How Tariffs Might Impact US Car Prices, By Brand

概要:Tariffs on imported goods can have a wide ripple effect on prices, especially in the auto industry w

Tariffs on imported goods can have a wide ripple effect on prices, especially in the auto industry where supply chains are global, complex, and highly sensitive to cost changes.

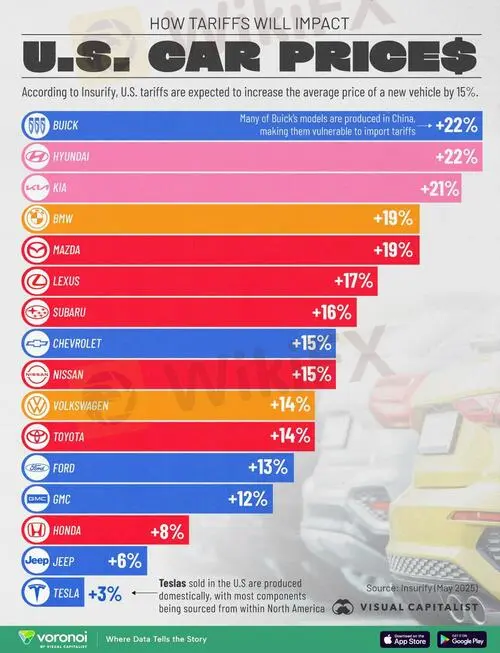

In this graphic, Visual Capitalist's Marcus Lu reveals how tariffs will impact U.S. car prices, assuming a flat 25% tariff is applied onto vehicles imported from outside North America.

Data & Discussion

The data for this visualization comes from Insurify, which projected price increases for various car brands based on their exposure to overseas manufacturing and parts.

For models assembled within North America, the projections represent a 25% tariff on a models non-U.S. content and up to a 15% tariff discount of the total MSRP. Visit the official White House fact sheet to learn more.

The analysis shows that Tesla, Jeep, and Hondawill be the least affected by Trumps auto tariffs, while Buick, Hyundai, and Kiawill face the steepest price hikes.

Buicks Asia-Centric Production

Although Buickis an American brand, the company produces many of its models in China and South Korea. As a result, Buick tops this list with a 22%projected price increase—the highest among all brands surveyed.

This underscores how globalization has changed the footprint of even legacy U.S. nameplates. In fact, Buick is so big in China it has its own sub-brand.

Hyundai and Kia Face High Tariff Risks

Other vulnerable brands are Hyundaiand Kia, each projected to see a 21–22%increase in vehicle prices. Though both brands have some manufacturing presence in the U.S., a significant portion of their models and components are still imported from South Korea.

In late 2024, Hyundai Motor Group Metaplant Americaopened in Georgia, which the company will use to build its U.S.-sold electric vehicles. The plant is capable of producing up to 500,000 vehicles per year.

Tesla Is the Least Affected

Tesla‘s vertically integrated supply chain and domestic manufacturing help shield it from tariff risks. With most of its production based in the U.S.—particularly at its Fremont and Austin plants—Tesla’s vehicles are projected to increase in price by only 3% under new tariff rules.

This minimal impact could give Tesla a competitive edge if other brands are forced to raise prices. Fortune recently reported that Tesla is still Americas EV leader, though sales dropped year-over-year in April by 16%.

免責事項:

このコンテンツの見解は筆者個人的な見解を示すものに過ぎず、当社の投資アドバイスではありません。当サイトは、記事情報の正確性、完全性、適時性を保証するものではなく、情報の使用または関連コンテンツにより生じた、いかなる損失に対しても責任は負いません。

WikiFXブローカー

話題のニュース

金融庁、仮想通貨を「金融商品」として再分類へ

2ヶ月無料で使い放題!FXブローカー向け製品パッケージ、必要なツールを自由に選べる、サブスクリプション型ソリューション

【2025年上半期まとめ】分散投資戦略がS&P500を超えた理由と注目資産ランキング

【WikiFX調査】MATRIX TRADER(JFX)を実際に使ってみた!入金・出金・取引のリアル体験レビュー

Plus500がカナダで新たな金融ライセンス取得 OTC取引サービスを展開へ

2025年WikiFX Gala Night、バンコクで盛況のうちに終了

ついに再始動!「WikiFXデモトレード週間コンテスト」開催決定!

SNSで出会った彼に騙された…ロマンス詐欺×Euronext偽サイトの手口とは

新台湾ドル、対米ドルで約3年ぶりの高値水準に

レート計算