简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

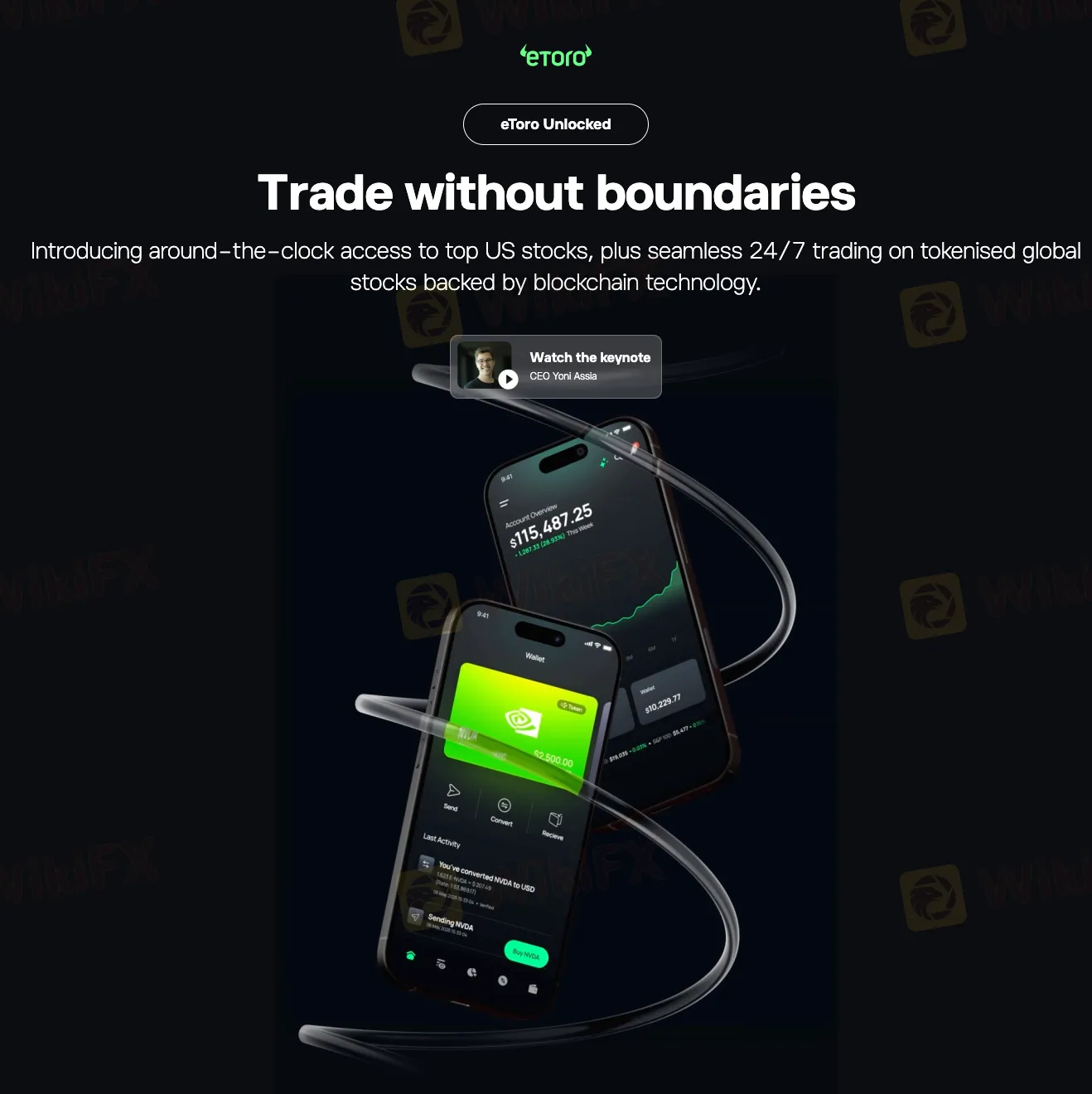

eToro Opens the Door to Anytime, Anywhere Investing

Abstract:eToro Group Ltd. has announced several updates to its product offering as part of its broader strategy to adapt to a tokenised financial system. Read this article to find out more, especially if you are eToro’s current user!

eToro Group Ltd., the online trading platform listed on Nasdaq, has announced several updates to its product offering as part of its broader strategy to adapt to a tokenised financial system. The announcements were made during a recent global webinar titled eToro Unlocked: Trade Without Boundaries, where the company outlined its direction in response to ongoing developments in blockchain regulation and technology.

According to the firm, the concept of tokenisation, which is the process of converting traditional financial assets into digital tokens recorded on a blockchain, is gaining traction as regulatory frameworks begin to form. New legislation, such as the Markets in Crypto-Assets (MiCA) regulation in the European Union and the Genius Act in the United States, is creating conditions under which digital representations of real-world assets can be issued in a regulated manner.

As part of its expansion, eToro will begin offering 24/5 trading on a selection of 100 widely traded US-listed stocks and ETFs. The move extends the platform's existing functionality beyond standard market hours, allowing users to respond to market developments outside traditional trading windows.

In parallel, the platform has introduced spot-quoted futures, developed in collaboration with CME Group. These contracts differ from standard futures by being priced directly against the spot market, and they feature longer expiry dates. Currently available in certain European markets, these instruments are intended to offer retail traders exposure to futures markets using a format more aligned with conventional pricing structures. eToro has indicated plans to make them available to a wider global user base.

eToro has also reiterated its ongoing work in the area of tokenisation. The company has been involved in this space since 2012, when its CEO co-authored a white paper on the use of blockchain for representing traditional assets. In 2019, it acquired the Danish blockchain firm Firmo, later launching tokenised versions of gold, silver, and selected fiat currencies.

The platform now plans to launch tokenised versions of US-listed equities using the ERC-20 standard on the Ethereum blockchain. These tokenised stocks will be linked to their real-world counterparts, and users will have the option to move them on-chain or redeem them back into traditional positions on the platform.

eToro views tokenisation as a step toward making financial markets more accessible across time zones and jurisdictions. The firm sees the process as a progression from extended trading hours to 24/5 access, and eventually, continuous 24/7 availability through blockchain integration. However, the wider adoption of such models may depend on how market participants, regulators, and infrastructure providers respond to these shifts.

While the concept of 24/7 trading and blockchain-based asset settlement introduces new possibilities, it also raises questions about custody, liquidity, and oversight. As platforms experiment with these technologies, broader industry response and regulatory clarity are likely to shape the long-term implications for retail and institutional investors alike.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Fraud Alert: Don’t Trust These Firms, SC Malaysia Warns

Investors, Pay Attention! This is a serious warning from the Securities Commission Malaysia against 5 scam brokers operating in the forex market without a legal license. Here is the list of 5 fake brokers you must avoid.

Tradersway Broker Review 2025

This article is a review of TradersWay. TradersWay remains notable for its unregulated status and high‐risk trading conditions. Below, we provide an impartial overview of TradersWay’s key features, trading conditions, platform offerings, fees, and community feedback.

Ultima Markets enters the UK and gains the FCA license

Ultima Markets has secured authorization from the FCA to offer CFDs to retail clients in the United Kingdom, marking its entry into one of the world’s most heavily regulated and competitive markets. According to the FCA register, the trading name “Ultima Markets” was approved on 21 July 2025.

LSEG Announces £1 Billion Share Buyback Program

London Stock Exchange Group (LSEG) launches a £1 billion share buyback program, partnering with Goldman Sachs for a capital reduction initiative through 2025.

WikiFX Broker

Latest News

What Is Forex Currency Trading? Explained Simply

LSEG Announces £1 Billion Share Buyback Program

Ultima Markets enters the UK and gains the FCA license

SEC Lawsuit Targets Real Estate Fraud Scheme by Joseph Nantomah

A Beginner’s Guide to Trading Forex During News Releases

ASIC Regulated Forex Brokers: Why Licensing Still Matters in 2025

Think Uncle Sam Owes $37 Trillion? It's Far Worse Than That

SkyLine Judge Community: Appreciation Dinner Successfully Held in Malaysia

Interactive Brokers: A Closer Look at Its Licenses

eToro Opens the Door to Anytime, Anywhere Investing

Currency Calculator