简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

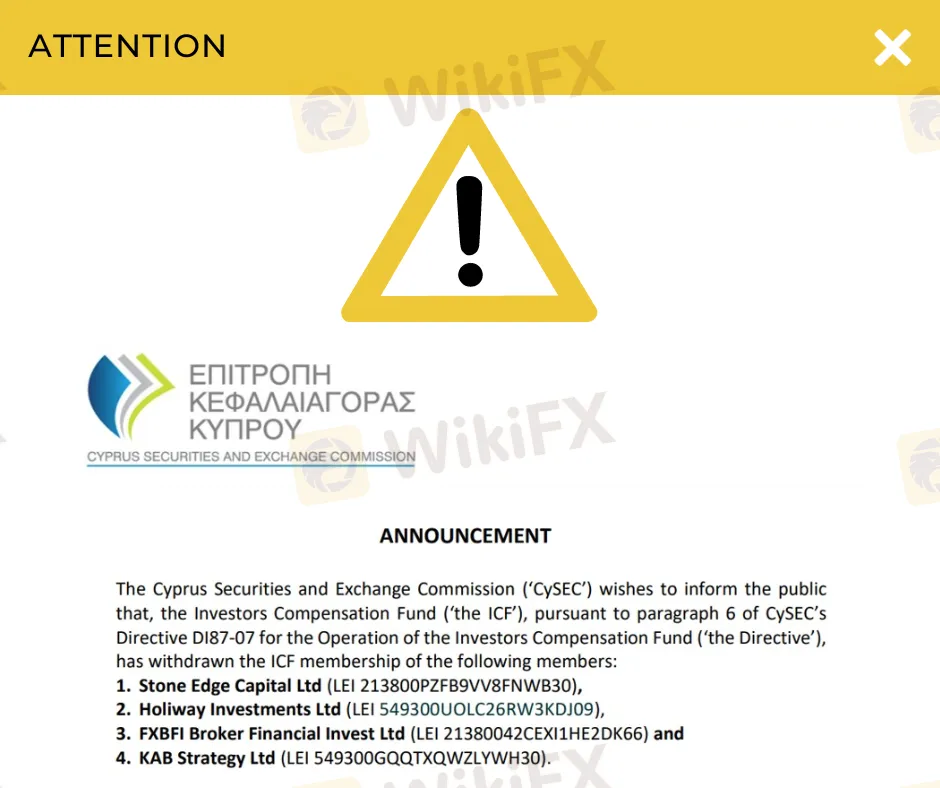

CySEC Cancels 4 Brokers’ ICF Membership

Abstract:CySEC withdraws membership from four major firms, exposing issues like voluntary license renunciations and regulatory compliance lapses.

The Cyprus Securities and Exchange Commission (CySEC) has recently disclosed the withdrawal of membership for four investment firms based in Cyprus by the Investors Compensation Fund (ICF). The affected entities include Stone Edge Capital Ltd, Holiway Investments Ltd, FXBFI Broker Financial Invest Ltd, and KAB Strategy Ltd.

The decision to revoke the membership of these firms stems from CySEC's choice to withdraw their Cyprus Investment Firm (CIF) authorizations, as officially stated by the regulatory body. Despite this development, clients covered by the four firms will retain the ability to file compensation claims for investment activities conducted prior to the withdrawal of membership. Eligibility criteria for such claims are outlined in CySEC's directives.

Established to provide compensation for covered investors in cases where the CIF fails to meet its obligations, the ICF operates under the regulatory mandate that all Cyprus Investment Firms must be its members. Consequently, when CySEC withdraws the CIF license of a firm, the ICF automatically terminates its membership.

KAB Strategy's license withdrawal, disclosed in the latter part of 2023, resulted from the company's voluntary renunciation. Meanwhile, FXBFI Broker Financial Invest also voluntarily relinquished its license, but only after facing a series of enforcement actions against the company due to deficiencies in anti-money laundering (AML) and combating the financing of terrorism (CFT) policies, controls, and procedures. This led to a €50,000 penalty imposed on FXBFI, the operator of 101investing.

In the cases of Stone Edge Capital and Holiway Investments, CySEC's investigations revealed violations of CIF authorization terms, prompting the cancellation of their licenses. In May, CySEC highlighted Stone Edge Capital's non-compliance with organizational standards, citing a lack of adequate systems to identify money laundering transactions. Additionally, the firm neglected to implement internal reporting systems and procedures.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Never Heard of Dynasty Trade? Here's Why You Should Be Worried

Have you heard this name before? No , it’s time you do because staying unaware could cost you. This platform is currently active in the forex trading and has been linked to several suspicious activities. Even if you’ve never dealt with it directly, there’s a chance it could reach out to you through ads, calls, messages, or social media. That’s why it’s important to know the red flags in advance.

Want to Deposit in the EVM Prime Platform? Stop Before You Lose It ALL

Contemplating forex investments in the EVM Prime platform? Think again! We empathize with those who have been bearing losses after losses with EVM Prime. We don't want you to be its next victim. Read this story that has investor complaints about EVM Prime.

WEEKLY SCAM BROKERS LIST IS OUT! Check it now

If you missed this week's fraud brokers list and are finding it difficult to track them one by one — don’t worry! We’ve brought together all the scam brokers you need to avoid, all in one place. Check this list now to stay alert and protect yourself from fraudulent brokers.

Catch the Latest Update on BotBro & Lavish Chaudhary

BotBro, an AI-based trading platform, became popular in India in 2024—but for negative reasons. Its founder, Lavish Chaudhary, who gained a huge following by promoting it heavily on social media. Since then, he has become well-known, but for many controversies. Let’s know the latest update about Botbro & Lavish Chaudhary.

WikiFX Broker

Latest News

Is Your Forex Strategy Failing? Here’s When to Change

FSMA Warns That Some Firms Operate as Pyramid Schemes

Apex Trader Funding is an Unregulated Firm | You Must Know the Risks

Sigma-One Capital Scam? Investors Say They Can’t Withdraw Funds

Federal Reserve likely to hold interest rates steady despite pressure from Trump. Here's what that means for your money

WEEKLY SCAM BROKERS LIST IS OUT! Check it now

Intel drops 9% as chipmaker's foundry business axes projects, struggles to find customers

Palantir joins list of 20 most valuable U.S. companies, with stock more than doubling in 2025

Textiles to whisky: U.K.–India 'historic' deal is set to boost bilateral trade by over $34 billion a year

Thailand-Cambodia border clashes: Cambodia's economy has more to lose, analysts say

Currency Calculator