22

- There are no major economic data releases scheduled.

Wednesday, July 23

- 10:00 AM Existing home sales, June (GS +2.0%, consensus -0.7%, last +0.8%)

Thursday, July 24

- 08:30 AM Initial jobless claims, week ended July 19 (GS 231k, consensus 230k, last 221k); Continuing jobless claims, week ended July 12 (consensus 1,960k, last 1,956k)

- 09:45 AM S&P Global US manufacturing PMI, July preliminary (consensus 52.7, last 52.9): S&P Global US services PMI, July preliminary (consensus 53.1, last 52.9)

- 10:00 AM New home sales, June (GS +3.1%, consensus +4.3%, last -13.7%)

Friday, July 25

- 08:30 AM Durable goods orders, June preliminary (GS -9.0%, consensus -10.8%, last +16.4%); Durable goods orders ex-transportation, June preliminary (GS -0.1%, consensus +0.1%, last +0.5%); Core capital goods orders, June preliminary (GS -0.2%, consensus +0.2%, last +1.7%); Core capital goods shipments, June preliminary (GS +0.3%, consensus +0.2%, last +0.4%): We estimate that durable goods orders retrenched 9% in the preliminary June report (month-over-month, seasonally adjusted), reflecting a partial normalization in commercial aircraft orders after last month‘s spike. We forecast a 0.2% decline in core capital goods orders—reflecting contractionary new orders readings for manufacturing surveys in June and payback for the prior month’s outsized increase—and a 0.3% increase in core capital goods shipments—reflecting the increase in orders over the prior month.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

U.S. doubles down on Aug. 1 tariffs deadline as EU battles for a deal

Buffett and Thorp’s Secret Options Strategies

Sharing Trading Mistakes and Growth

Trading Market Profile: A Clear and Practical Guide

Eyeing Significant Returns from Forex Investments? Be Updated with These Charts

CNBC Daily Open: The silver lining of positive earnings could be too blinding

Global week ahead: Banking bellwethers and a tariffs waiting game

CNBC Daily Open: Solid earnings beats might mask tariff volatility these two weeks

Mastering Deriv Trading: Strategies and Insights for Successful Deriv Traders

Brexit made businesses abandon the UK. Trump's hefty EU tariffs could bring them back

Currency Calculator